Another Leg Down for the USD After Disappointing ADP Employment

The USD is looking soft again today while risk assets are benefitting as odds for more FED hikes decline after a softening US labour market

The USD has been on a very strong bullish trend in August, but it is closing the month on the opposite direction, as it retreats down against most assets. Yesterday we saw a dive after the weak JOLTS job openings numbers and softer Conference Board consumer confidence. Today the foreign exchange (FX) market is setting up for a repetition of what we saw yesterday. Soft economic data has led to a decline in the value of the US dollar and an increase in demand for bonds which has sent the 10-year US Treasury yields below 4.10%.

The US dollar took another 50-60 pip dive across the board and is currently at its lowest point of the day against all major currencies. EUR/USD has reached its highest level since August 16, indicating a growing possibility of a larger retracement in its price. Traders are not really expecting a rate hike from the Federal Reserve next month while the odds for a rate hike on November 1 have fallen to 45%, down from over 50% at the beginning of this week.

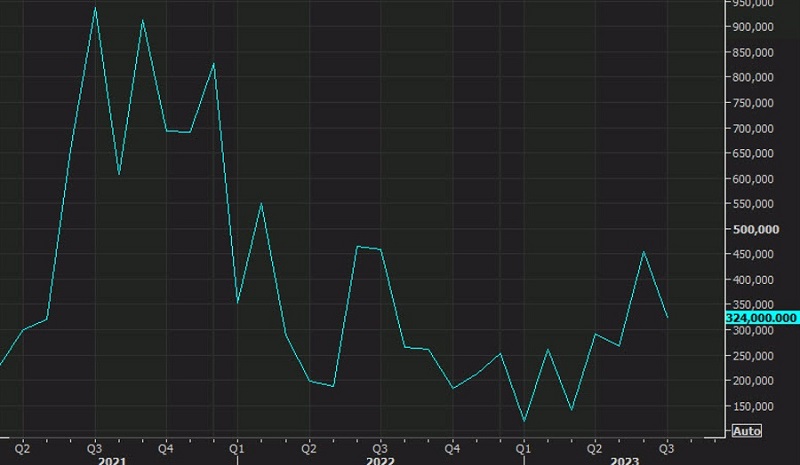

This decline in the value of the USD reflects diminishing concerns among investors about extreme rate hikes. These probabilities are declining and could drop further if the upcoming non-farm payrolls (NFP) report on Friday indicates weak job growth, following today’s miss in ADP employment which cooled to +177K from 324K last month which was actually revised higher to 371K.

It’s becoming increasingly evident that FED hikes are having a negative impact on the US economy. Although, the Q3 is looking strong after a 5.9% estimation for GDP growth according to the Atlanta Fed’s GDPNow, so there is still some room before genuine concerns of a recession emerge. However, historical patterns show that once layoffs commence, they can be difficult to halt. Given the Federal Reserve’s commitment to addressing inflation, it’s possible that assistance might not be readily available.

The August 2023 ADP Employment Report

- ADP August employment +177K vs +195K expected

- Prior was +324K (revised to 371K)

Details:

- Small (less than 50 employees) +18K vs +237K prior

- Medium firms (500 – 499) +79K vs +138K prior

- Large (greater than 499 employees) +83K vs -67K prior

- Job stayers 5.9% vs 6.2%

- Job changers 9.5% vs 10.2%

Just last month, this particular data point showed an increase of 324,000 jobs, far surpassing the expected 189,000. This outcome certainly didn’t anticipate a weak non-farm payrolls report. However, we find ourselves once again relying on the ADP (Automatic Data Processing) data to gain insights.

Job growth exhibited a significant slowdown last month, primarily attributed to the leisure and hospitality sector. Job generation within hotels, restaurants, and related establishments in this sector plummeted to 30,000 in August, following several months of robust recruitment.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account