Nikkei 225 Forecast: Dips to 39,688 Amid BOJ Policy Shift Speculation

The Nikkei 225 concluded a week of mixed fortunes, closing at 39,688.94, a 0.63% increase on Friday but recording a weekly decline for the..

The Nikkei 225 concluded a week of mixed fortunes, closing at 39,688.94, a 0.63% increase on Friday but recording a weekly decline for the first time in six weeks, attributed to profit-taking and anticipation of the Bank of Japan (BOJ) potentially tightening its expansive monetary policy imminently, which cast a shadow over market sentiment.

Nikkei 225 Sees Weekly Drop Amidst Policy Shift Speculation

Nikkei 225 retracted from an intra-day peak of 39,989.33. The index fell by 0.6% over the week, snapping a streak of five consecutive weeks of gains during which it breached its 1989 peak, fueled by government-led corporate reforms and robust foreign investments.

However, the momentum waned as the index surpassed the 40,000 threshold early in the week, influenced by profit-taking activities and a strengthening yen amid speculations of a BOJ policy normalization in its mid-March meeting.

Auto Sector Faces Pressure from Stronger Yen

The automotive sector experienced a downturn on Friday due to the yen’s appreciation, affecting major players such as Toyota Motor, Subaru, and Suzuki Motor with respective declines of 1.4%, 3.2%, and 2.1%. The market is adjusting, particularly in exporter stocks, in anticipation of the upcoming BOJ meeting, according to Nomura’s chief macro strategist, Naka Matsuzawa, highlighting the uncertainty surrounding the yen’s potential rebound post-policy adjustment.

Banking Sector Anticipates Monetary Policy Adjustment: Conversely, the banking sector saw a rise of 2.1%, with the sub-index achieving its most significant weekly gain since September at 6%, spurred by increasing expectations of the BOJ departing from its ultra-loose monetary stance.

Upcoming Economic Events to Watch

In the coming week, pivotal economic data including Japan’s Final GDP for the quarter, the GDP Price Index year-on-year, and the M2 Money Stock year-on-year, are set to be released, providing further insights into Japan’s economic health. Additionally, preliminary figures for Machine Tool Orders year-on-year and the BSI Manufacturing Index will be closely monitored, alongside the Producer Price Index (PPI) year-on-year, offering clues on manufacturing health and price pressures.

The Nikkei 225 price forecast remains in focus as investors gauge the impact of these developments, especially with the BOJ’s meeting on the horizon, which could significantly influence the trajectory of Japan’s financial markets and the broader economic landscape.

