Gold Demand Remains Strong Despite Bullish USD

The US Dollar has resumed the uptrend today as risk sentiment remains in retreat. Everything else is down against the USD besides Gold, which is experiencing decent demand this year, especially from Asia and the Middle East. The Gold Price is approaching $2,400 again, and chances are that it will push above that level and stabilize there.

Gold Chart H4 – MAs Are Supporting the Uptrend

Despite some up-and-down price action today, the dollar is making further progress in the US session, after some stagnation in today’s European trading session. In the last hour, we’re seeing a retreat, however, the USD still maintains a strong position according to the charts.

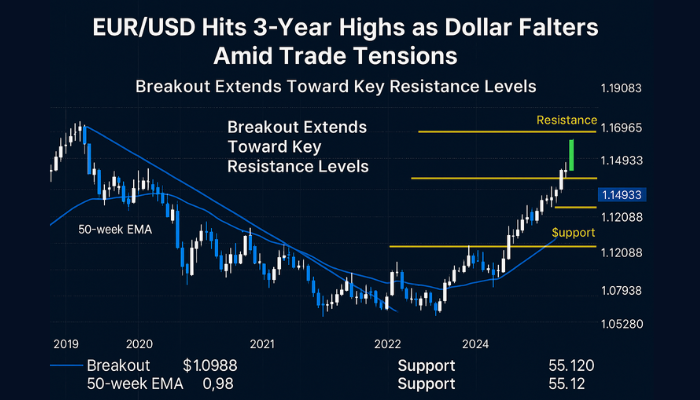

EUR/USD made a new low, slipping to 1.0601 a while ago, but has returned within the range for the day. Looking at the broader picture, the pair seems poised for a decline towards 1.0500 once the 1.06 level has been broken. We’re following the price action in this pair, so we can open a sell forex signal once the retrace higher is complete.

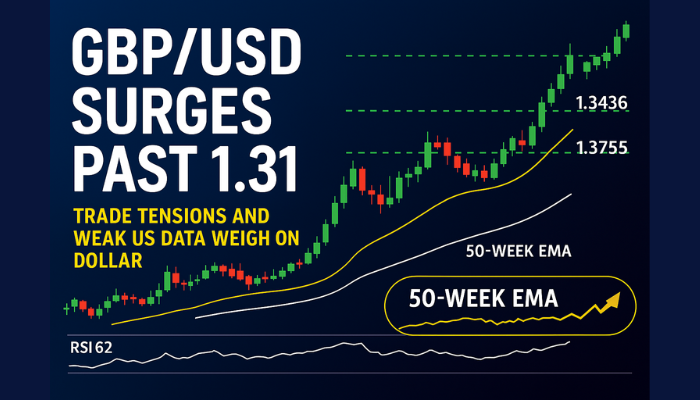

On the other hand, higher Treasury yields are providing support to the USD, with the USD/JPY pair, which is up 0.2% at 154.65. Today’s UK labor market data presented a mixed picture, showing some softness. Despite this, earnings remain robust. However, the response in the pound was muted, with GBP/USD trading flat at 1.2450 for the day.

Gold XAU Heads for $2,400 Again

GOLD , on the other hand, doesn’t care much about anything else, rather than its own self. Despite it only being four months into 2024, gold has experienced an impressive rally, soaring above $2,400. What’s noteworthy is that this surge occurred while the dollar remained relatively stable, highlighting the strength of the precious metal.

Additionally, traders have been observed reducing their FED rate cut expectations since the beginning of the year. Amid ongoing tensions between Israel and Iran, Gold briefly surpassed $2,400 late last week, before profit-taking set in, leading to increased price volatility in recent sessions. However, the current technical picture suggests that buyers are still in control., with buyers coming in after every dip to moving averages, particularly the 50 SMA (yellow). In April, they have effectively defended the more bullish near-term bias, as depicted in the H4 chart above, so we have been trying to buy the pullbacks in XAU/USD and will continue to do so.