GBP the Weakest Currency Today, After the Miss in UK Inflation CPI

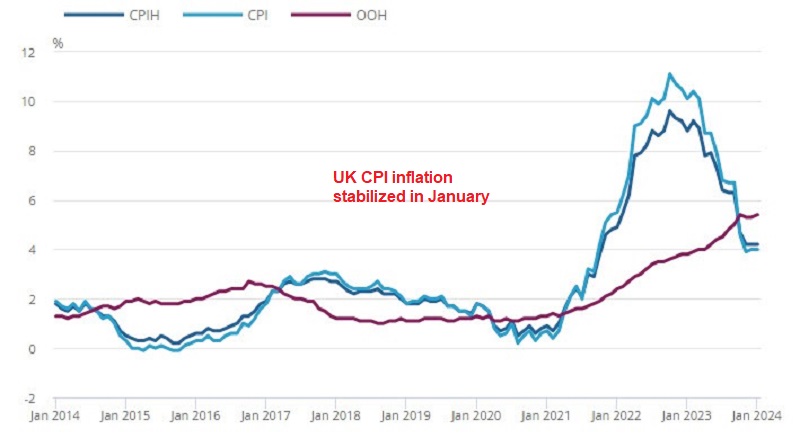

The GBP was showing resilience in January as BOE held steady, but UK fundamentals are turning softer for GBP/USD. Today’s CPI repot showed that the inflation rate remained unchanged in the UK in January, against expectations for an increase, which weighed down the GBP.

The UK’s Consumer Price Index (CPI) for January showed a year-on-year (YoY) increase of 4.0%, in line with December’s figure. However, this was slightly below expectations, as analysts had forecasted a rise of 4.2%, so it’s a 2 point miss. Meanwhile, the Core CPI, which excludes the volatile food and energy prices, also missed expectations, registering a YoY increase of 5.1%, the same as in December, while expectations were for a slight increase to 5.2%. These figures suggest that inflationary pressures in the UK remained elevated in January but stable, since they did not accelerate as anticipated.

January UK CPI Inflation Report from ONS – 14 February 2024

- UK January CPI YoY +4.0% vs +4.2% expected

- December CPI YoY was+4.0%

- Core CPI January +5.1% vs +5.2% expected

- December core CPI was +5.1%

Looking deeper into the report, the persistent elevation of services inflation, indicated by a tick higher to 6.5% in January compared to 6.4% in December, presents a challenge for the Bank of England (BOE). The inflation in services implies continued pressure on the prices of non-tradable goods and services, which could complicate the central bank’s efforts to manage overall inflation within its target range.

Uncertain If Bank of England Will Start Easing Policy in June

This aspect of the report may prompt the BOE to maintain its hawkish stance on monetary policy in order to curb inflationary pressures. The 71% probability of a rate reduction in the June meeting reflects an increased expectation following the UK CPI data release. However, there remains uncertainty regarding whether the Bank of England (BOE) will indeed implement a rate cut by the end of the first half of this year.

Despite a slight easing in goods inflation from 1.9% to 1.8% month-on-month, the persistent increase in services inflation from 6.4% to 6.5% in January presents a significant challenge for the BOE. Services inflation, being a key concern for the central bank, indicates ongoing pressure on non-tradable goods and services prices, complicating the management of overall inflation. As such, the data does not provide a clear signal for a rate cut, and market participants may remain cautious until further clarity emerges regarding the BOE’s policy stance.