Buying the Retreat in EUR/JPY as MAs

EUR/JPY used to be on a strong bearish trend, with the sentiment in the forex market remaining negative or uncertain. As a result, safe havens such as the JPY have been in demand, which means that EUR/JPY was declining lower.

The uncertainty continues, but the situation in the market seems a bit lighter/clearer now, hence the bullish reversal in USD/JPY , which has sent this pair higher in the last week. Moving averages have turned into support, so we decided to open a buy forex signal earlier today, after the Eurozone consumer confidence, which improved compared to August. Below is the report from the Eurozone:

EUR/JPY Live Chart

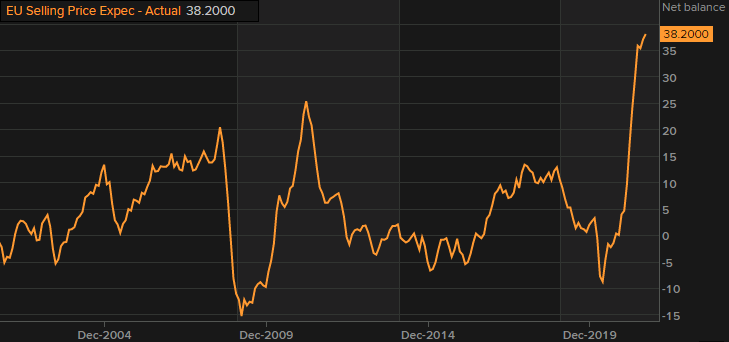

Consumer Confidence Report from Eurostat – 29 September 2021

- September final consumer confidence -4.0 points vs -4.0 prelim

- Economic confidence 117.8 points vs 116.9 expected

- August consumer confidence was 117.5 points

- Industrial confidence 14.1 points vs 12.5 expected

- August industrial confidence was 13.7 points

- Services confidence 15.1 points vs 16.5 expected

- Prior services confidence was 16.8 points

Eurozone economic sentiment edges up in September, beating estimates of a drop – aided by an improvement to industrial sector sentiment as services declined on the month.