Gold’s Ascent Amid Dollar Weakness and Economic Signals

The price of GOLD (XAU/USD) has surged, reaching $1,978, its highest mark since late July. This gain during the early Asian trading hours on Friday has been spurred by two primary catalysts: a weakened US dollar (USD) due to dovish remarks from Federal Reserve Chair, Jerome Powell, and a surge in demand for safe-haven assets.

Simultaneously, the US Dollar Index (DXY), which gauges the USD’s value against a basket of six major currencies, is consolidating its recent losses, hovering around the 105.85 mark. Also noteworthy is the rise in US Treasury yields; the 10-year Treasury yield has climbed to 4.99%, a rate not seen since 2007.

Recent US job data has shed light on the American economy’s robust health. For instance, the latest figures show that the weekly initial jobless Claims for the week ending October 14 plummeted to 198,000, the lowest since January. Conversely, the housing market shows signs of strain, with existing home sales registering a decline of 2.0% MoM in September and a stark 19% YoY fall, reflecting the lowest numbers since 2010. Such data implies that rising mortgage costs might be denting confidence in the housing sector.

Fed Chair Jerome Powell’s recent comments further elucidate the decline of the USD. He hinted at a potential pause in rate hikes, suggesting that the Federal Reserve will be observing upcoming economic data closely. Powell also entertained the possibility of further monetary tightening if subsequent data indicates above-trend growth and a taut labor market.This viewpoint contributed to the USD’s dip and, conversely, a boost for USD-denominated gold.

As we await significant economic data releases from the US, the speeches from Fed officials, namely Logan, Mester, and Harker, will be closely watched by market stakeholders.

Technical Perspective on Gold

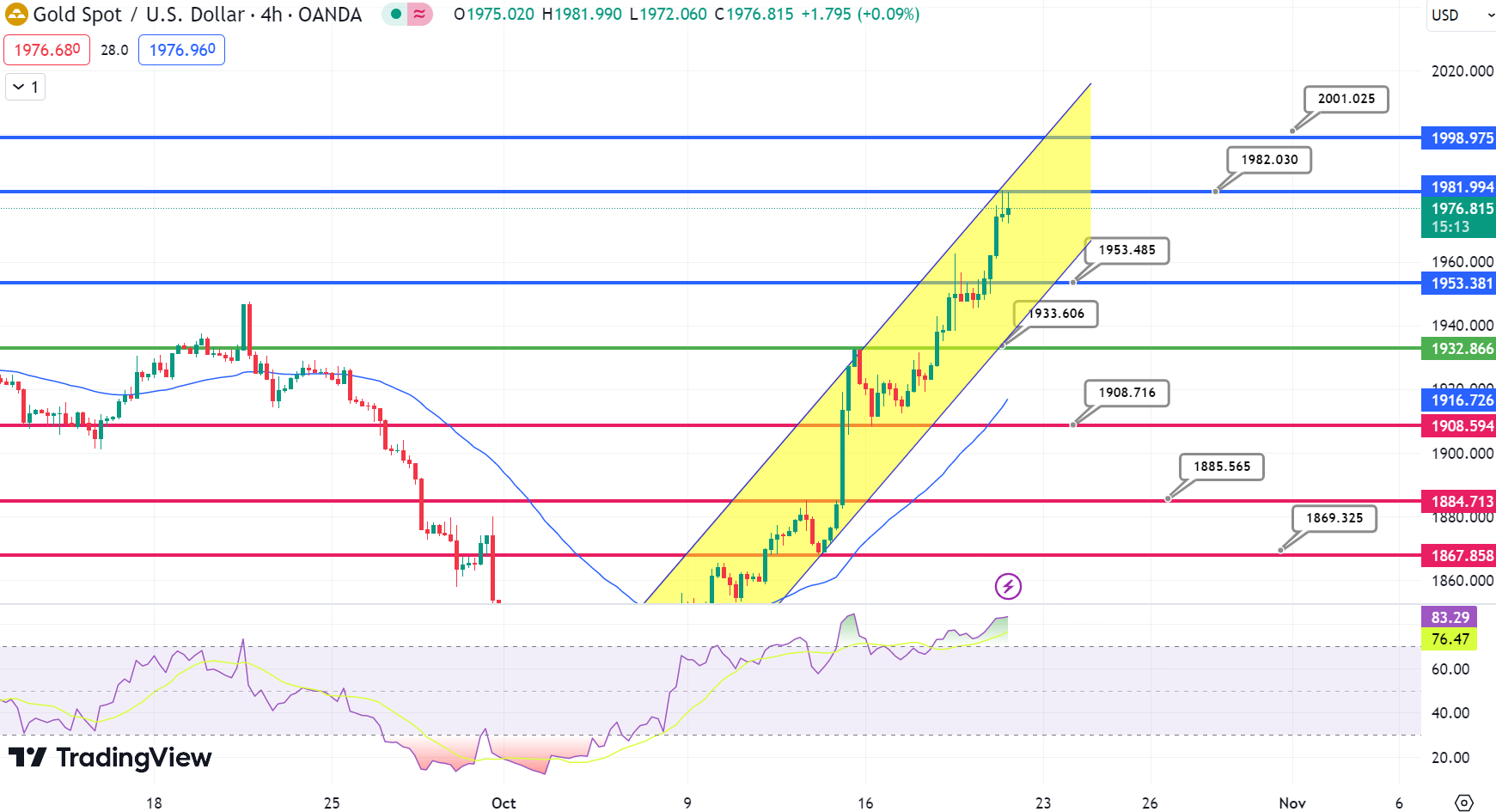

Yesterday, the GOLD price experienced a significant upward momentum, achieving the anticipated target at $1,977.25. Current trends suggest the metal may breach this level, potentially leading to further gains in upcoming sessions, with targets set at $2,000.00, followed by $2,016.90.

The EMA50 metric consistently backs this bullish trajectory. However, it’s crucial to note that if GOLD fails to sustain levels above $1,977.25, the expected upward trend might halt, possibly triggering a price decline. For today, the trading range for gold is projected to oscillate between a support level of $1,965.00 and a resistance level of $2,000.00. The current trend prediction for the day remains bullish.