USDCAD Jumps 80 Pips Higher on Better US Data

The USD to CAD rate has resumed the upside momentum again, as sentiment turns negative after the strong US economic data.

The USD to CAD rate has resumed the upside momentum again, as sentiment turns negative after the strong US economic data. USD/CAD was retreating lower yesterday, but it found support at MAs as shown on the chart below, and today we’re seeing a jump after the US data was released.

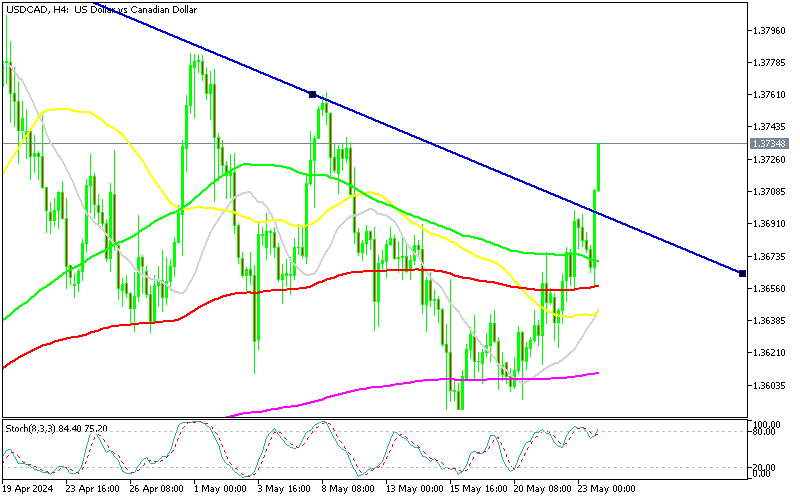

USD/CAD Chart H4 – The Descending Trendline Has Been Broken

The US dollar is underperforming in trading today, largely due to a positive broader risk sentiment bolstered by Nvidia’s strong earnings report after the close yesterday. This upbeat earnings news has driven US futures higher, with technology stocks leading the charge, further supporting the growth of risk assets. In the session, the release of eurozone and UK PMI data added to the market’s movements.

The US economic data presented a upbeat picture: the Manufacturing and particularly the Services PMI posted some nice improvement, while Unemployment Claims for last week fell to 215K, which is closer to the lower band of the range.

Overall, the dollar’s performance remains positive amid this week’s fluctuating market dynamics, as investors weigh the mixed economic signals and maintain a focus on the FED. The strength in technology stocks, coupled with the strong PMI data from the US, continues to influence currency movements, keeping the dollar under pressure.

US S&P Global Manufacturing and Services PMI data for May

- Manufacturing PMI: Rose to 50.9, above the estimated 50.0 and up from the prior month’s 50.0. This suggests a modest expansion in the manufacturing sector.

- Services PMI: Surged to 54.8, significantly higher than the expected 51.3 and marking the best reading since May 2023. This highlights a robust expansion in the services sector.

- Composite PMI: Climbed to 54.4, exceeding the 51.1 estimate, indicating a broad-based improvement across both sectors.

These stronger-than-anticipated PMI readings reflect a resilient US economy, with notable strength in the services sector driving overall growth. The positive data has influenced the market sentiment and policy expectations, impacting the US dollar positively, thus sending USD/CAD above 1.37.

Comments From the S&P Global PMI:

US business activity growth accelerated sharply to its fastest for just over two years in May, according to provisional PMI survey data from S&P Global, signalling an improved economic performance midway through the second quarter. The service sector led the upturn, reporting the largest output rise for a year, but manufacturing also showed stronger growth. Although companies continued to report lower employment, the rate of job losses moderated amid improved business confidence for the year ahead and higher order book intakes. Both input costs and output prices meanwhile rose at faster rates, with manufacturing having taken over as the main source of price growth over the past two months. However, the overall rate of selling price inflation remained below the average seen over the past year.

USD/CAD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account