AUD/USD Price Outlook: Aussie Nears $0.6510 Amid US Jobs Surge and Local Data

The AUD/USD pair continues to face downward pressure, trading near the 0.6510 level, as a robust US Dollar, underpinned by solid job gains, overshadows the Australian currency. The uplift in the US dollar came on the heels of an impressive nonfarm payrolls report, indicating an addition of 353,000 jobs that eclipsed market expectations.

Domestic Challenges for the Aussie

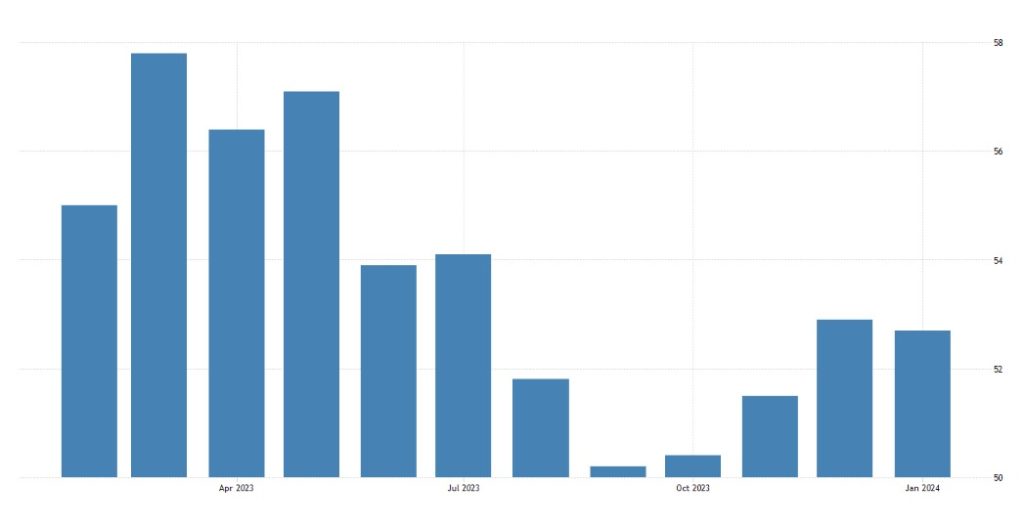

Domestic factors add to the Aussie’s challenges, with the S&P/ASX 200 Index retreating from highs and a marked decline in the Chinese Services PMI to 52.7, signaling a slowdown that could impact Australia’s export-driven economy.

The Australian economic landscape shows complexities, with the Trade Balance shrinking to 10,959M from a revised 11,764M, suggesting a potential trade dampening. However, slight upticks in the Judo Bank Composite PMI to 49 and Services PMI to 49.1 provide some domestic economic resilience.

The Reserve Bank of Australia’s cash rate is projected to stay at 4.35%, while inflation data shows a modest month-on-month increase of 0.3%, a decrease from December’s 1.0% rise.

US Economic Strength Exerts Pressure

Conversely, the US Dollar’s ascent to an eight-week peak reflects a market buoyed by strong economic indicators and reduced expectations for a Fed rate cut in March. The labor market strength, highlighted by the notable job additions in January and a 4.5% year-over-year rise in average hourly earnings, endorses the bullish sentiment for the dollar.

Federal Reserve Chair Jerome Powell’s cautious remarks confirm a prudent approach towards rate adjustments, further bolstering the greenback.

In summary, the AUD/USD pair confronts the dual headwinds of a vigorous US Dollar and mixed signals from Australian economic indicators, setting the stage for potential further declines in the currency pair.

AUD/USD Price Forecast: Technical Outlook

The Australian Dollar is currently exhibiting signs of consolidation against the US Dollar, with the AUD/USD pair receiving support near the $0.64980 level. At the time of analysis, the pair hovers around this mark, suggesting a potential pivot point for the currency’s direction.

Immediate resistance for AUD/USD is encountered at $0.65335, with further resistance likely at the 23.6% Fibonacci retracement level of $0.65640. Beyond this, the 38.2% Fibonacci mark at $0.65935 is the next notable resistance.

Support levels are observed at $0.64980 and $0.64881, with an additional support level potentially at the $0.64744 mark. The Relative Strength Index (RSI) rests at 42.40, indicating that the pair is neither overbought nor oversold, providing room for movement in either direction.

The formation of a Doji candlestick pattern near the support above suggests a possible reversal, as this pattern often signifies indecision, which, following a decline, may hint at a bullish resurgence.