USD/JPY Remains in a Range, as US Employment Comes Mixed

USD/JPY seems uncertain now with mixed US employment figures this week

On Wednesday, we saw the US ADP non-farm employment post a big miss for August, as it came at nearly half the expected number. Economists were expecting a 640K increase in ADP jobs, but they increased by 374K. June was quite similar, with expectations at 695K while the actual number came at 330K. That hurt the sentiment for the USD yesterday, which sent it lower across the board.

USD/JPY was trying to push above the 50 SMA (yellow) on the daily chart, but it reversed down and lost around 40 pips after that report, although the expectations have been a bit high in my opinion, since employment has been increasing in the US for more than a year and the number of unemployed is not extraordinarily high, as it was a year ago, so we aren’t likely to see those 600K and 900K figures that we were seeing a year ago.

USD/JPY Analysis – USD/JPY Daily Chart

USD/JPY remains stuck between MAs

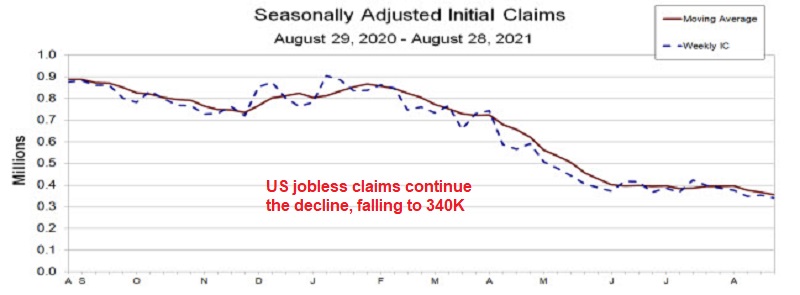

On Thursday, there was interest regarding the US jobless claims posted, which turned out to be a big miss on Wednesday. But, jobless claims continue to decline, falling to 340K last week. Now USD traders are not so certain anymore and the USD/JPY remains stuck between moving averages. Below is the jobless claims report:

US Initial Jobless Claims and Continuing Claims

- Initial jobless claims 340K versus 342K estimate

- Prior week 353K revised to 354K

- Initial jobless claims 340K vs expectations of 342K. That is a new post-COVID low

- 4 week moving average initial jobless claims 355K vs 366.75K last week. New post-COVID low

- Continuing claims 2.748M which is a new post-COVID low

- 4 week moving average continuing claims 2.855M vs 2.913M last week

The US monthly jobs report will be released today. The expectations are for the nonfarm payroll to show a 750K increase after the 943K rise last month. The jobless claim numbers from a few weeks ago corresponded with the survey week and they were at the lowest level since COVID.

However the data has been pointing toward a weaker jobs report, with ADP surprisingly to the downside (374K vs 640K estimate), and the ISM manufacturing employment index moving back below the 50.0 level (contracting).

USD/JPY Live Chart

USD/JPY

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account