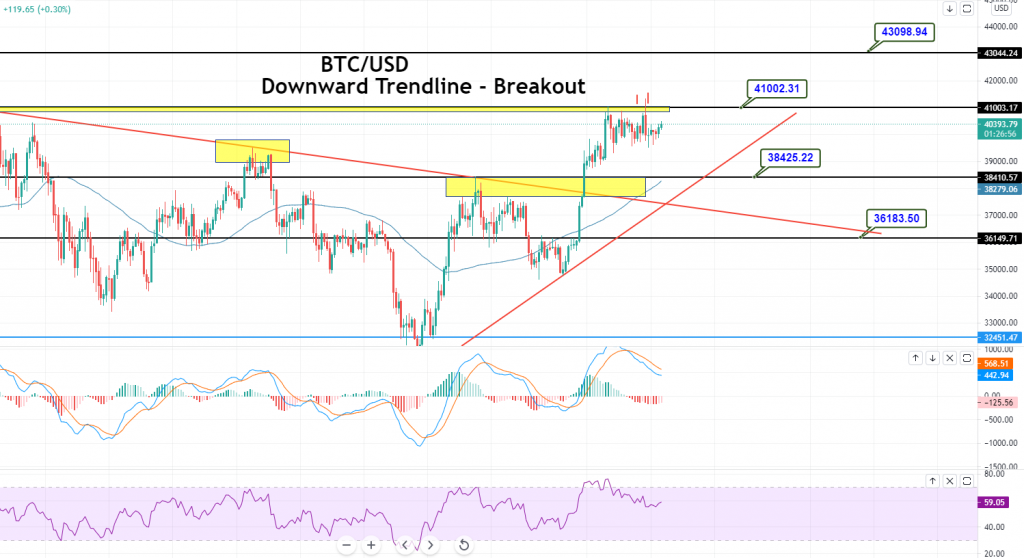

BTC/USD Steady Below Triple Top $41,000 – Can We Expect a Breakout?

The BTC/USD coin succeeded in extending its overnight upward rally, remaining well above the $39,000 and $40,000 levels. The BTC/USD pair started a fresh increase after it broke the key $38,500 resistance zone. It rose above the $40,000 resistance zone, and settled well above the 100 hourly simple moving average. Conversely, the price seems to be struggling above the $41,000 level. It is worth noting that there have been two tries to gain strength above $41,000, but the buyers have failed so far. The recent high formed at around $41,384, before the price turned bearish. It dropped below $40,500, but the buyers were active near $39,500.

On the other side, the low formed near $39,476, and the price is now consolidating within a range. However, the mild buying bias surrounding the BTC/USD pair was sponsored by the weaker US dollar. The greenback dropped slightly on the day, as investors tried to determine whether the Federal Reserve is likely to change the tone on its stimulus, after a recent hike in US inflation. The BTC/USD price is currently trading at 40,202.2, and consolidating in the range between 39,645.3 and 40,372.3.

BTC/USD – Daily Support and Resistance

S2 38,549.87

S1 39,255.53

Pivot Point: 40,279.57

R1 40,985.23

R2 42,009.27

R3 43,738.97BTC/USD Technical Outlook

The BTC/USD is trading with a bullish bias at the 40,450 level, and facing immediate resistance at 41,000. The BTC/USD pair continues to trade below the triple top resistance level of 41,000 on the two-hourly timeframes. Above this level, the BTC/USD pair may head further up until the next resistance level of 43,098. The MACD and RSI are holding in a selling zone, but the recent direction has shifted from bearish to bullish. On the lower side, the BTC/USD may find support at 39,620 and 38,425. Good luck!