NASDAQ – Mr Bostic and Today’s Inflation Report!

USA100 – Price Performance Dependent on Fed Rate Adjustments and Today’s CPI!

The direction of the USA100’s performance hinges largely on this afternoon’s release of inflation data. Technical analysts have observed a reluctance among US stocks to undergo significant prolonged declines. However, heightened inflation has the potential to dampen risk appetite and reduce demand for equities. Investors, in particular, will closely monitor whether inflation surpasses the anticipated 0.3% figure, including the Core Consumer Price Index (CPI).

Later in the evening, investors will be closely monitoring the FOMC Meeting Minutes for insights into the committee’s stance regarding potential interest rate adjustments. This week, Mr. Bostic has indicated his readiness to adjust expectations for future cuts if inflationary conditions do not align with the Fed’s policy objectives. According to Mr Bostic, he could consider lowering possible future adjustments from 3 cuts to only 1 for 2024. However, Mr Bostic said this was only possible if inflation stabilized above the target and the employment sector remains resilient. So far, jobs growth remains and it’s all dependent on inflation.

US Bond Yields and the US Dollar is more or less unchanged and therefore do not provide any signals on the market’s risk appetite. The CM Fedwatch Tool indicates investors are starting to push back a potential cut in June 2024. The possibilities have declined from 65% to 56%. If this continues to decline, the stock market can witness stronger pressure. However, this will also depend on the upcoming earnings data. If earnings data is higher than expectations, strong sentiment may quickly return. The main quarterly earnings reports will be for the following companies:

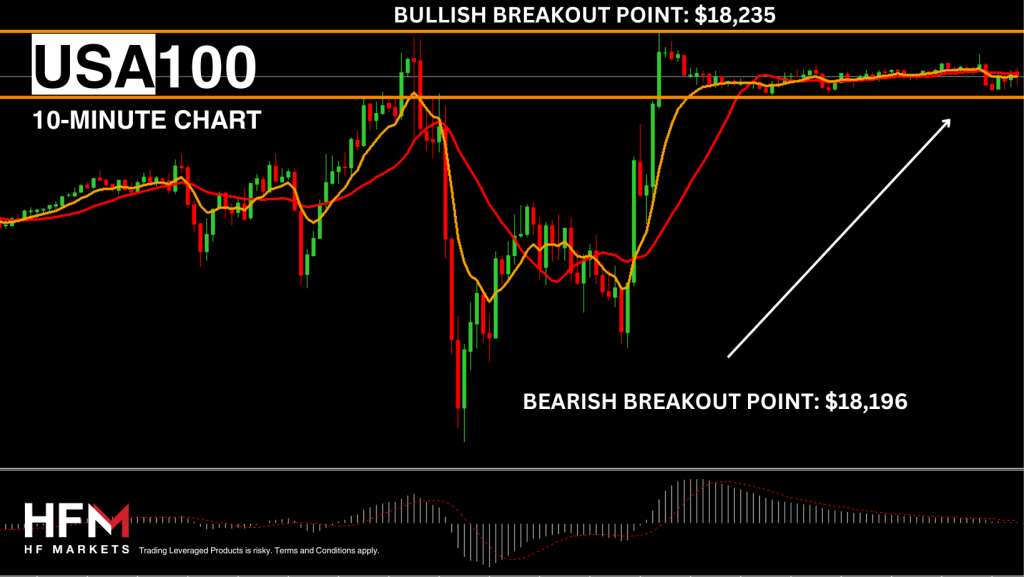

These ten stocks make up a weight of 49% of the index and therefore hold a stronger influence over the overall price. Technical analysis for the USA100 is signalling neither a sell or buy. The price is trading slightly higher than the 75-Bar EMA and at the 55.00 mark on the RSI. However, the price is forming a horizontal price range this morning. Therefore, for a buy signal to be confirmed, the price will need to form a bullish breakout and ideally inflation will not beat expectations.