XRP Shaky Despite Archax Listing: $0.50 Emerges As Support

XRP fell yesterday but closed with a long lower wick, pointing to buying pressure in lower time frames. Thus far, sellers appear to be taking over in the altcoin scene. However, considering what lies ahead for XRP, prices are relatively firm and technically in a bullish alignment. Nonetheless, if sellers press on, reversing losses of early this week, bears might flow on, extending the selloff in the days ahead. Going forward, a close above the middle BB would be massive for buyers, possibly setting up the coin for more gains.

As it is, XRP is down in the past day but up in the previous trading week following gains of April 22. Meanwhile, trading volumes are decent. When writing, it is up 9% to $1.5 billion.

The following Ripple and XRP news might draw users, impacting prices in the short to medium term:

- Archax, the digital asset trading platform regulated by the U.K.’s FCA, has added HBAR and XRP. The move follows the exchange’s tokenization of BlackRock’s MMF on Hedera, lifting HBAR prices by over 80%.

- Recently, Ripple announced plans to expand and issue stablecoins. This week, one of their executives participated in a round-table discussion alongside a U.S. Department of Treasury official. Among the many topics discussed were the technical and regulatory requirements needed to upgrade the legacy capabilities of central bank money.

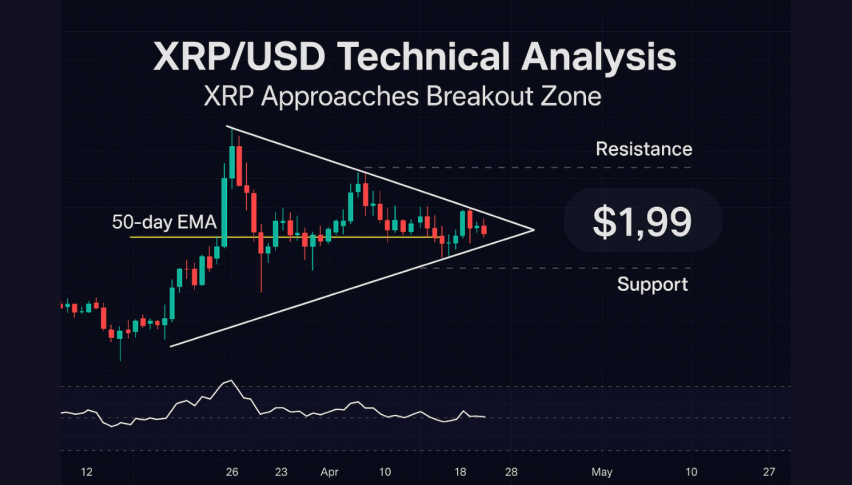

XRP Price Analysis

XRP/USD is down, looking at the performance in the daily chart.

Still, bulls have the upper hand, and prices are trending above April 13 highs.

Technically, every low above $0.50 and $0.52 may offer entries for aggressive bulls targeting $0.60.

However, if sellers are persistent, XRP may reverse gains from April 20 to 22, deflating hopes of a spike back to the March 2024 range.

In that case, prices may slip to $0.41, continuing the bear breakout formation of April 12 and 13.