US Dollar Sees Quiet Start to the Week Amid Japan, China Holidays

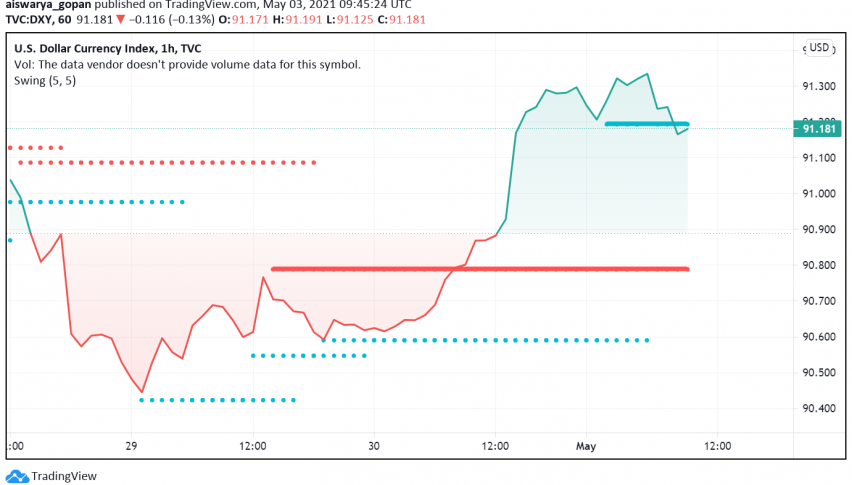

The US dollar is starting the week on a somewhat strong footing, as it holds on to its recent gains early on Monday, with markets waiting to hear from other leading central banks in the coming days after last week’s FOMC. At the time of writing, the US dollar index DXY is trading around 91.18.

Today’s Asian session is exhibiting thin trading volume on account of market holidays in China and Japan, which is keeping volatility in the forex market low. This could be another reason for the greenback holding steady after making gains on Friday.

Easing concerns about high inflation as the US economy recovers saw the US dollar index lose around 2% of its value through the month of April, while a risk-on sentiment boosted by rising hopes for global economic recovery also contributed to weakening the US currency’s safe haven appeal. On the other hand, however, commodity currencies like the AUD and NZD registered monthly gains and are also trading higher today.

Friday was a good day for the US dollar which received a boost from a strong reading for consumer consumption in the world’s most powerful economy. This week will offer more opportunities for volatility in the reserve currency as manufacturing and non-manufacturing activity as well as the crucial non-farm payrolls report release in the coming days.