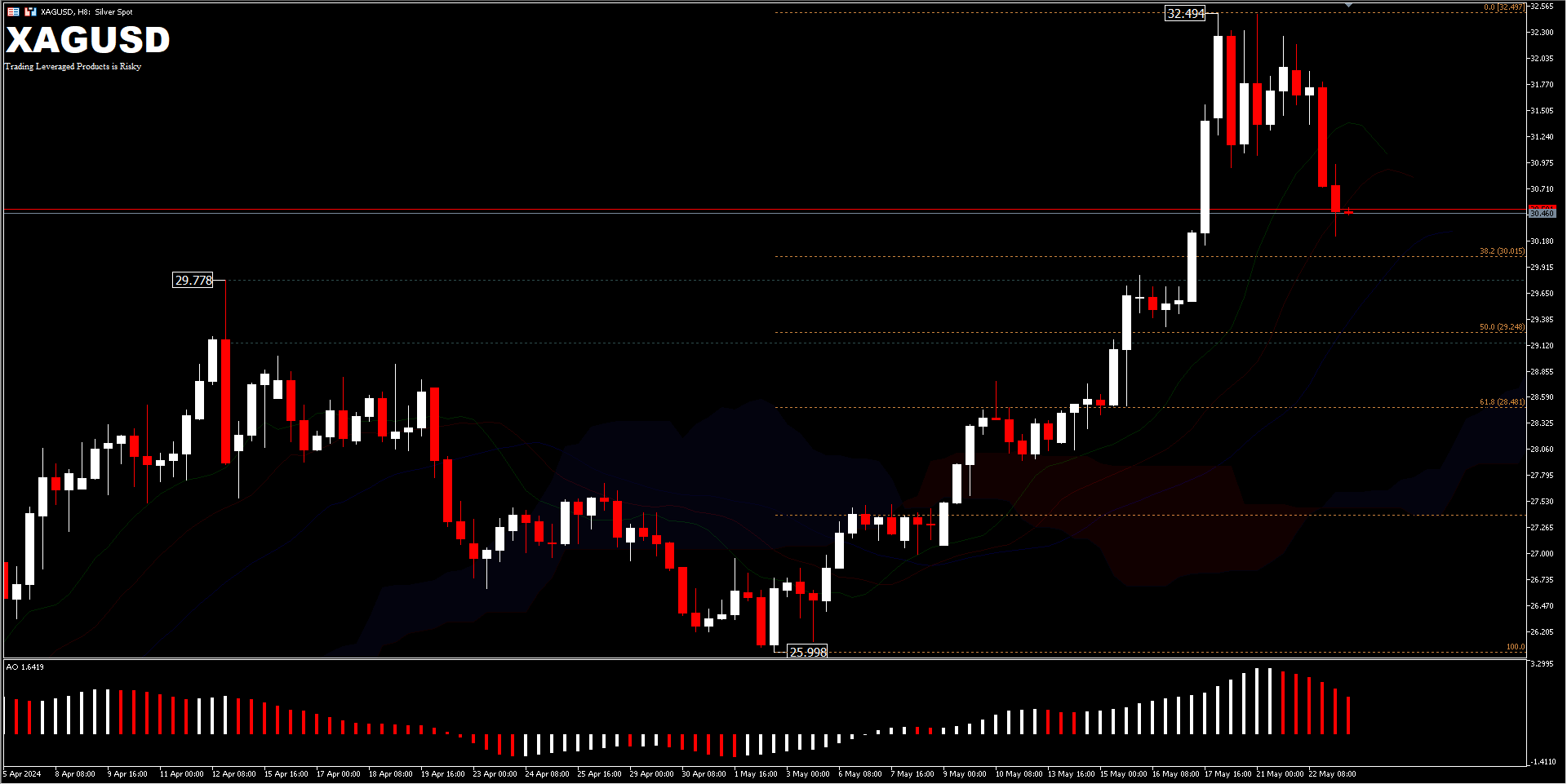

Silver Prices Surge to $32.49 Per Ounce: Highest Level Since 2012

Silver prices have soared to $32.49 per ounce, the highest since 2012, driven by robust demand and positive futures market sentiment. This year, it has rallied over 28%, with a 15% increase in the past three weeks alone.

Futures Market Boost

Between February and April, an accumulation of profitable long bets in the futures market spurred this recent rally. Investors have been increasing their silver holdings, further driving up demand.

Electric Vehicles and Renewable Energy

The electric vehicle (EV) sector significantly contributes to silver’s rising demand. EV production, which relies heavily on silver due to its superior electrical conductivity, is expected to consume nearly half of all silver on the global market. As the shift towards renewable energy continues, it’s role in manufacturing solar panels also boosts its demand.

China’s Role in Silver Demand

China’s rapid advancements in producing solar panels and electric vehicles are pivotal in supporting rising silver prices. The country’s growing capabilities in these industries underpin the increasing global demand for silver.

Recent Market Movements

On Wednesday, the precious metal prices closed down 3.8%, pressured by a strong USD Index and rising global bond yields. A decline in US home sales in April and hawkish Federal Open Market Committee (FOMC) meeting minutes also weighed on silver prices. However, in today’s trading, it stabilized above $30 per ounce as investors reassessed the Federal Reserve’s monetary policy outlook.

Industrial Applications and Supply Deficits

Despite high interest rates reducing the appeal of non-bearing assets, silver remains supported by its critical industrial applications. The metal is heading for a fourth consecutive year of supply deficit, with stocks tracked by the London Bullion Market Association hitting a record low in April and trading volumes in New York and Shanghai remaining low.

Technical Analysis

From a technical standpoint, XAGUSD’s decline from the $32.49 peak is part of a correction within the bullish trend established since September 2022. The next support level is at $29.77, with potential further corrections testing the $29.24 and $28.48 levels. A significant trend change would only occur if prices drop below the $25.99 support.

Overall, despite recent declines, silver’s price movement remains bullish. Breaking above the recent peak of $32.49 could trigger further upward momentum.

Silver’s strong performance, driven by increasing demand from the EV and renewable energy sectors, along with supply constraints, suggests that the bullish trend in silver prices is likely to continue. Investors should watch key support and resistance levels for potential market movements.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account