Ethereum Bulls Have A Mountain To Climb: Will They Break $3,700?

Ethereum bulls have a mountain to climb, provided prices are below $3,700 and trading volume continue shrinking

Ethereum is firm at press time, attempting to shake off sellers of early April. Even though confidence is high, its impact is not visible on the daily chart. Sellers are in a commanding position, keeping prices way from the middle BB and the $3,700 level. Technically, bears remain in charge even with bulls attempting to wind up recent losses.

ETH is stable in the past hour and day. However, it is down 8% in the last week of trading. At the same time, participation has been decreasing. The average trading volume is around $15 billion, roughly half the average during the last bull cycle. Unless trading volume recovers, Ethereum prices will likely continue flat-lining.

Currently, traders are looking at fundamental factors as potential triggers of demand. Accordingly, the following Ethereum news event might influence price action in the short term:

- Eyes are on Ethereum Layer-2 solutions, designed to scale the mainnet. VanEck predicts these chains, including Arbitrum and Optimism, will command over $1 trillion in valuation by 2030. At this level, these chains, despite the lower transaction fees, will be accruing more revenue than the mainnet. Layer-2 solutions are scalable, providing lower transaction fees.

- JP Morgan thinks with the number of Ethereum validators crossing the 1 million mark, the risk of the United States SEC classifying it as a security is decreasing. The regulator is yet to provide clarity on the status of this coin. Accordingly, there are doubts on whether they will proceed approving a spot Ethereum ETF in May 2024.

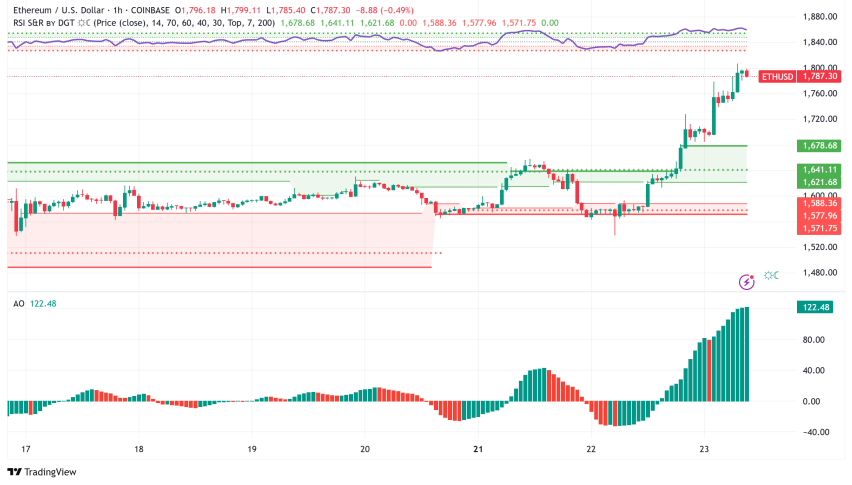

Ethereum Price Analysis

ETH/USD is in green when writing but still boxed inside a wide-ranging bear candlestick.

While optimism runs high, buyers have a mountain to climb.

For the uptrend to remain, prices might surge above $3,700, reversing April 2 losses.

If not, Ethereum prices risk plunging, especially if recent gains are reversed with rising trading volume.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account