Bitcoin Dips to $67,000 as Winklevoss Twins Invest in RBFC’s Crypto Future

Bitcoin is trading at 66,900 decreasing by 5.36% on Saturday. Real Bedford Football team (RBFC) now has Cameron and Tyler Winklevoss as co-owners. The two have invested $4.5 million in Bitcoin to help the team achieve its goals, which include creating infrastructure and a Bitcoin treasury. The owner of the team, Peter McCormack, wants to take RBFC to the English Premier League and is using Bitcoin for different kinds of transactions. McCormack’s perspective is also shared by the Winklevoss twins, who view Bitcoin as a driving force behind RBFC’s success.

Their recent donation to a political action committee that supports cryptocurrency is accompanied by this investment, which is consistent with their view of Bitcoin’s potential. The news shows that well-known individuals are confident in the potential growth and usefulness of Bitcoin, which could have a positive short-term influence on BTC prices. But the long-term impact might rely on how well RBFC does and how much Bitcoin is used in sports and beyond.

| Broker | Review | Regulators | Min Deposit | Website | |

|---|---|---|---|---|---|

| 🥇 |  | Read Review | FCA, CySEC, ASIC, MAS, FSA, EFSA, DFSA, CFTC | USD 100 | Visit Broker |

| 🥈 |  | Read Review | FSCA, FSC, ASIC, CySEC, DFSA | USD 5 | Visit Broker |

| 🥉 |  | Read Review | CySEC, MISA, FSCA | USD 25 | Visit Broker |

| 4 |  | Read Review | ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB | USD 200 | Visit Broker |

| 5 |  | Read Review | ASIC, FCA, CySEC, SCB | USD 100 | Visit Broker |

| 6 |  | Read Review | FCA, FSCA, FSC, CMA | USD 200 | Visit Broker |

| 7 |  | Read Review | BVI FSC | USD 1 | Visit Broker |

| 8 |  | Read Review | CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA | USD 10 | Visit Broker |

| 9 |  | Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker |

| 10 |  | Read Review | IFSC, FSCA, ASIC, CySEC | USD 1 | Visit Broker |

The Winklevoss twins have “deep conviction” that Bitcoin will be able to “supercharge” the club to the English Premier League. https://t.co/yUOZWaSUlD

— Cointelegraph (@Cointelegraph) April 13, 2024

Majority Views Cryptocurrency as Key Future Asset and Payment Class

Over half of respondents to a recent Deutsche Bank study of 3,600 consumers indicated that they were beginning to embrace cryptocurrencies as legitimate asset classes and forms of payment. 10% of those surveyed said they thought Bitcoin would reach $75,000 by year’s end.

Only one-third of American respondents to the survey predicted that Bitcoin would fall below $20,000 by year’s end, indicating a decline in pessimism regarding the cryptocurrency. Analysts at Deutsche Bank believe that the impending halving, anticipated regulatory actions, and the prospect for SEC-approved spot Ethereum ETFs are some of the reasons that could support the price of Bitcoin.

An optimistic outlook for Bitcoin is suggested by market sentiment, which includes expectations of aggressive buying during declines and upbeat predictions from industry professionals. Short-term buyer confidence and greater buying activity as anticipation grows for Bitcoin’s possible price growth could be the beneficial effects of this news on BTC prices.

Rising Optimism as Bitcoin Halving Approaches

With the recent conclusion of Paris Blockchain Week, optimism around the impending Bitcoin halving is evident. By year’s end, Tim Draper believes Bitcoin might reach $250,000, while the CEO of eToro believes the worldwide cryptocurrency market will reach $100 trillion.

Even after paying $4.3 billion in settlement, Binance is optimistic about the obstacles facing the industry. Though institutional involvement is predicted to rise, retail investors continue to make up the majority of Bitcoin ETF inflows. Dubai intends to loosen rules for novice investors in an effort to promote greater involvement in the cryptocurrency space. As the halving event approaches, this excitement may boost investor confidence in Bitcoin and raise demand and prices.

You can catch the full recap here, including, @TimDraper's BTC prediction, @Ubisoft's new #web3 game, and more! https://t.co/ncKF1Wf8r8

— Cointelegraph (@Cointelegraph) April 12, 2024

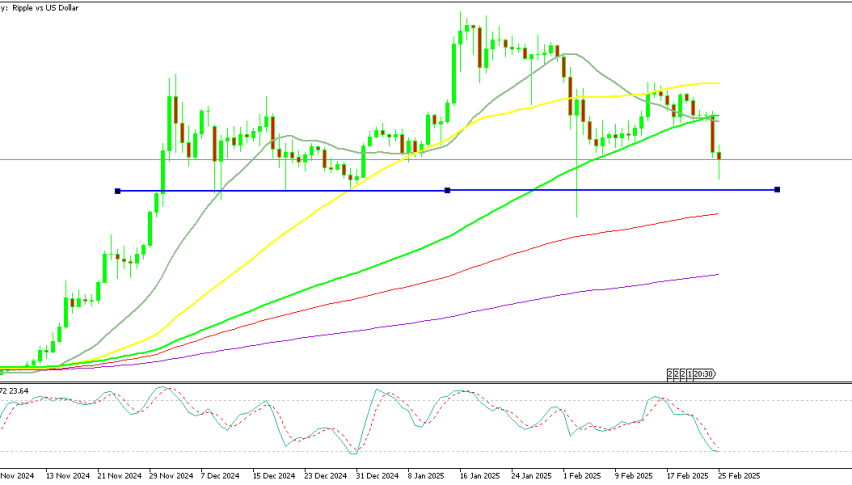

Bitcoin Price Forecast: Technical Outlook

Bitcoin is currently trading at $67,660, marking a 2.48% decline. On the weekly chart, Bitcoin is wrestling with significant levels that may dictate the near-term trend. The pivot point stands at $68,574, suggesting a critical juncture for bullish and bearish tides. Resistance levels loom overhead at $71,113, $72,652, and $74,221, challenging any upward price ambitions.

Conversely, supports are firming at $66,426, with further potential floors at $64,583 and $62,367 providing a cushion for descending prices.The RSI at 39 leans towards a bearish sentiment, while the 50 EMA at $69,344 hovers above the current price, reinforcing the pivot point’s significance. The current analysis implies bearishness below $68,574, with a break above possibly reversing this bias.

Sidebar rates

82% of retail CFD accounts lose money.