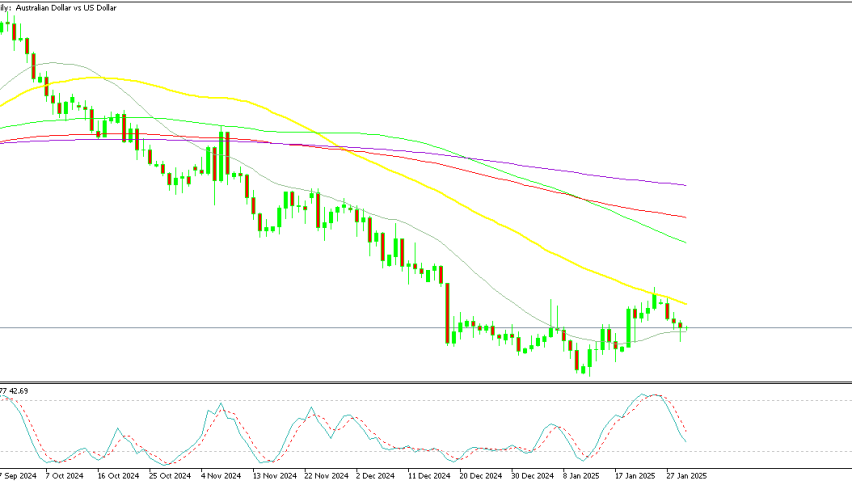

Decisive Time at Resistance for AUD/USD

AUD/USD experienced a significant rally during Monday’s trading session, mainly due to a weaker US dollar and positive data on Australian business conditions. This rally has brought the price action close to the top of a multi-week range, testing key resistance levels around 0.68. The 100-Day Exponential Moving Average (EMA) is currently positioned just below the 0.68 level.

In the past, this area has acted as a major resistance level on diffetent occasions. We will see whether this forex pair can successfully break out above this level or reverse back down, but it is showing signs of weakness which points to a reversal.

So, we are closely observing the market now, as the price trades at the upper boundary of the recent trading range between 0.66 and 0.68. If buyers manage to push and hold above 0.68, it could potentially lead to a move towards the 0.70 level. Otherwise, a reversal from this point could result in a decline towards the 0.67 level for AUD/USD , which coincides with moving averages down there and represents the midpoint of the consolidation range. Further downward action may take the price toward the 0.66 level, which has recently provided support.

Last night the retail sales for April was released, showing a 0.6% decline in Australia.

Q1 Retail Sales from Australia

- Australian Q1 retail sales QoQ -0.6% vs -0.6% expected

- Q4 of 2022 retail sales were -0.2%

- April retail sales MoM +0.4%

- Retail sales Yoy +5.4%