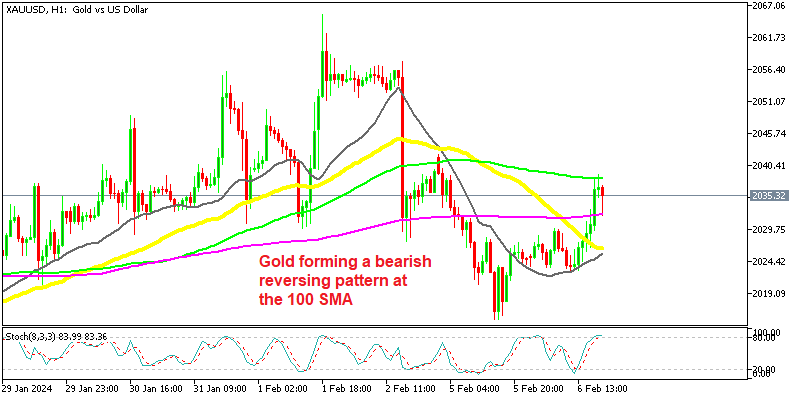

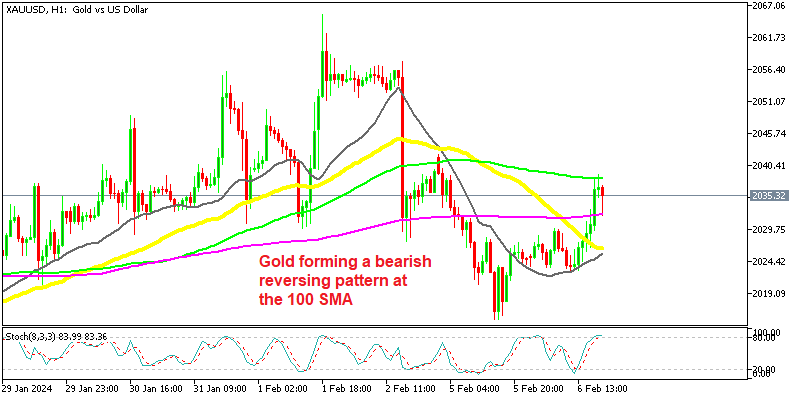

XAU/USD Avoids $2,00 Again As Gold Price Jumps Higher in US Session

Gold tumbled $50 lower in the last two days but Gold buyers are back again today

Gold tumbled $50 lower in the last two days as the USD sentiment turned bullish after the hawkish FOMC and great NFP jobs report last week. But, buyers continue to keep the price of Gold above the $2,000 level and today we are seeing them come back again, pushing the price toward $2,040.

We have seen some really strong economic figures from the US in the last several weeks, which imply resilience in the economy, giving the FED enough room to keep rates higher for longer. This has turned the rhetoric from Federal Reserve officials quite hawkish in recent weeks, so markets are not expecting the FED to cut rates too steeply this year, benefitting the USD.

Besides that, the upbeat economic picture in the US has been sending US Treasury rates higher which are helping the USD and may limit Gold’s upward potential. Gold has seen strong demand since October, but in recent weeks Gold buyers have shown difficulties and XAU has been quite volatile.

GOLD has been on a strong upward trend for several months, as central banks were giving signs of turning dovish and reversing the policy from extremely tightening to accommodative, while geopolitical tensions in the Middle East remain high, keeping the demand high for safe havens. As a result, Gold continues to trade above $2,000 and every attempt to return the price back to this level has failed

XAU/USD fell on Friday following the publication of an unexpectedly strong US NFP (non-farm payrolls) report. The figures may have ruined the market’s expectations of ambitious rate cut projections for the FED, with the first one now being postponed from March to May. Even a rate decrease at the May meeting is no longer thought to be a done deal. So, the magnitude of monetary easing by the FED in 2024 will also be scrutinized. Prior to the data release on Friday, the market expected a Fed funds rate of roughly 4% at the end of the year based on Fed fund futures while now expecations are for a 4.30% FED funds rate by the end of 2024.

Gold XAU Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account