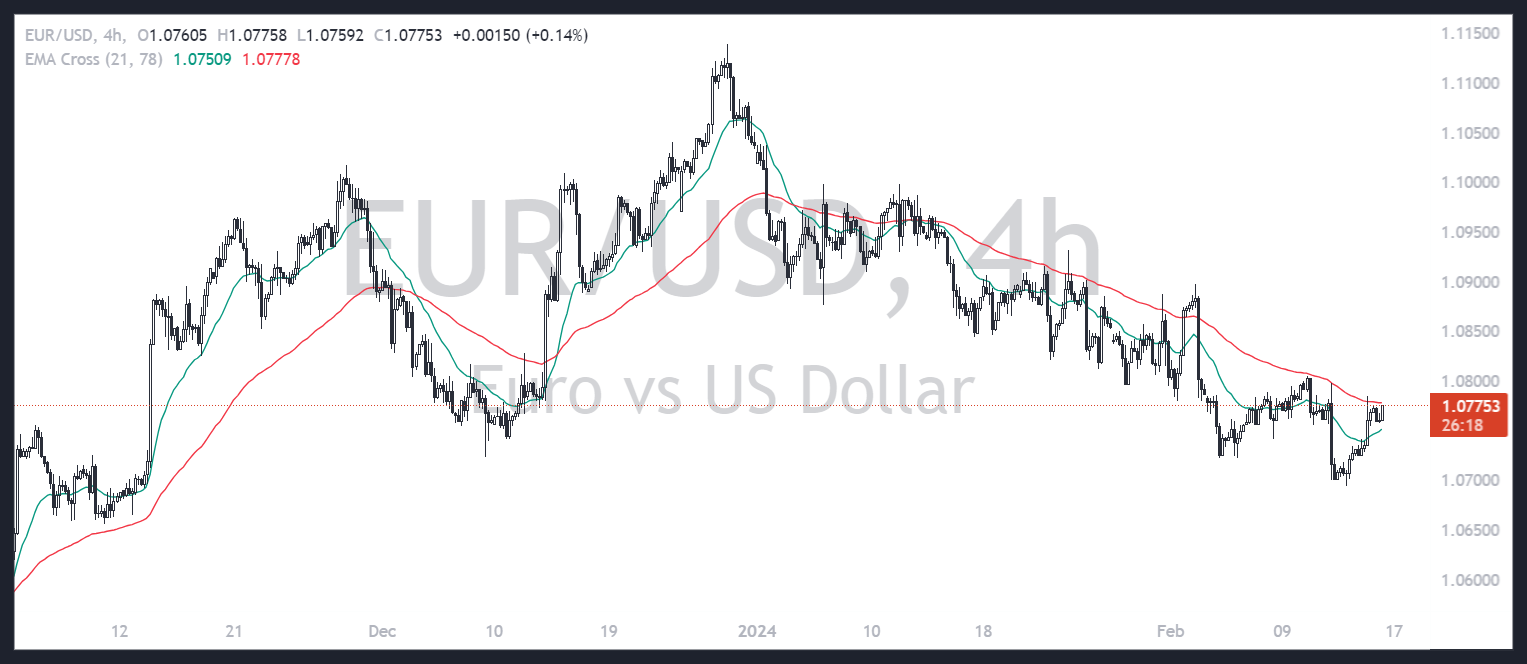

EUR / USD on a challenging path

The European economy has taken a challenging path

The European economy has experienced a lack of development over the past year due to several factors, including high interest rates, the collapse of the Chinese economy, and a slowdown in the manufacturing industry. Of particular concern is the rapid decline of the German economy, which has traditionally been known as the ‘Engine of Europe.’

Furthermore, the prolonged high-level inflation experienced in Europe significantly influenced the suppressing demand within the region.

