EURUSD Analysis – Is the Fed More Hawkish Than Previously Thought?

Recent statements from Federal Reserve members are bolstering the US Dollar, although there is divergence in forward guidance within the Fed. While the Chairman suggests the Fed may soon feel comfortable reducing rates without requiring much additional evidence, Fed Governor Mr. Waller advises a more cautious approach, preferring to wait for a few months of data before deciding on the next steps. Consequently, upcoming inflation and employment figures will remain crucial and could potentially delay rate hikes further. Economists predict the Federal Reserve will decrease interest rates three times this year, yet the timing of the initial cut is uncertain and subject to change based on forthcoming data.

A positive note for traders is the absence of conflicting currencies in the EURUSD exchange. The US Dollar is currently trading 0.12% higher, while the Euro is weakening against most other currencies, trading 0.06% lower against the Pound and the Canadian Dollar, and 0.16% lower against the Japanese Yen. Yesterday, Mr. Cipollone, the head of the Bank of Italy, expressed confidence that inflation would return to the 2.0% target by mid-2025. He also advocates for lowering interest rates and intends to utilize this as a basis for adjusting monetary policy. The Euro is facing downward pressure as investors anticipate challenges for the European Central Bank in avoiding cuts if the Fed delays its adjustments.

The US Dollar will be influenced by four major economic data releases. The US Final GDP, Weekly Unemployment Claims, Pending Home Sales and Consumer Sentiment Index. If these read higher than expectations with the weekly unemployment claims dropping, the US Dollar is likely to witness further support. However, investors should note the main release will be tomorrow’s Core PCE Price Index. Traders are expecting no major news for Europe and volatility levels may fall tomorrow as European markets are closed for Easter.

European data on the other hand is stable and consumer confidence indexes are actually improving. This is largely due to the expectations of upcoming imminent rate cuts. However, the main factor is that the region is not seeing any real growth and inflation is down to a more acceptable level. No significant data is expected for the European market until next Tuesday. On April 2nd, Germany will confirm their latest CPI (inflation) data. If inflation continues to fall, a rate cut become more likely and the Euro can further decline.

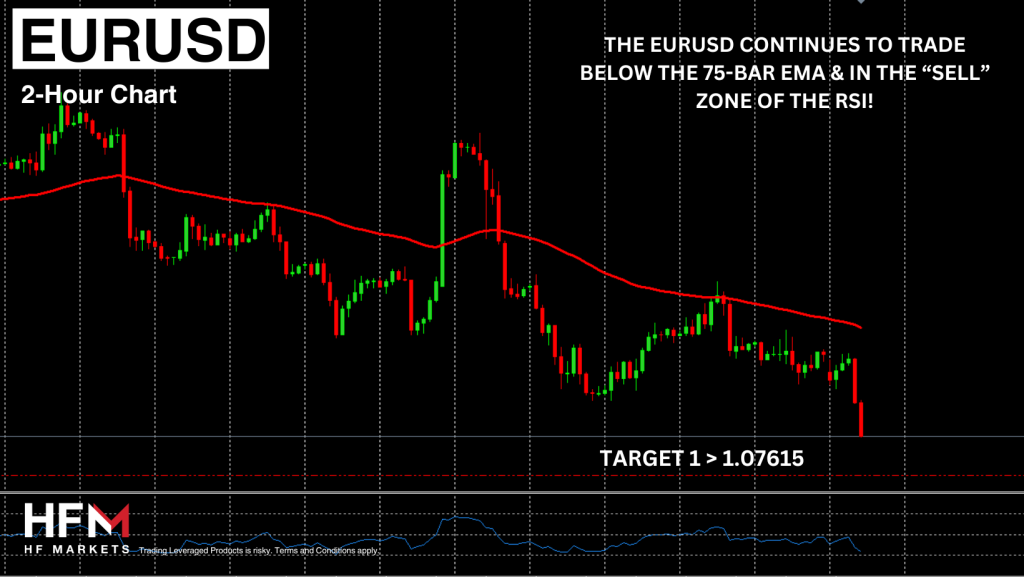

Technical analysis currently points towards a continued downward trend. The price is trading below the neutral on the RSI and below the 75-Bar EMA. However, investors should note this will also be dependent on upcoming US data.