Gold Slips Below $1,778, Ahead of US Nonfarm Payroll

Gold prices were closed at $1769.90 after setting a high of $1783.75 and a low of $1762.30. Gold slipped on Thursday to its lowest since Nov

The [[gold]] prices closed at $1,769.90, after setting a high of $1,783.75, and a low of $1,762.30. On Thursday, gold slipped to its lowest level since November 3, after the initial safe-haven demand for the metal proved to be short-lived, due to worries over the new coronavirus variant, Omicron.

Global equities rallied for the day, in the hopes that the Omicron variant would prove mild and not have a harsh impact on economic recovery in the US. This lack of concern boosted the risk-on-market sentiment and pushed the US dollar higher in choppy trading, causing the yellow metal to drop at the same time.

Meanwhile, the number of Americans filing new claims for jobless benefits increased less than estimated last week. The actual number of Americans filing jobless claims was 222K, while the expectations were for 238K. As a result, the US dollar gained strength in the market, putting further pressure on precious metals. The US Dollar Index, which measures the greenback’s value against a basket of six major currencies, rose for the second consecutive session, reaching 96.18. After falling for seven consecutive days, the US Treasury Yield on the benchmark 10-year note reversed course and moved higher, recovering some of its previous daily declines, after reaching 1.46%. Rising yields and greenbacks put pressure on precious metals, dragging gold down.

The market saw some strength in US Treasury yields after Fed Chairman Jerome Powell’s comments prompted rate hikes, which weighed on the non-interest-bearing precious metal. It appears that, against expectations, the Omicron virus variant will not disrupt economic recovery, and the projections that interest rates will rise sooner than everyonee thought put major pressure on the precious metal on Thursday.

Moreover, Atlanta Fed President Raphael Bostic said on Thursday that it would be appropriate to end the central bank’s bond-buying program by the end of March, to allow the Fed to raise rates, in order to deal with inflation.

Meanwhile, San Francisco Fed President Mary Daly has said that Federal Reserve officials always need to be prepared for various economic scenarios and that it is time to start crafting a plan for increasing interest rates, so as to address above-target inflation. These comments by various Fed officials also boosted the US dollar, which dragged the precious metal to the downside in its wake.

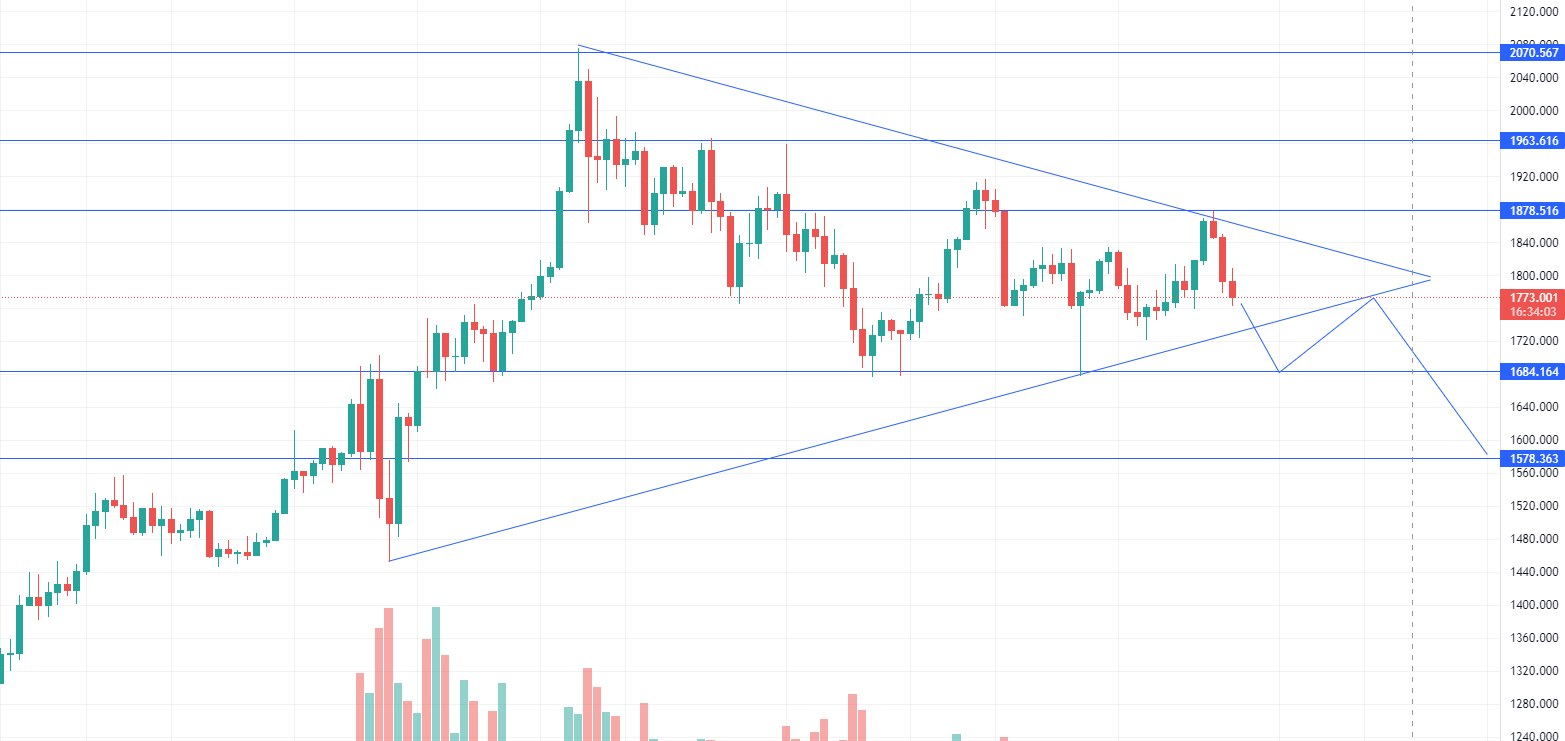

Gold – A Technical Outlook – XAU/USD slips below $1,778

Daily Technical Levels

1,760.50 1,800.55

1,745.85 1,825.95

1,720.45 1,840.60

Pivot Point: 1,785.90

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account