USD to CAD Rate 1.5 Cent Higher After Dovish BOC Policy Decision

The USD to CAD exchange rate has surged 1.5 cents as the Bank of Canada starts to give dovish signals, pointing to rate cuts soon.

The USD to CAD exchange rate has surged 1.5 cents as the Bank of Canada starts to give dovish signals, pointing to rate cuts soon. The US CPI, on the other hand, was quite hot today once again, which has reduced the odds of a june FED rate cut, so everything is working out great in favour of USD/CAD bulls at the moment.

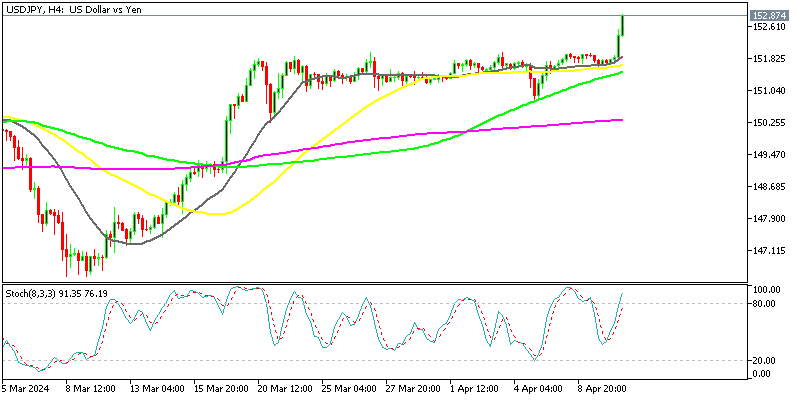

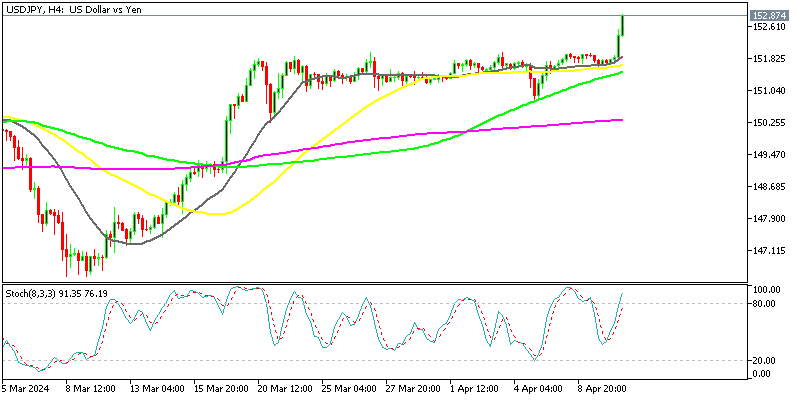

USD/CAD Chart H4 – Bouncing 150 Pips Higher Off the 100 SMA

The USD/CAD rate has weakened recently due to a combination of factors, including strong US nonfarm payroll (NFP) employment data and disappointing Canadian jobs figures. The USD has been in demand due to the Federal Reserve’s hawkish stance, while the Bank of Canada has adopted a more dovish outlook, further pressuring the Canadian dollar. This situation has resulted in a double impact on the USD/CAD pair, with both fundamental factors contributing to its movement.

Bank of Canada interest rate decision

- The Bank of Canada (BOC) has decided to hold interest rates steady at 5.00%, in line with expectations.

- The overnight rate remains at 5.00%.

BOC Statement:

- While inflation remains elevated and risks persist, both the Consumer Price Index (CPI) and core inflation have shown further easing in recent months.

- The Council will be closely monitoring to ensure that this downward trend in inflation continues.

- The Governing Council is particularly attentive to the evolution of core inflation, focusing on factors such as demand-supply balance, inflation expectations, wage growth, and corporate pricing behavior.

- Recent indications suggest that wage pressures are starting to ease.

- The statement about the BOC being concerned about inflation risks has been removed.

Macklem Opening Statement:

- The BOC is looking for evidence that the recent easing in underlying inflation will be sustained.

- Economic growth appears to be picking up, with solid GDP growth expected for this year and further strengthening in 2025.

- The outlook for global growth has been revised upward, with the US economy outperforming expectations.

- There are signs that wage pressures are starting to alleviate.

- The BOC aims to avoid keeping monetary policy excessively restrictive for an extended period.

- Data since January have increased confidence that inflation will gradually decline despite strengthening economic activity.

Key Line from Macklem:

- The BOC needs to see sustained evidence before considering a rate cut. While recent declines in core inflation are promising, the BOC requires assurance that this trend is not temporary.

USD/CAD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account