Gold Remains Supported As US Durable Goods Orders Dive

Today the data started coming out and US durable goods orders posted a major decline. Gold was retreating lower earlier, with the XAU price falling to $2,030, but it is finding support at moving averages on the H1 timeframe chart, as shown below. We are long on Gold already and the chart setup is looking good for a bullish reversal soon, we’re holding on to our GOLD signal.

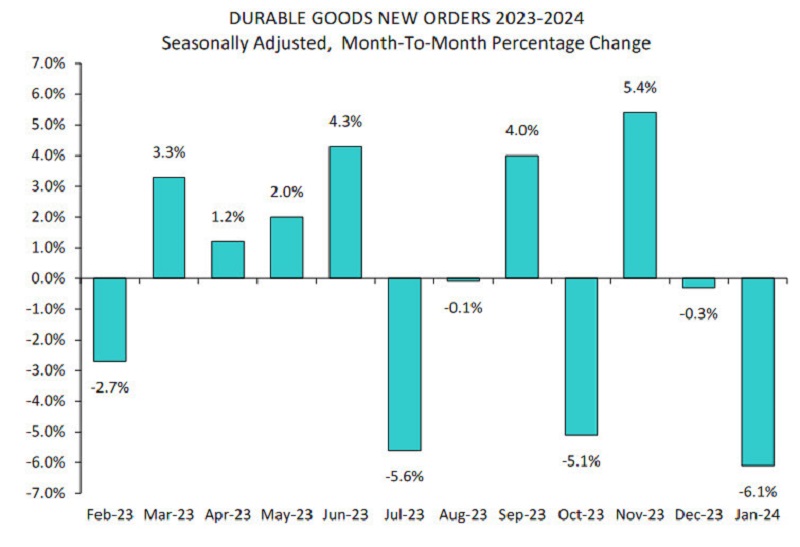

US January Durable Goods Orders

The forecast for US durable goods orders indicated an expected decrease of 4.5% last month, after the December number came at 0.0%, which was revised lower today to -0.3%, while the decline for January was much larger. However, these figures may be influenced by a decline in aircraft orders, which can sometimes cause distortions in the overall data. So, traders are paying closer attention to non-defense capital goods orders excluding aircraft.

| Broker | Review | Regulators | Min Deposit | Website | |

|---|---|---|---|---|---|

| 🥇 |  | Read Review | FCA, CySEC, ASIC, MAS, FSA, EFSA, DFSA, CFTC | USD 100 | Visit Broker |

| 🥈 |  | Read Review | FSCA, FSC, ASIC, CySEC, DFSA | USD 5 | Visit Broker |

| 🥉 |  | Read Review | CySEC, MISA, FSCA | USD 25 | Visit Broker |

| 4 |  | Read Review | ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB | USD 200 | Visit Broker |

| 5 |  | Read Review | ASIC, FCA, CySEC, SCB | USD 100 | Visit Broker |

| 6 |  | Read Review | FCA, FSCA, FSC, CMA | USD 200 | Visit Broker |

| 7 |  | Read Review | BVI FSC | USD 1 | Visit Broker |

| 8 |  | Read Review | CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA | USD 10 | Visit Broker |

| 9 |  | Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker |

| 10 |  | Read Review | IFSC, FSCA, ASIC, CySEC | USD 1 | Visit Broker |

January Durable Goods Report for the United States

- Overall durable goods orders declined by 6.1% compared to expectations of a 4.5% decrease. This represents a notable downturn from the previous reading, which was revised from 0.0% to -0.3%.

- Non-defense capital goods orders excluding aircraft, a key indicator of business investment, remained flat at +0.1%, in line with expectations. However, the prior reading was revised downward from +0.3% to -0.6%.

- Excluding transportation, durable goods orders fell by 0.3%, missing expectations of a 0.2% increase.

- Excluding defense, durable goods orders dropped significantly by 7.3%, contrasting sharply with the prior reading of +0.5%.

- Shipments of durable goods decreased by 0.9%.

Overall, the January durable goods report indicates weakness in both overall orders and specific components such as non-defense capital goods orders and shipments. These figures may reflect challenges in the manufacturing sector and business investment, which could have implications for broader economic growth in the coming months. However, durable goods orders are volatile in nature. Digging into the data, the only notable growth in orders was in ‘computers and related products’, which is strongly suspected as AI computer chips and the like. The shipments were up 5.7% and new orders were up 5.8%. The rest were all down.