Following a slow September, the EUR/USD is on the rally to open October. Rates are on the doorstep of 1.1800 and driving toward yearly highs. At this point, it appears that forex players are pricing in dovish FED policy and lagging U.S. economic performance. However, this sentiment doesn’t complement recent data that suggests America’s COVID-19 recovery is in full swing.

Here’s a quick look at today’s key economic reports:

Event Actual Projected Previous

ISM Services PMI (Sept.) 57.8 56.3 56.9

ISM Employment Index (Sept.) 51.8 58.1 47.9

Market Services PMI (Sept.) 54.6 54.6 54.6

All in all, the service sector continues to improve, as evidenced by the ISM and Markit services PMIs. However, employment remains a bit of a sore spot for analysts. Although U.S. labor continues to recover, most in the media are critical of the speed by which jobs are returning to the markets. It will be interesting to see if U.S. unemployment falls beneath 7% as expected by year’s end.

Right now, the forex is skeptical of the COVID-19 recovery taking place in the United States. Let’s dig into the EUR/USD technicals and see if we can spot a trade or two.

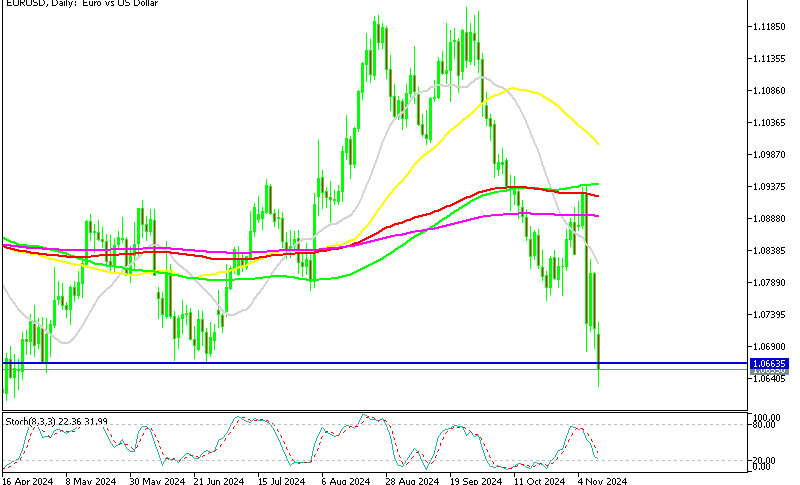

EUR/USD Drives At All-Time Highs

As September drew to a close, the greenback began to show strength vs the euro. Now, the rally appears over as rates are ticking higher for the second straight week.

+2020_41+(11_20_15+AM).png)

For this week, there are two key levels to keep an eye on for the EUR/USD:

- Resistance(1): Yearly High, 1.2010

- Support(1): Weekly SMA, 1.1747

Bottom Line: Right now, both the fundamentals and technicals point to a bullish EUR/USD. If the positive sentiment persists, a shorting opportunity may come into play from topside resistance. Until elected, I’ll have sell orders in the queue from 1.1999. With an initial stop loss at 1.2026, this trade produces 25 pips profit on a slightly sub-1:1 risk vs reward management plan.