XRP Bulls Reject Sellers: Time for Ripple Prices to Fly?

XRP has been relatively steady at spot rates over the past 24 hours. While the broader crypto market is collapsing under pressure, the resilience of XRP is bullish. The coin is changing hands above $0.61, and despite yesterday’s Doji bar, the uptrend remains. Buyers expect more gains in the days ahead, provided sellers don’t wipe gains of April 8.

At the current valuation, XRP is still perched at sixth with a market cap of over $33 billion. At the same time, it is steady in the previous trading day but up 4% in the past week. Overall, buyers have a chance if they manage to repulse bears and maintain prices above $0.60. Unlike Bitcoin, the overall trading volume in the past trading day is up 25% to over $2.4 billion.

For buyers to cement their position, traders should be watching the following XRP and Ripple news events:

- Analysts are bullish following Ripple’s decision to foray into the $154 billion stablecoin market, which Tether dominates. Notably, how Ripple navigates through this scene and even becomes more popular than PayPal’s product will be key. If it becomes successful, XRP will directly benefit.

- One analyst also predicts that XRP will reach $1,000 within five to ten years. He adds that the primary drivers of this run will be increasing capital inflow into crypto, especially from institutions.

XRP Price Analysis

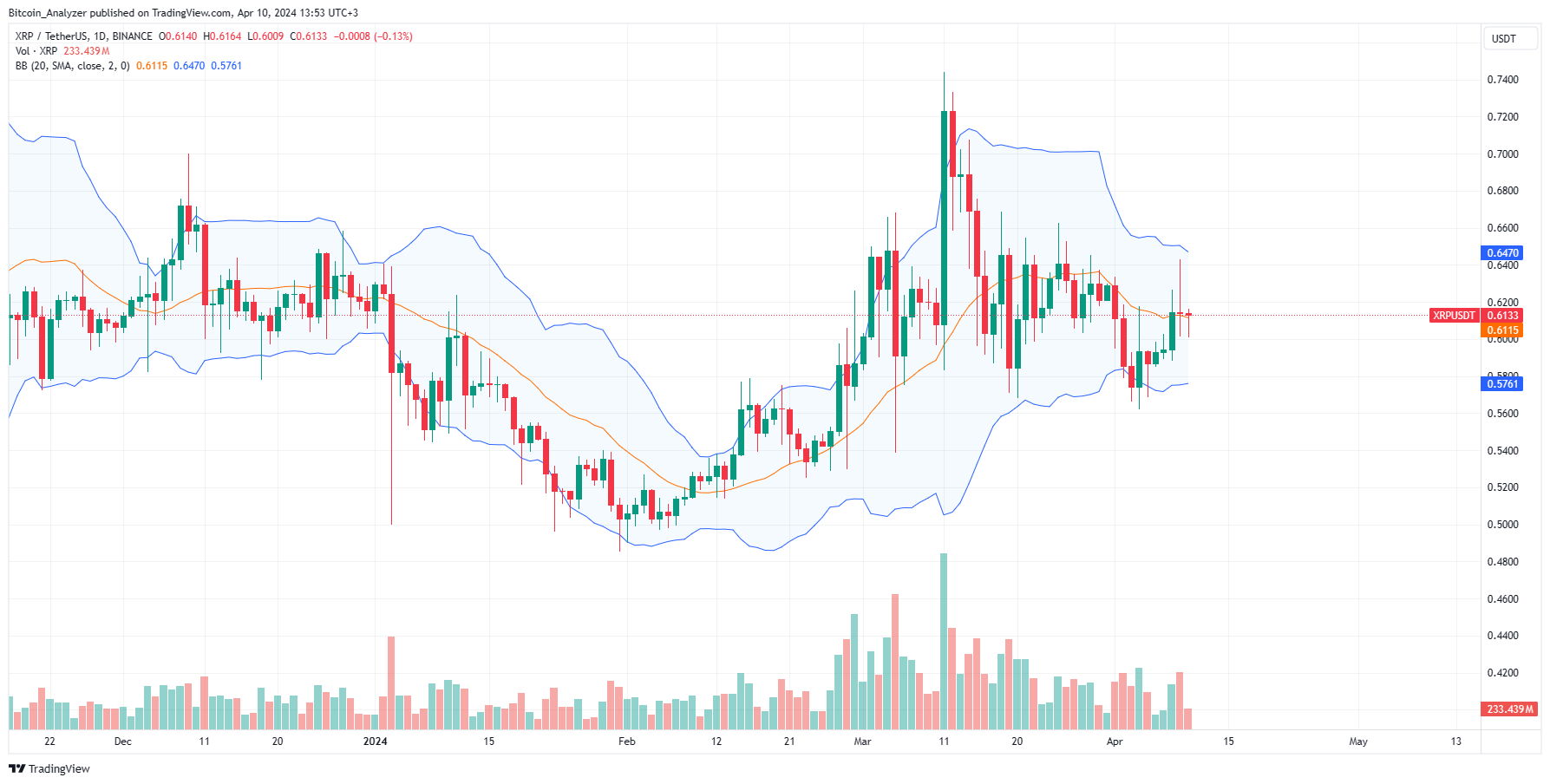

XRP/USD is firmer than Bitcoin at spot rates.

The attempts to reject bears will only be confirmed today if bulls drive prices even higher.

Aggressive traders can buy on dips above the $0.57 to $0.60 support zone.

Conservative traders can wait for prices to crack above $0.66, with high volumes, before loading the dips.

If sellers take over, the reaction at $0.57 will determine how fast the drop to $0.50 will be.