British Pound on the Rise, Quick Update on GBP/USD & GBP/JPY

On the daily chart, GBP/USD bulls target the 50% mean reversion level of the previous bearish impulse. Bears must breach critical support

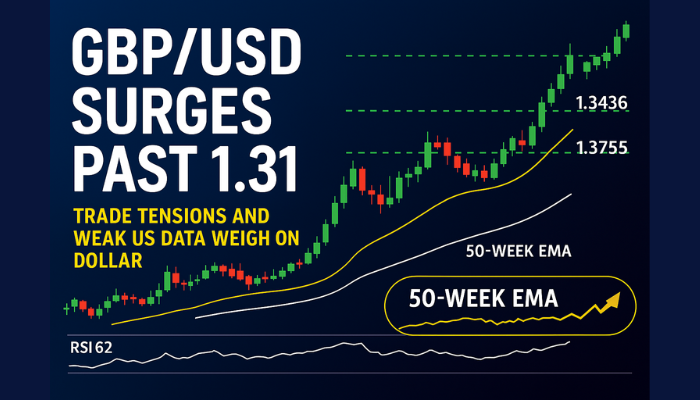

GBP/USD

On the daily chart, GBP/USD bulls target the 50% mean reversion level of the previous bearish impulse. Bears must breach critical support at or below 1.1100.

GBP/USD is trading within 1.1250, the 200-period SMA on the four-hour chart. If the pair falls below that level and begins to use it as resistance, further losses toward 1.1200 (psychological level) and 1.1100 (psychological level) are possible.

On the upswing, the initial resistance level is 1.1300 (Fibonacci 61.8% retracement), followed by 1.1350 (Fibonacci 50% retracement, 100-period SMA) and 1.1435 (Fibonacci 38.2% retracement).

GBP/JPY

After touching Thursday’s low at 165.10 in the early Tokyo session, the GBP/JPY pair has drawn substantial bids. Even though the risk-off drive and a worsening UK recession are working against the cross, it has stayed the same. The risk-off sentiment persists, as S&P500 futures maintained their downward trend in the Tokyo session.

Despite the UK economy’s poor growth prognosis due to a recession, the asset has seen renewed demand around 165.10.

Fundamental Outlook

The Bank of England (BOE) announced monetary policy on Thursday, confirming that the UK economy is in recession and that the situation could persist for potentially two years longer than during the subprime crisis.

The Bank of England Governor raised interest rates by 75 basis points (bps) for the first time since 1989, as inflationary pressures have risen over double-digit levels, threatening the economy’s prospects. Weaker economic forecasts have left less room for further rate hikes, as such an attempt would result in high unemployment and claims, thereby dampening the economy.

Investors in Tokyo are concerned about Japan-China relations. North Korea escalated tensions after firing an unidentified ballistic missile over Japan, as reported by NHK. As a precautionary step, the Japanese government advised civilians to seek shelter from missile threats.

Aside from that, a stronger rebound in the USD/JPY pair has raised anticipation for the Bank of Japan (BOJ) to intervene again to defend the Japanese yen against extreme volatility.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account