Gold Supported Over the 50 EMA – Is it a Good time to go long?

During Monday’s Asian trading session, the price of the yellow metal failed to put an end to its early-day downward rally. It remained depressed around the $1,800 level, as the policymakers discussed President Joe Biden’s infrastructure spending bill in Asia, early on Monday. This kept the market trading sentiment positive and contributed to the losses in the safe-haven assets. Meanwhile, the upbeat US economic data added further optimism to the market trading sentiment, which reduced the demand for safe-haven assets and contributed to the losses in GOLD.

The rising number of COVID-19 cases keeps challenging the market trading mood, which may help to limit deeper losses in the gold price. The long-lasting tussle between the US and China also capped the declines via Beijing-backed companies.

In the meantime, accusations directed towards Iran by the US and the UK, for the recent attack on an Israeli ship, coupled with freshly released soft PMI data from China, could lift the demand for the safe-haven assets. Apart from this, the weakness of the broad-based US dollar was also seen as one of the critical factors that helped to cap the declining streak in the bullion prices. Gold is currently trading at 1,811.07, and consolidating in a range between 1,808.59 and 1,816.99.

Stimulus Optimism & Upbeat US Data:

Despite the multiple negative factors, the market trading sentiment maintained its bullish early-day performance and remained well bid in Asia on Monday morning. This was witnessed after S&P 500 Futures picked up bids around 4,410, which was an intraday increase of 0.50%, as the policymakers started a discussion over President Joe Biden’s infrastructure spending bill in Asia, early on Monday morning. According to the latest report, the Senators introduced the bill on the floor, after wrangling over it on Sunday.

Meanwhile, the democratic leaders of the US house asked President Joe Biden’s administration to extend the moratorium on housing evictions through October 18. Furthermore, Senator Rob Portman, an Ohio Republican, said that, on top of $450 billion in previously approved funds, the bill also includes $550 billion in new spending. It was anticipated that this would go towards various projects, including rail infrastructure, electric vehicle charging stations, roads and the replacement of lead water pipes. Thus, the policymakers showed willingness, stating that the plan would go through the Senate this week. This news instantly improved the market sentiment, despite the worsening coronavirus conditions.

Furthermore, the upticks in the market trading sentiment were further bolstered after the upbeat US economic data, which raised hopes over economic recovery in the United States. However, the positive tone around the global equity markets undermined the safe-haven gold prices. On the data front, the Personal Income and Spending for June came in higher, and at 0.4%, the Core Personal Consumption Expenditure (PCE) index was below the market forecast of 0.6%.

Bearish US Dollar Tries to Underpin Gold

Despite the upbeat US data, the broad-based greenback failed to put a stop to its downward rally of early in the day, remaining well offered, as the upbeat mood of the market tends to undermine the safe-haven dollar. Meanwhile, investors held tight positions, heading into a busy week, highlights of which will be the monthly US jobs data and a critical decision by the Australian Central Bank. Anyhow, the declines in the US dollar helped to limit deeper losses in gold, due to the negative relationship between the precious metal and the US dollar.

Coronavirus (COVID-19) Fears, US-China Jitters & Downbeat Chinese Data

On a different page, the growing numbers of COVID-19 cases, especially in Australia and Japan, keep questioning the market risk-on sentiment. This, in turn, has become a key factor that is supporting the gold price and capping more profound losses.

Besides this, the downbeat Chinese data and the long-lasting Sino-US tussle are also having a negative effect on the upbeat mood of the market. The US and China continue to jostle over Beijing-backed companies, and in the meantime, the dismal Chinese Caixin Manufacturing PMI dropped to 50.3 in July, which was below the market projections of 51.0.

On the back of the Delta variant of the coronavirus in Nanjing, higher commodity prices and stormy weather, these figures were the lowest since April 2020. As a result, the downbeat data released in China leaves a negative impact on the market trading sentiment, which could boost the price of the safe-haven metal, GOLD.

Looking forward, later during the early North American session, the market traders will keep their eyes on the US economic docket, which highlights the release of the US ISM Manufacturing PMI. In the meantime, the US-China jitters and COVID updates will also be essential to watch.

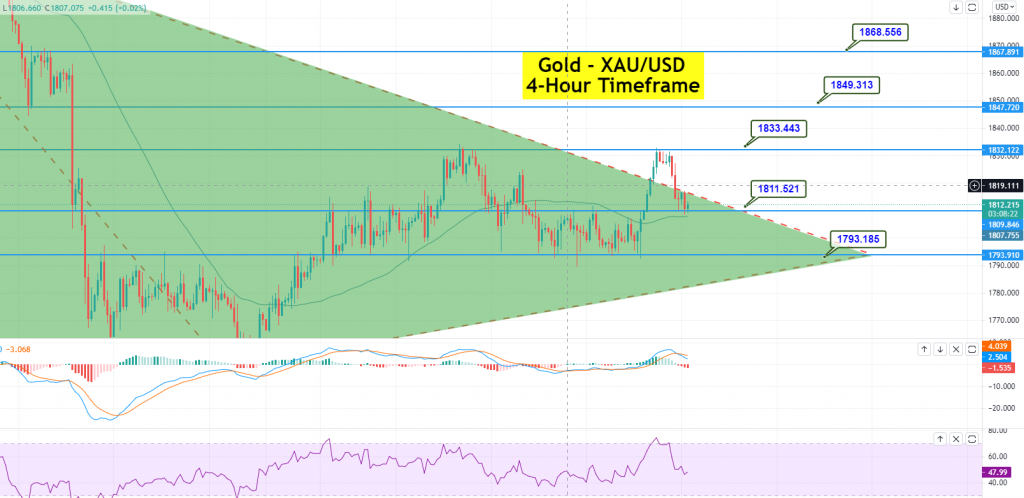

Gold – XAU/USD – Daily Support and Resistance

S2 1,797.52

S1 1,805.93

Pivot Point: 1,818.68

R1 1,827.09

R2 1,839.84

R3 1,861

Gold – XAU/USD – Technical Outlook – 50 EMA Lends Support at $1,811

On Monday, gold is trading at a 1,811, gaining support over the 50 periods EMA level of 1,811. A bearish breakout at this level could extend the selling trend until the next support level of 1,793. At the same time, the resistance remains at 1,819.

The downward trendline extends resistance at the 1,819/20 level; however, a breakout at this level could drive more buying until 1,833. The MACD and RSI are in a selling zone, supporting odds of a continuation of the selling trend. On Monday, we should keep an eye on the 1,810 level, as above this, the bullish bias will continue to be solid. Good luck!