The EUR/USD has been on the march south today, falling by 0.64%. Rates have broken hard to the bear, plunging beneath the 1.1750 handle. With inflation stale on both sides of the Atlantic, one has to wonder what is driving the sentiment. For the time being, it appears that a second wave of COVID-19 is hitting the eurozone and prompting the sell-off.

On the COVID-19 front, there are several news stories that have broken in the past 18 hours. Here are two of the largest:

- Vaccine Troubles: Pharmaceutical company Johnson & Johnson has paused clinical trials for its COVID-19 vaccine due to “unexplained illnesses.” In the race for a vaccine, Johnson & Johnson was a leading player; the sudden halt of its program suggests that developing such a product may be more challenging than expected.

- Virus Surge: In response to a coronavirus surge in the U.K., a three-tier lockdown system has been introduced. The measures have been adopted to cease the spread of the virus and flatten a potential hospitalization curve. The U.K.’s new policies have come on the heels of tightened restrictions in Germany as it appears a second-wave of infections is falling upon the eurozone.

As it has been all year long, the coronavirus pandemic continues to be a key forex market driver. For the EUR/USD, new concerns are at least partially responsible for today’s decline.

EUR/USD Falls As COVID-19 Re-emerges

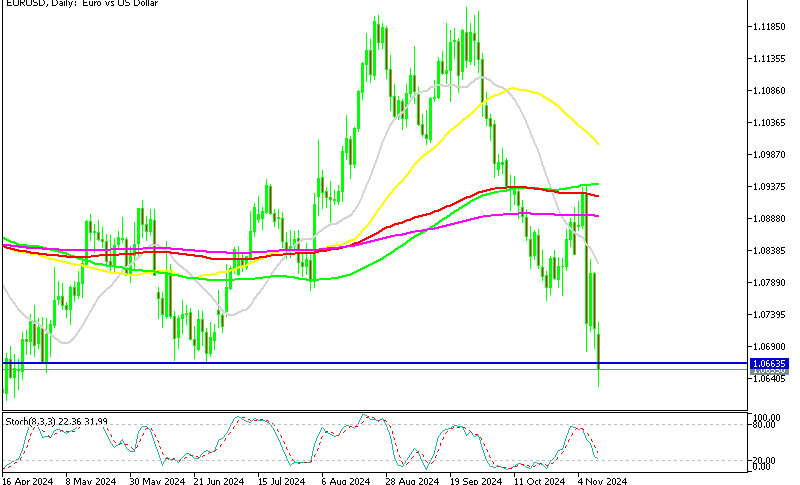

Since the lows of March, it has been a big year for EUR/USD bulls. But, are we at a turning point in this market? In short, not yet. However, if rates fall beneath the 38% Fibonacci Retracement at 1.1485, then a correction will be underway.

+2020_42+(11_15_00+AM).png)

Here are the key levels to watch in this market:

- Resistance(1): Weekly SMA, 1.1779

- Support(1): Bollinger MP, 1.1489

- Support(2): 38% Retracement, 1.1485

Bottom Line: If the recent bearish action in the EUR/USD keeps up, then a buying opportunity may come into play for later this month. Until elected, I’ll have buy orders in the queue from 1.1506. With an initial stop loss at 1.1446, this trade produces 120 pips on a 1:2 risk vs reward ratio.