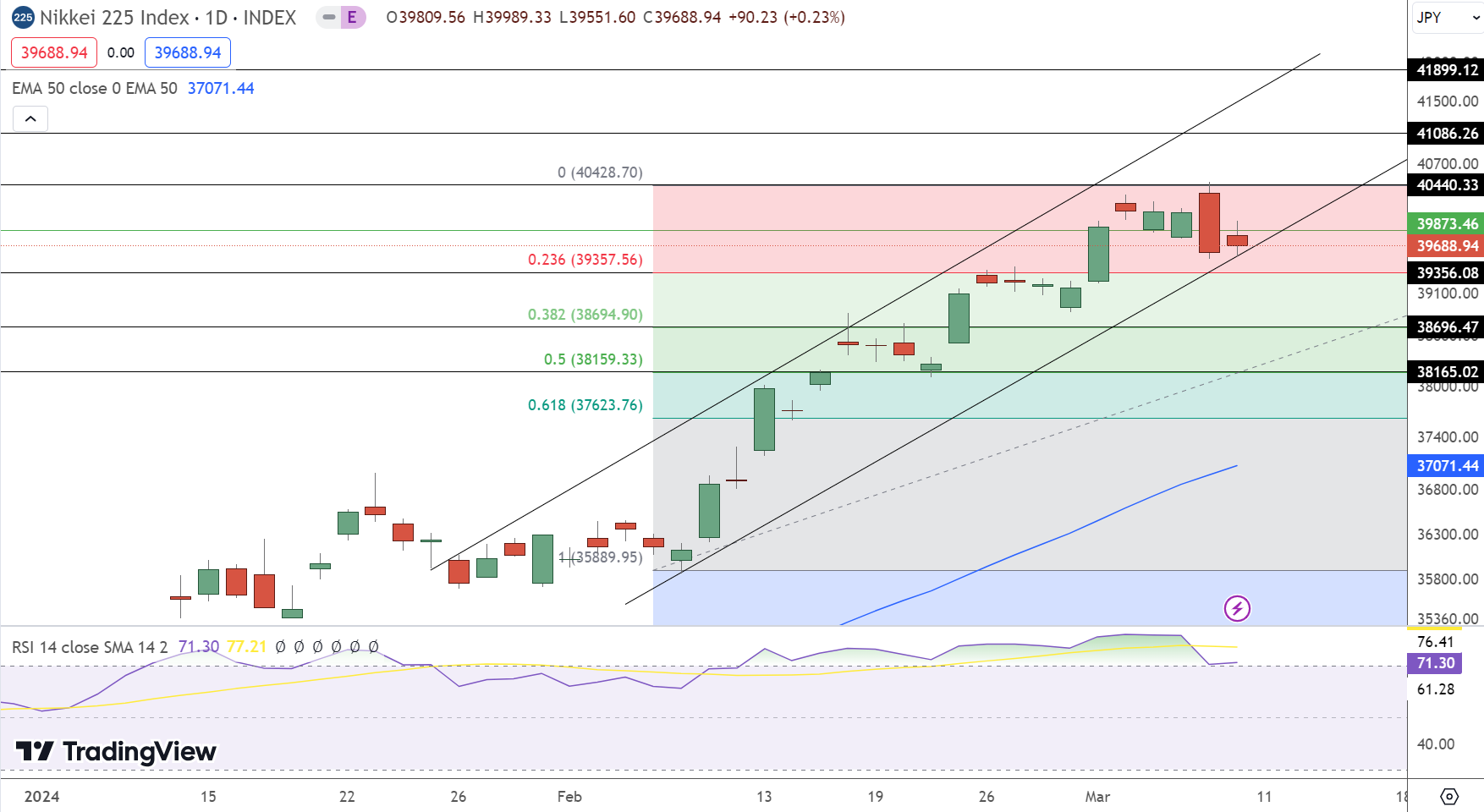

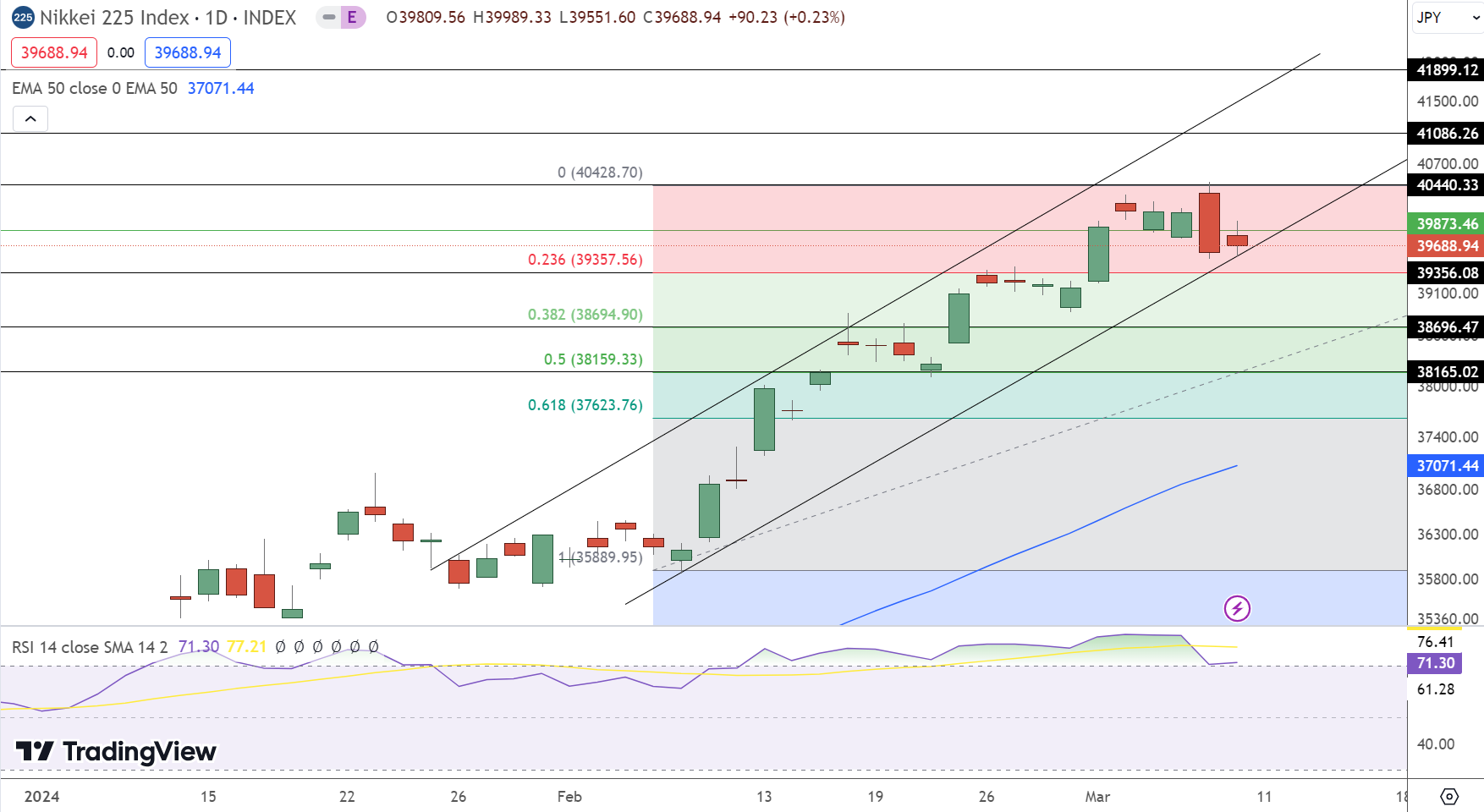

Nikkei (NKY) Price Forecast: Technical Outlook

The pivotal point for the index stands at 39,873.46, indicating a near-term bullish sentiment if sustained above this level. Resistance points are mapped out at 40,440.33, 41,086.26, and 41,899.12, each representing potential hurdles in the index’s upward trajectory.

Support levels are strategically placed at 39,356.08 (23.6% Fibonacci retracement), 38,696.47 (38.2% Fibonacci retracement), and 38,165.02 (50% Fibonacci retracement), providing a safety net against potential pullbacks. The Relative Strength Index (RSI) at 71 signals an overbought condition, suggesting caution, while the 50-Day Exponential Moving Average (EMA) at 37,071.44 underscores the index’s underlying strength.

An upward trendline, bolstered by the 23.6% Fibonacci retracement level, supports the Nikkei’s continuing rise, especially above the 39,357 mark. In summary, the Nikkei exhibits a bullish stance above 39,870, yet a drop below this threshold could lead to a sharp correction. Short-term expectations lean towards the index challenging the resistance at 40,440.33 in the upcoming days, amidst prevailing market dynamics.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account