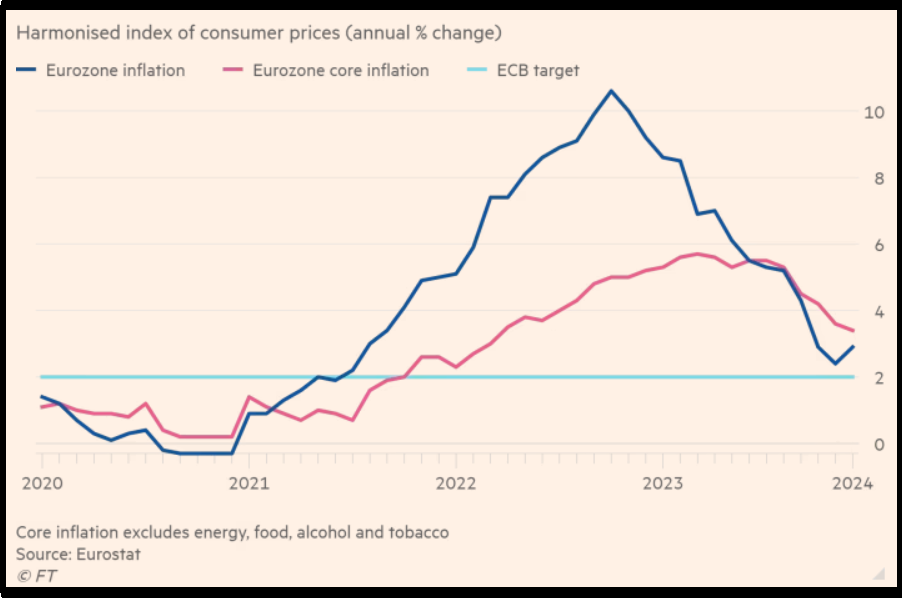

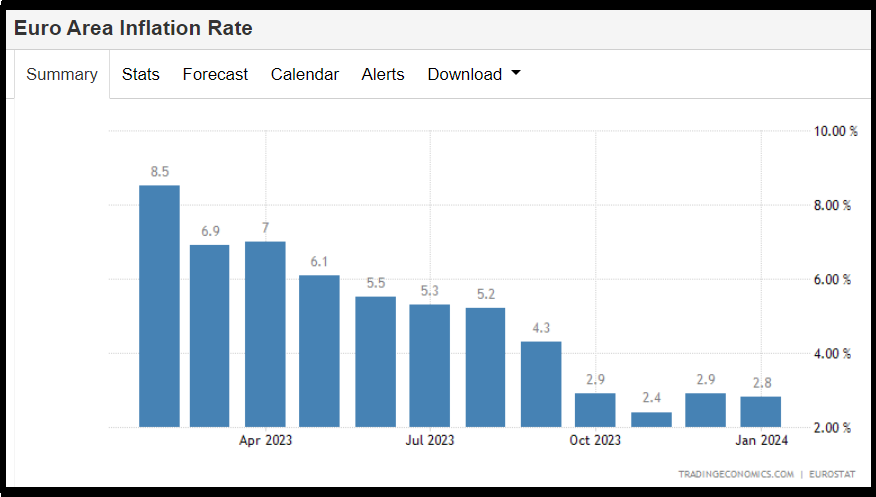

The Consumer Price Index(CPI) in Europe, which experienced a significant surge to 10.6% in November 2022, gradually declined due to the ECB’s fast rate hike. However, it still remained at the higher level of 4% until November of last year, considerably surpassing the central bank’s intended target of 2%. This notable increase in CPI strengthened the ECB’s restrictive monetary policy stance and resulted in tighter financial markets.

In December, the CPI of the Eurozone declined to 2.4%, indicating that the impact of the ECB’s rate hikes is now being felt substantially. However, in January, the CPI experienced a rebound from 2.4% to 2.9%, indicating the scenario that central banks are most wary of – “A resurgence in inflation.”

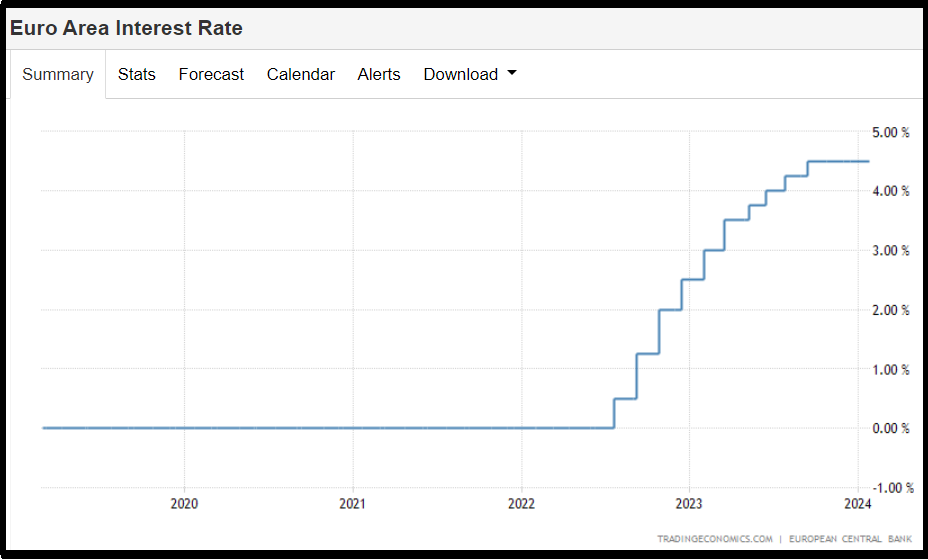

Given the prevailing scenario, there is a consensus among the market participants that the future direction of the European economy will primarily hinge on the ECB’s interest rate path. The market believes that the restrictive monetary policy stance will have a detrimental effect on the European economy, eventually leading it into a state of further recession.

