Buying USD/CAD at the 100 SMA, as Canadian Inflation Cools Off

USD/CAD pops higher after the cool off in CPI inflation for June

Inflation has surged in the US, coming in at 5.1% in May and at 5.5% in June, with oil prices on the rise during those months and the economy surging too. This has increased the pressure on the FED to start looking seriously into tightening the monetary policy. Later this evening, the FED will have their regular meeting, so we will soon see where they stand now.

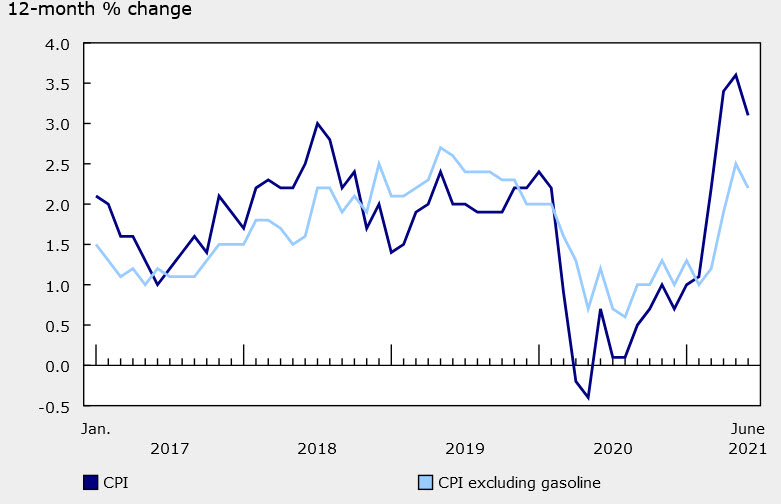

Inflation has increased all over the globe, as the global economy has bounced quite strongly during late spring and summer so far, after the second reopening, following last winter’s restrictions. In Europe and Canada, inflation reversed after the dip toward the end of 2020. But in the EU, the CPI (Consumer Price Index) inflation has stagnated at around 1.9-2%, as the latest report showed, and this has taken some pressure off the ECB (European Central Bank).

USD/CAD Analysis – USD/CAD H4 Chart

The 100 SMA holds as support for USD/CAD again

Today, Canadian inflation cooled off slightly, which made the USD/CAD jump higher. We decided to buy this pair after the retrace down to the 100 SMA (green) on the H4 chart. So, this trade looks good at the moment, as the Bank of Canada is more relaxed since June’s CPI report. Below is the Canadian inflation report for June:

Canadian Consumer Price Index Report for June

- June CPI YoY +3.1% vs +3.2% expected

- May CPI YoY was +3.6%

- June CPI MoM +0.3% vs +0.4% expected

- May CPI MoM was 0.5%

- Full report

Core Inflation Measures:

- Median CPI YoY 2.4% vs 2.3% exp (prior 2.4%)

- Common CPI YoY 1.7% vs 1.9% exp (prior 1.8%)

- Trimmed mean CPI YoY 2.6% vs 2.6% exp (prior 2.7%)

USD/CAD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account