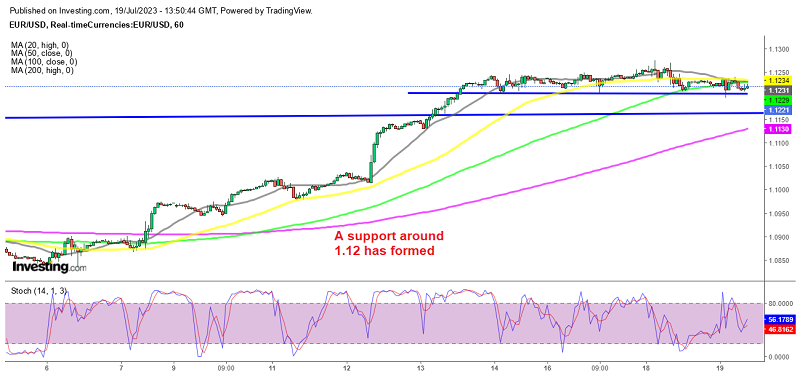

EUR/USD Trades in the Range After Final CPI, Before Breakout

EUR/USD continues to trade in a range with 1.12 as support, despite higher Eurozone core CPI and softer housing data from the US

Earlier today, EUR/USD started to slip lower as the US Dollar (USD) was gaining some momentum, following yesterday’s decline which came after the softer US headline retail sales for June. However, the release of softer-than-expected inflation data from the UK resulted in a bullish rally in the EUR/GBP pair, showing that the Euro benefited from capital outflows from Pound Sterling which gave support to other Euro pairs.

As a result, EUR/USD found support around the 1.12 zone, which has been holding since Friday and didn’t experience significant downward pressure. Later in the day, the building permits and housing starts both came in weaker than expected, showing a slowdown in the US. Although that came after an impressive 21.7% increase in May.

Earlier on, the final CPI (consumer price index) report for May was released from the Eurozone, which came in stronger than expected. The headline CPI remained unchanged at 5.5%, while core CPI ticked higher to 5.5% from 5.4% in the previous reading for the same period.

Eurozone June Final CPI Inflation Report

- June final CPI YoY +5.5% vs +5.5% prelim

- May CPI YoY was +6.1%

- Core CPI YoY +5.5% vs +5.4% prelim

- Prior core CPI YoY was +5.3%

Core annual inflation gets revised higher and that continues to vindicate the ECB’s more hawkish stance ahead of the July decision. The Euro has been performing exceptionally well in the past month. However, the currency’s future performance in the coming weeks and months hinges significantly on the actions of the European Central Bank (ECB). Currently, the market perceives a 70% probability of a rate hike in September, which presents opportunities for investors to reconsider their positions, potentially putting pressure on the Euro.

During a recent session, a certain ECB official, known for his “hawkish” bias, suggested that the ECB might have to increase interest rates beyond July. Nevertheless, he also highlighted the importance of striking a balance between the economic data and inflation, to avoid excessive tightening of monetary policy. These remarks acknowledge the delicate task the ECB faces in managing its policy to support economic growth while preventing inflation from spiraling out of control.

EUR/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account