The European Central Bank’s attitude is the most important key

During a recent speech, the President of the European Central Bank, Christine Lagarde, advised caution regarding interest rate cuts. Specifically, she emphasized the need for vigilance with respect to the potential for a resurgence of inflation as the ongoing trend of wage increases persists.

President Lagarde is not the only one who has shown a lukewarm response to the rate cut. The director of the ECB, Ms. Isabel Schnabel, has expressed concern over the possibility of a resurgence in inflation, citing higher energy prices and rising wages as possible factors contributing to this trend.

The ECB’s firm stance towards monetary policy, particularly its hawkish approach, may exacerbate the market’s disappointment over the rate cut. In addition, from a macroeconomic standpoint, high-interest rates are likely to serve as a contributing factor to the contraction of the European economy.

What euro traders should pay attention to

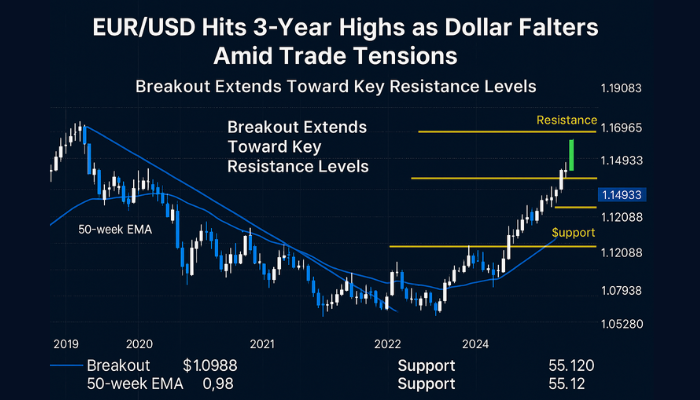

So what impact will the current Eurozone economy and the ECB’s actions have on the Euro in the future?

In order to gain a comprehensive understanding of the euro’s future trajectory, traders must analyze its movement from three distinct angles.

First, traders must remain mindful of the Federal Reserve’s monetary policy position.

The Fed has been lukewarm on cutting interest rates based on a Goldilocks scenario of a gradual slowdown in inflation combined with a healthy U.S. economy. There are apprehensions that a hastily implemented rate cut may lead to the resurgence of inflation, which could pose a challenge to the Fed’s monetary policy shift.

With the Fed’s tight monetary policy, the dollar is poised to gain strength. This could result in a relative downward pressure on the euro. For the euro traders, it is crucial to monitor any potential changes in the Fed’s monetary policy in the future.

The second is the results of European inflation (CPI) data.

During a recent speech, Christine Lagarde, the President of the ECB, stated that although disinflation is progressing, the upward pressure on prices cannot be ignored. As a result, the inflation indicators for the region that are yet to be announced will bear significant importance in determining the future direction of the ECB’s monetary policy.

In the event that the CPI of the Eurozone experiences a downward turn again, and there is solid evidence of disinflation, there are chances that the expectations of the ECB taking a rate cut decision will rise again. This, in turn, could act as a decisive trigger for the euro to fall.

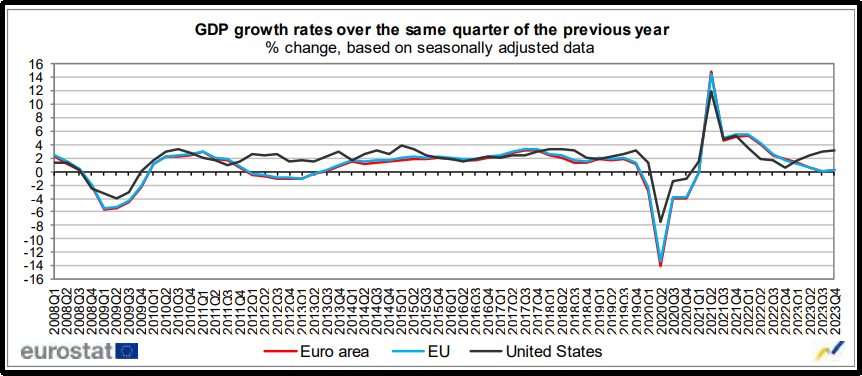

Third is the future direction of the European economy.

As previously discussed, there are concerns over the potential for negative growth in the European economy, including Germany. In the fourth quarter of last year, the Eurozone’s GDP registered a modest 0.1% growth, while Germany’s GDP contracted by -0.3%, indicating a decline in overall economic activities.

There is an observable trend of the U.S. economy outpacing that of Europe, which could result in a potential increase in the value of the dollar and a further decline in the strength of the euro.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account