GBP the Weakest Link Despite Somewhat Stronger UK Inflation

GBP/USD has broken below 1.25 since last week and today's UK CPI inflation report couldn't change the situation

GBP/USD has broken below 1.25 since last week and today’s UK CPI inflation report couldn’t change the situation. In fact, the GBP has turned out to be the weakest of the major currencies today, declining against the USD while most other currencies have been making gains.

GBP/USD Chart Daily – Consolidating Below 1.25

The price was fluctuating between 1.25 and 1.28, spanning three cents for several months. In early March, buyers managed to push the price close to 1.29, but the momentum was not sustained, resulting in a decline in the currency pair. Last week, sellers pushed the price below 1.25 after the strong US CPI inflation report, opening the door for 1.20.

The response to the inflation figures, which were only marginally better than expected, is somewhat surprising. We saw a 0.5% increase to 1.2482, but the GBP/USD pair reversed back down to the lows of the day, while other currencies continued to move higher. So sellers still maintain control if the pair remains below that level.

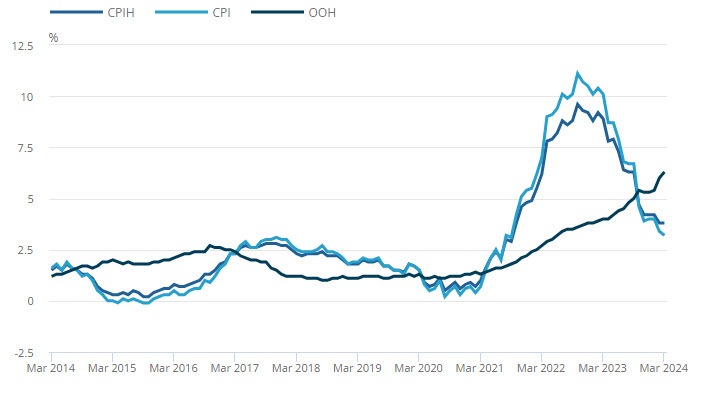

March UK CPI Inflation Report Released by ONS – 17 April 2024

- UK March CPI (Consumer Price Index) rose by 3.2% year-on-year, exceeding expectations of +3.1%.

- UK February CPI (Consumer Price Index) was +3.4%.

- Core CPI, which excludes volatile food and energy prices, increased by 4.2% year-on-year, surpassing expectations of +4.1%.

- Previous Core CPI was +4.5%.

The pound strengthened initially in response to the slightly stronger-than-expected inflation figures but gave it all back pretty soon. Although the annual readings are lower compared to February, the Bank of England may still be concerned as core inflation remains above 4%. Prior to this report, there was a 71% probability of a rate move in August, with markets factoring in a total reduction of 42 basis points for the year. It remains to be seen how the market will react when it opens later, but significant changes are not expected.

GBP/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account