USD to Yen Above 153 As Inflation Fears Subside After Soft US PPI

Yesterday the USD to yen rate climbed above 153 after the hot US CPI numbers. Today traders were fearing a strong PPI inflation report

Yesterday the USD to yen rate climbed above 153 after the hot US CPI numbers. Today traders were fearing a strong PPI inflation report, and the producer prices did grow in March, but they missed expectations of 2.2% for the headline PPI reading, which has calmed some of inflation fears.

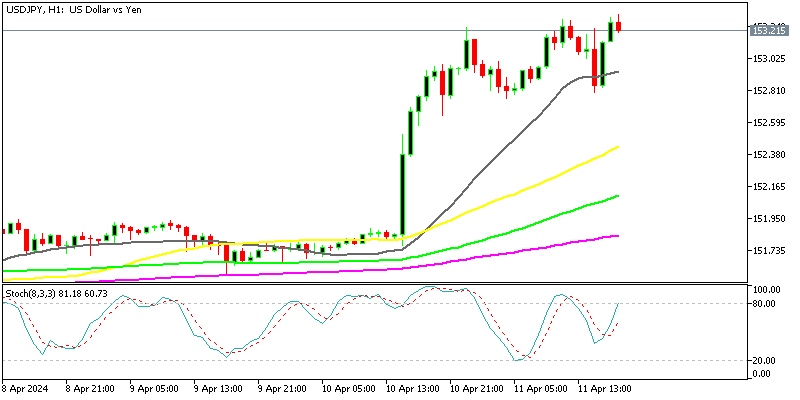

USD/JPY Chart H1 – Buyers Getting Comfortable Above 153

USD/JPY returned to the 152 level for the third time in two years, which showed that it was going to break this level this time. Besides that, the price wasn’t retreating as it did on the previous occasions, instead it was sticking to this level, indicating that buyers wanted to push above it at any cost.

Overall, while the PPI increased both y/y and m/m, the figures were slightly below expectations. However, the core measures excluding food and energy showed stronger growth, indicating underlying inflationary pressures in the US economy.

- Year-on-Year (y/y) PPI: The PPI rose by 2.1% compared to the same period last year, slightly below the expected increase of 2.2%. The previous reading was 1.6%.

- Month-on-Month (m/m) PPI: The PPI increased by 0.2% compared to the previous month, which was slightly lower than the expected increase of 0.3%. The unrounded figure was +0.23%.

- Excluding Food and Energy: The PPI excluding food and energy rose by 2.4% y/y, surpassing expectations of 2.3%. The previous reading, excluding food and energy, was revise

- d upward from 2.0% to 2.1%. On a monthly basis, the increase was in line with expectations at 0.2%.

- Excluding Food, Energy, and Trade: The PPI excluding food, energy, and trade increased by 0.2% compared to the previous month, meeting expectations.

USD/JPY Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account