Another Report Confirms US Employment Is in Good Shape

The employment sector has been strong in the US as other sectors soften up, being one of the factors that have been keeping the US economy afloat, the FED hawkish and the USD bullish. We did see a slump in the jobs figures in late August as the unemployment rate jumped from 3.5% to 3.8% and JOLTS job openings fell below 8 million.

But in the last two weeks, the employment figures and other economic indicators have been solid, starting with ISM services which dampened any expectations of a contraction in this sector, followed by higher consumer inflation CPI figures on Wednesday, while on Thursday retail sales and producer inflation PPI jumped higher. Unemployment claims increased slightly to 220K from 217K, but came below expectations of 226K.

US Initial Jobless Claims and Continuing Claims

Initial jobless claims and continuing claims

- Initial unemployment claims 220K versus 225K estimate

- Prior week jobless claims were 216K revised to 217K

- 4-week moving average of initial jobless claims 224.5K vs 229.5k prior

- Continuing claims 1.688M versus 1.695M.

- Prior week of continuing claims 1.684M versus 1.679 previously reported

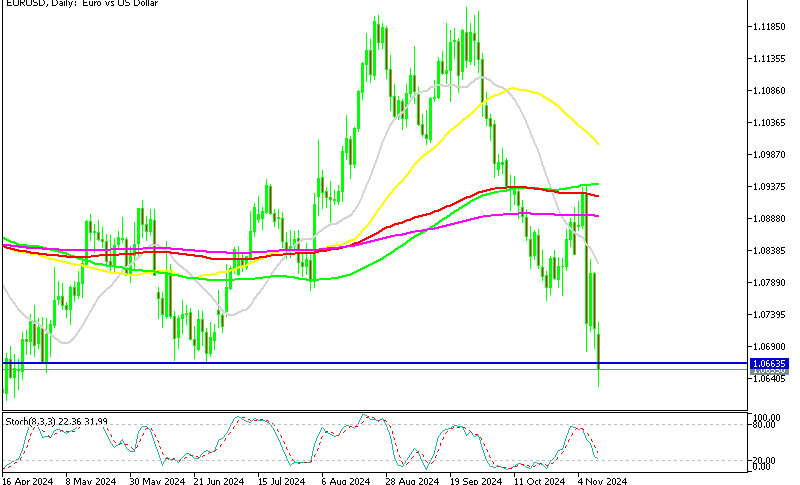

While the continuing claims have recently been constant, the initial jobless claims are heading further in the right direction. This shows that the labor market is still strong. The Labor Department said that new unemployment claims, a proxy for layoffs, decreased to 36,990 in the week ending September 9 from 38,418 the previous week. This indicates that the labour market will keep the US consumer in good shape as well, which in turn will help the US economy. The USD rallied around 100 pips across the board after that, so we will continue to remain long on the USD, and particularly short on EUR/USD as the ECB seems to have stopped rate hikes.