Gold Price Forecast: FOMC Holds Rates, Gold Hits $2203

Gold‘s market value experienced a significant surge as the Federal Reserve maintained its benchmark interest rate but adjusted its Federal Funds Rates projections higher for 2025.

The XAU/USD pair is currently trading with volatility in the region of $2170 to $2180, marking an ascent of over 1%.

Fed’s Decision Stabilizes Rates

Despite the sustained high rates of 5.25%-5.50%, the Fed’s commentary on the strength of the U.S. economy and the labor market’s resilience has invigorated gold investors. The Federal Reserve’s cautious but optimistic tone suggests that while progress on inflation is noted, the end goal remains distant, with data-driven decision-making continuing to be the Fed’s compass.

Powell’s Remarks on Inflation and Economic Outlook

Jerome Powell’s reaffirmation of the need for more concrete evidence to initiate rate cuts has reinforced the Federal Reserve’s steadfast approach. His comments on expecting a ‘bumpy road’ to the 2% inflation target reflect the central bank’s commitment to a careful and measured pathway to price stability.

Economic Indicators and Revised Projections

The Federal Reserve’s updated projections indicate a gradual rise in the Federal Funds Rate to 3.9% by 2025, along with an upward revision of GDP growth for 2024 to 2.1%. The Unemployment and PCE Price Index targets remain unchanged, suggesting a steady course for the foreseeable future.

Market’s Anticipation and Data-Driven Speculation

Recent U.S. economic data presents a mixed view, highlighting the challenges in anticipating economic slowdowns. While the labor market exhibits cooling signs, inflation persists, prompting a recalibration of expectations around the Fed’s rate-cut timeline. Current market sentiments, influenced by Powell’s congressional testimony and recent economic figures, now reflect a 64% anticipation for a rate cut by June, slightly down from last week’s 72%.

Gold’s price forecast and the XAU/USD trajectory will continue to be closely tied to the evolving economic landscape and the Federal Reserve’s policy decisions in the months ahead.

