Dogecoin (DOGE) Strengthening Again: Here’s Why

Dogecoin is back on fire, and of course, Elon Musk is the one driving all the moves yet again. Musk's favorite memecoin is rallying higher

| (%) | ||

MARKETS TREND The market trend factors in multiple indicators, including Simple Moving Average, Exponential Moving Average, Pivot Point, Bollinger Bands, Relative Strength Index, and Stochastic. |

Dogecoin is back on fire, and of course, Elon Musk is the one driving all the moves yet again. Musk’s favorite memecoin is rallying higher a few days after he called it a “hustle” only to put out a poll asking if his company Tesla should accept DOGE as payment, spiking interest once again.

The latest bullish moves early on Friday have been triggered by his announcement – via Twitter, that he is working with Dogecoin’s team of developers towards improving its system transaction efficiency. Markets have run off with his comment, taking it as a signal that he’s still interested in the digital currency and that the step could power higher adoption.

While the announcement sent Dogecoin (DOGE) higher by 12% almost instantaneously, there is an element of uncertainty among traders holding it back from crossing the $0.50 level mark just yet. This is because Musk has created enough confusion in the markets by stating that his company Tesla will no longer be accepting Bitcoin as payment, on account of the environmental impact of mining cryptocurrencies. This caused Bitcoin to crash below the $50,000 level, driving bearish moves through most of the crypto market and wiping off more than $300 billion from the market as a result.

Key Levels to Watch

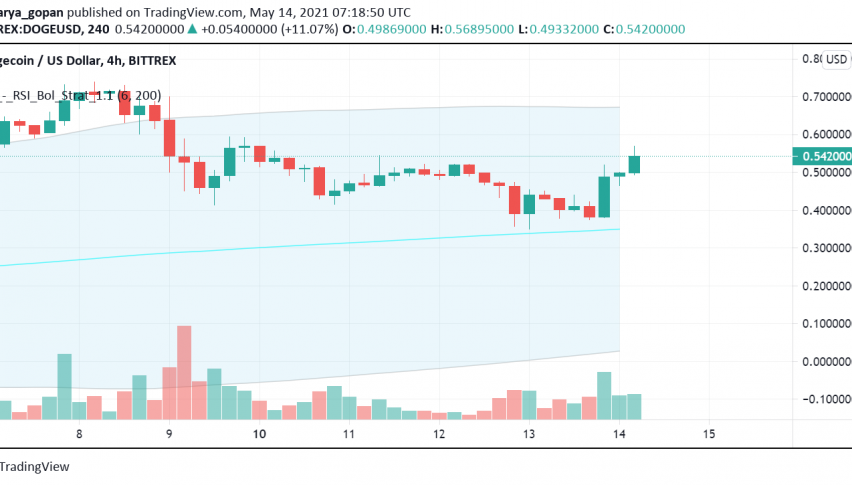

At the time of writing, DOGE/USD is trading at around $0.54. and its bullish trend is finding support from technical indicators MACD and momentum on the 4-hour price chart. Moving averages are also indicating a strong bullish bias, so things are definitely looking up for Dogecoin at the moment.

The next key resistance sits at $0.70 for DOGE/USD, and a break above this can propel buying interest at least until the $0.92 level. However, in case traders are unable to sustain the uptrend and break past this resistance, Dogecoin could see its price sliding down to $0.42 and even lower towards $0.33.

| (%) | ||

MARKETS TREND The market trend factors in multiple indicators, including Simple Moving Average, Exponential Moving Average, Pivot Point, Bollinger Bands, Relative Strength Index, and Stochastic. |

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account