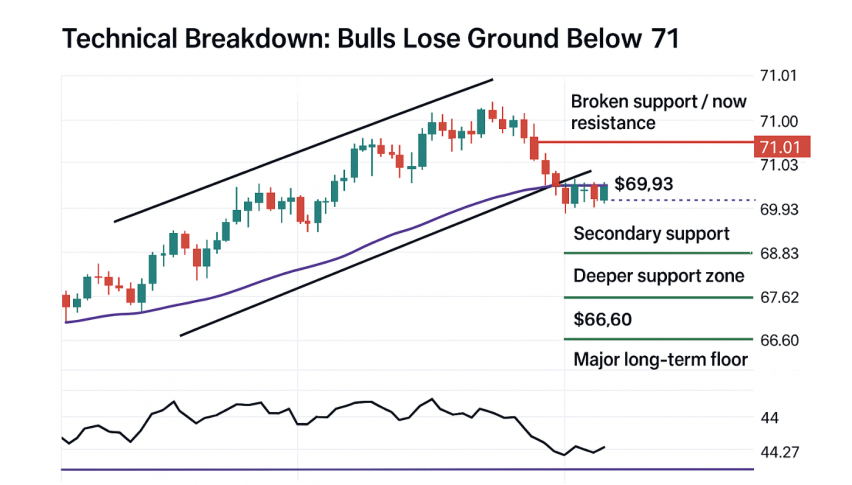

Selling the Retrace in EUR/GBP at the 100 SMA

The EUR/GBP has been on a bearish trend throughout this month, and the downtrend has been quite predictable. Retraces higher have ended at moving averages, particularly the 50 SMA (yellow), which has been a great resistance indicator, pushing the price down. The 50 SMA has been broken now, and the price has reached the 100 SMA, as the Euro benefits form a weaker USD, but my gut feeling is that we will see a reversal here as well.

The stochastic indicator has been showing when this pair is about to reverse, and now it is overbought again. So, we decided to open a sell Forex signal just below it, after the US durable goods orders report, which is shown below.

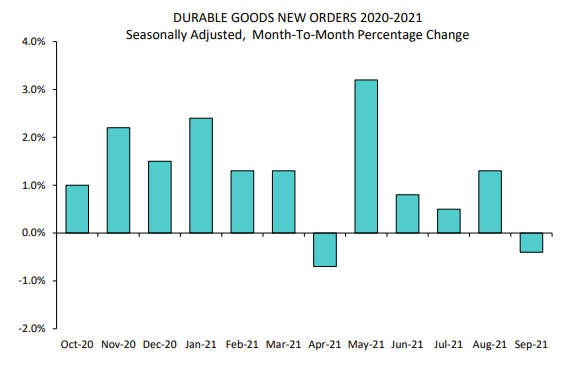

US durable goods orders data

- September durable goods orders -0.4% vs -1.1% expected

- The first decline after four months of gains

- August orders were +1.8% (revised to +1.3%)

- Good orders excluding transportation +0.4% vs +0.4% expected

- Prior ex. transportation +0.3%

- Capital goods orders non-defense ex-air +0.8% vs +0.5% expected

- Prior capital goods orders non-defense ex-air +0.6% (revised to +0.5%)

- Capital goods shipments non-defense ex-air +1.4% vs +0.7% prior

Core orders are solid, and the strong shipments numbers for September will lead to some last-minute upward adjustments, ahead of tomorrow’s advance Q3 GDP report. In terms of the overall headline, downward revisions to August data eliminate most of the gains. Deeper in the report, unfulfilled orders rose by 0.7%, and they have risen for eight consecutive months.