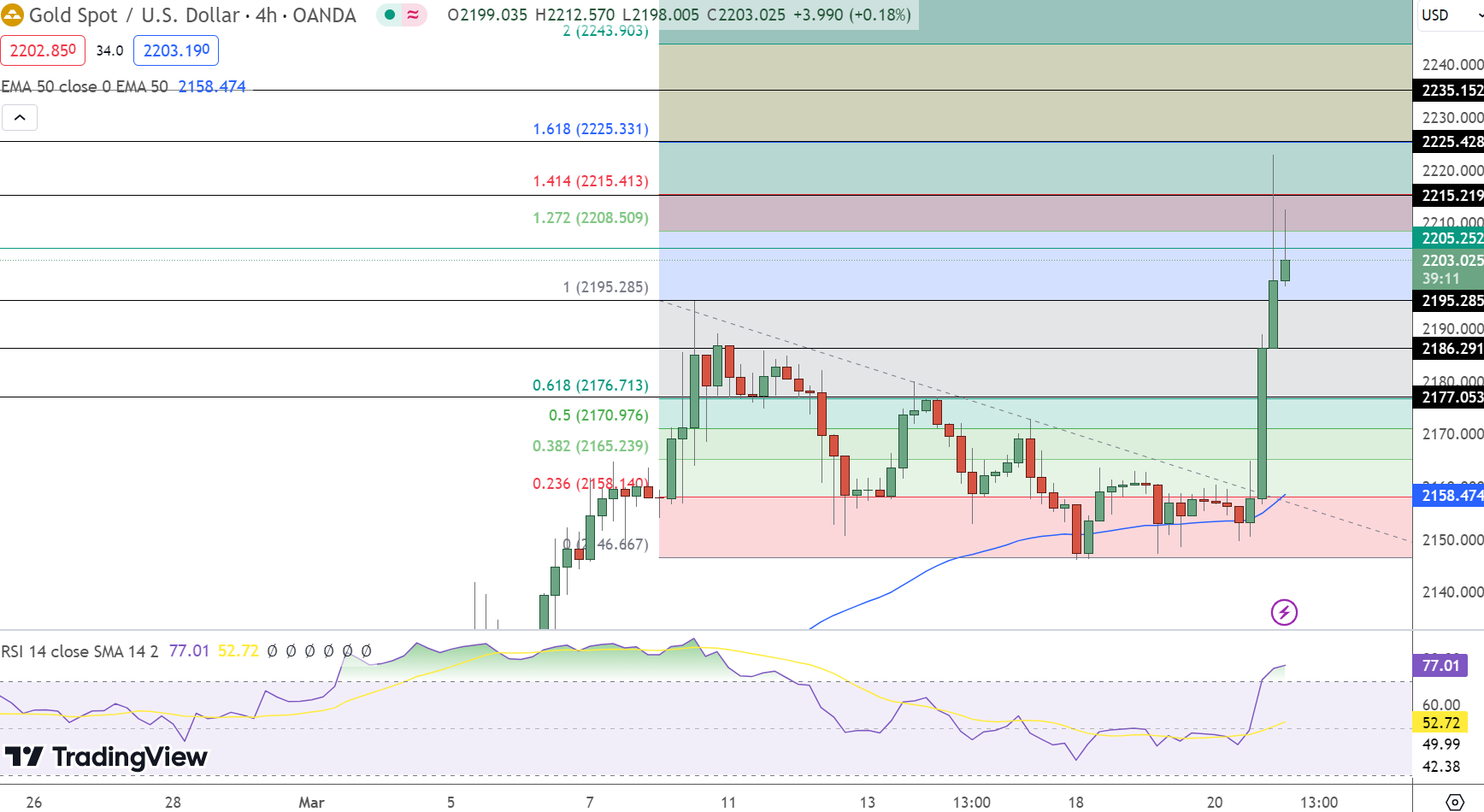

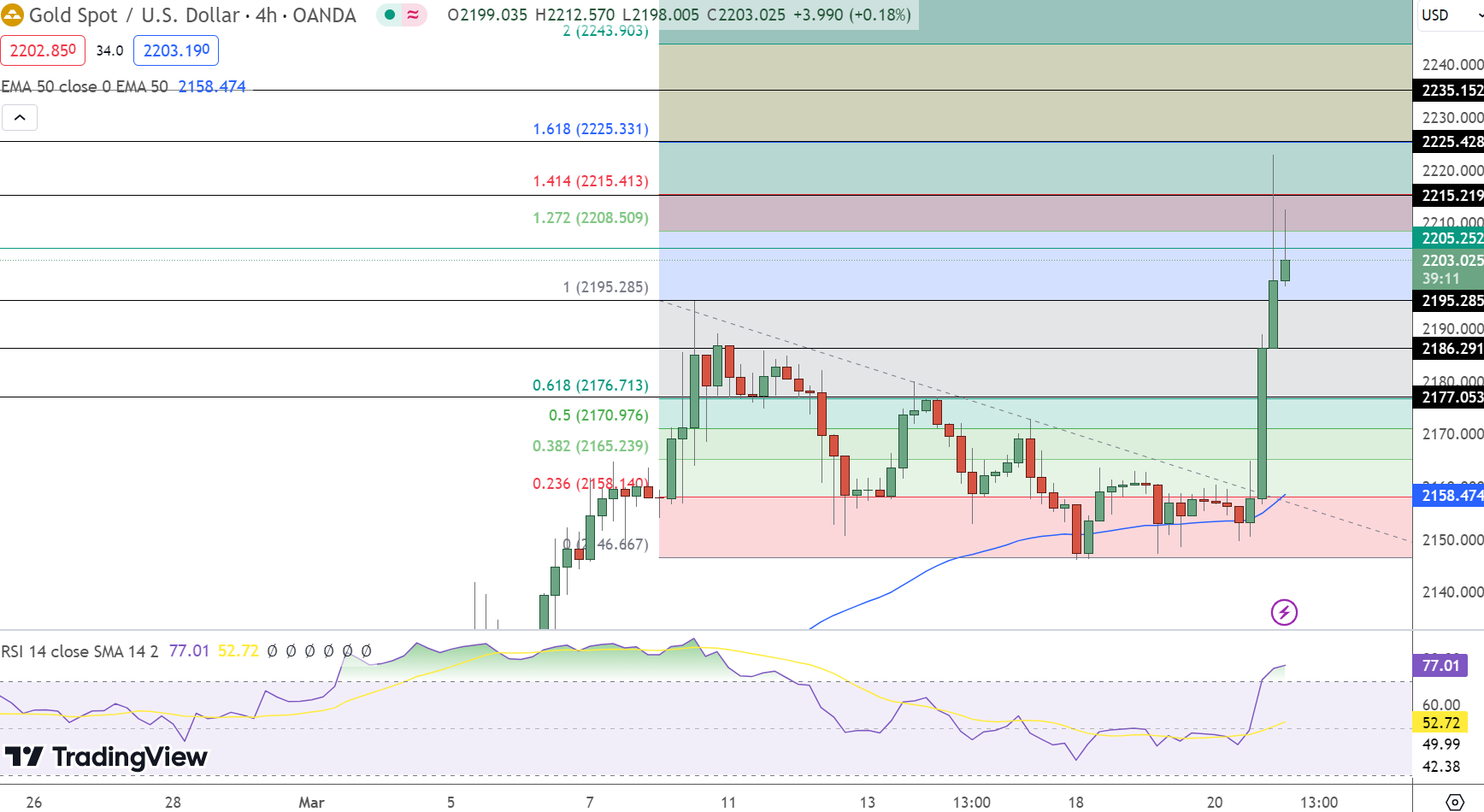

Gold Price Forecast: Technical Outlook

On March 21, Gold’s price action reflected investor optimism, pushing the precious metal up by 0.76% to $2203.02. As market participants digest the latest economic data and central bank insights, the technical outlook of Gold pivots around the $2205.25 mark—the established green line on charts signaling the inflection point of current trends.

Resistance levels at $2215.22, $2225.43, and $2235.15 stand as thresholds that could cap upward movements, should Gold attempt to extend gains. Conversely, support forms at lower echelons, with $2195.29, $2186.29, and $2177.05 serving as buffers against price pullbacks.

A significant indicator, the Relative Strength Index (RSI), currently at 77, signals that Gold might be entering overbought territory. The recent bullish candles post-FOMC suggest a momentary ascendancy, yet caution prevails as the market approaches the pivot point, where further upside may be challenged.