Who’s Taking All Profit in UK as Earnings Remain High, While Public Sector Strikes?

UK public sector workers are going on strike as prices surge, bonusses for financial services in the City increase while wages stagnate

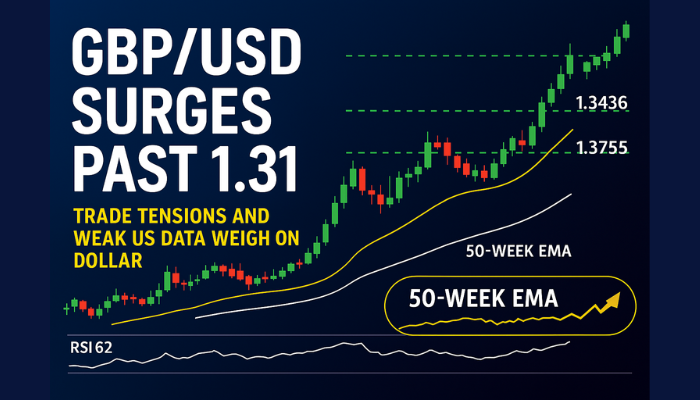

Yesterday we covered GBP/USD and how there are several factors that might affect this pair, starting with the UK October GDP report yesterday, which kept the GBP slightly bullish. Today’s US consumer inflation CPI is another factor and the last major piece of data from the US before tomorrow’s rate hike decision by the FED.

Earlier today we had the UK Claimant Count Change, the Average Earnings Index and the Unemployment Rate, while the BOE Governor Bailey will speak later on, although he might touch on the monetary policy ahead of Thursday’s meeting and rate decision by the Bank of England, which will be another major factor for the GBP.

Earnings showed a 6% increase for November this morning, which is a very decent pace of increase, although it hasn’t been going into wages. Prices have bees surging as CPI inflation remains above 10% in the UK and the UK finance minister Jeremy Hunt said that he doesn’t know if inflation has peaked or not, adding that the economy is likely to get worse before it gets better.

UK November Employment Report

- November payrolls change 107k vs 74k prior

- October 74k; revised to 79k

- October ILO unemployment rate 3.7% vs 3.7% expected

- Prior 3.6%

- October average weekly earnings +6.1% vs +6.1% 3m/y expected

- Prior +6.0%

- October average weekly earnings (ex bonus) +6.1% vs +5.9% 3m/y expected

- Prior +5.7%

The report continues to exemplify that labour market conditions are still holding up well in the UK, with a rise of 3.2% in payrolled employees seen since February 2020. That said, pay growth in real terms (adjusted for inflation) continue to record a fall – both in total and regular pay – and that just points to how difficult the working/living conditions are at the moment and why we are seeing the strikes mentioned here.

In August to October, pay growth fell by 2.7% – which is among the largest falls since comparable records began in 2001.

Meanwhile, strikes are erupting all over the public sector. UK prime minister, Rishi Sunak is facing a wave of worker strikes that is building up across Britain. Nurses are the latest to go on strike and the workers union points out that more strikes are due each day this month across a wide range of sectors, resulting in an estimated loss of 1 million working days in December. This follows strikes in the rail network and postal service, with airports also bracing for disruptions and junior doctors, midwives, and teachers also prepared to join too.

This should be negative for the GBP since it would mean more disruption a negative impact on the economy this month, but if workers force the government to accept their requests and increase wages, then that would be great for the economy. So, let’s see how much pay rise they will get from Sunak.

GBP/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account