US Economy Keeps the Pace in October, As ISM Manufacturing Shows

Skerdian Meta•Monday, November 1, 2021•2 min read

While the economy seems to be going through a soft patch in Autumn, the US economy has left the soft period behind in Autumn and it is performing quite well once again. Manufacturing increased above 60 points and today’s report came above expectations, despite cooling off from September. This should keep the UD bullish, so we decided to short EUR/USD a while ago.

ISM manufacturing index

- October manufacturing 60.4 points vs 59.2 expected

- September Ism manufacturing was 61.1 points

- Employment 52.0 points vs 49.6 exp and 50.2 prior

- Prices paid 85.7 points vs 78.5 exp and 81.2 prior

- New orders 59.8 points vs 66.9 exp and 66.7 prior

- Full report

More details:

- production 59.3 points vs 59.4 last month

- supplier deliveries 75.6 points vs 73.4 last month

- inventories 57.0 points vs 55.6 last month

- customer inventories 31.7 points vs 31.7 last month

- backlog of orders 63.6 points vs 64.8 last month

- new export orders 54.6 points vs 53.4 last month

- imports 49.1 points vs 54.9 last month

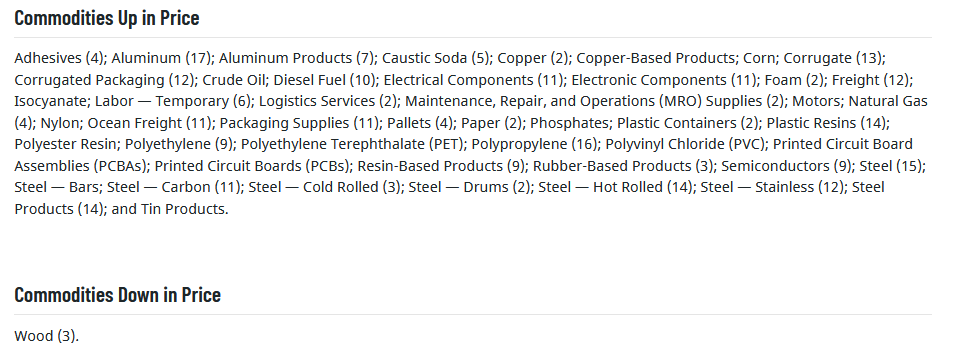

There’s obviously some inflationary pressure here but it’s tough to see customer inventories so low and not envision many months of strong production.Comments in the report:

- “Global supply chain issues continue. Getting anything from China is near impossible – extreme delays. Microchip and circuit breaker shortages continue and are expected to continue into 2022.” [Computer & Electronic Products]

- “Business is getting stronger, but the supply chain is getting worse every day.” [Chemical Products]

- “Strong sales continue; however, we have diverted chips (semiconductors) to our higher-margin vehicles and stopped or limited the lower-margin vehicle production schedules.” [Transportation Equipment]

- “Import costs and delays hurting business, requiring more safety stock for uncertainty. Rolling blackouts in China starting to hurt shipments even more.” [Food, Beverage & Tobacco Products]

- “Domestic original equipment manufacturer (OEM) capital-expenditure spending is trending up for our business. We are seeing an increase of capital equipment with life spans of more than 10 years in the fourth quarter.” [Fabricated Metal Products]

- “Demand continues to be strong, but we continue to be held back by supply chain issues – logistics delays, as well as capacity and labor issues at suppliers.” [Electrical Equipment, Appliances & Components]

- “Business remains strong, with brisk incoming orders. We have become much more supply driven versus demand driven, due to shortages of labor, materials and freight. Costs continue to increase on all fronts, and we are considering our third price increase of the year for our customers.” [Furniture & Related Products]

- “Customer demand remains high. COVID-19 related supply chain issues still hamper our ability to meet demand. Labor is still difficult for our suppliers to obtain, and labor costs are rising.” [Machinery]

- “Demand for our products remains strong, but we continue to struggle to secure enough raw material to keep our manufacturing lines running.” [Miscellaneous Manufacturing]

- “My prediction is that 2022 will be very similar to 2021 – similar demand, constrained supply, restricted logistics and rampant inflation.” [Plastics & Rubber Products]

For the global economy as a whole, here’s the story:

Check out our free forex signals

Follow the top economic events on FX Leaders economic calendar

Trade better, discover more Forex Trading Strategies

Skerdian Meta

Lead Analyst

Skerdian Meta Lead Analyst.

Skerdian is a professional Forex trader and a market analyst. He has been actively engaged in market analysis for the past 11 years. Before becoming our head analyst, Skerdian served as a trader and market analyst in Saxo Bank's local branch, Aksioner. Skerdian specialized in experimenting with developing models and hands-on trading. Skerdian has a masters degree in finance and investment.

Related Articles

Comments

0

0

votes

Article Rating

Subscribe

Login

Please login to comment

0 Comments

Oldest

Newest

Most Voted

Inline Feedbacks

View all comments