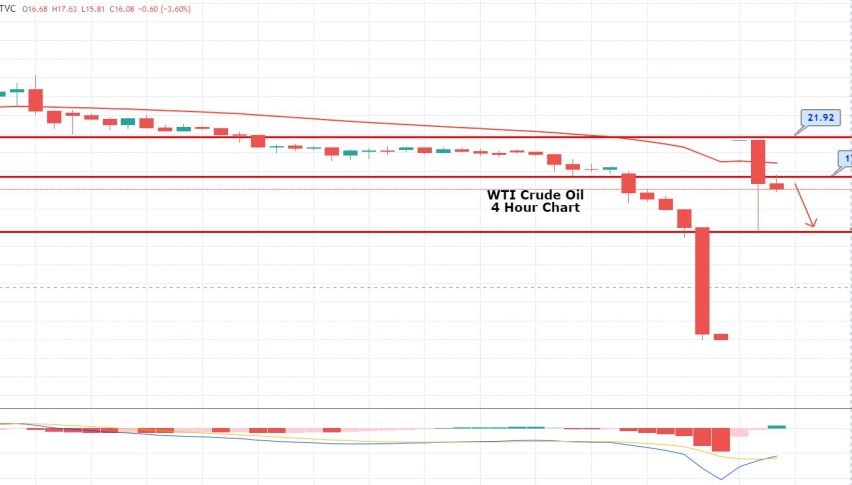

WTI Crude Oil Prices Slightly Up Following Historical Declines

Today in the early European session, []WTI]] crude oil prices turned positive after the historical drop below $0 for the first time since futures trading started in 1982 mainly due to the demand destruction caused by coronavirus pandemic. Additionally, the travel restrictions and lockdowns to control the outbreak of the coronavirus exerted significant downside pressure on crude oil prices. As a result, the demand for crude oil decreased by almost 30% all over the world.

It should be noted that the US President Donald Trump said yesterday after historical drops in crude oil prices that his administration was thinking about ending Saudi crude oil imports in order to help the US drilling industry.

Daily Support and Resistance

S1 14.66

S2 11.66

S3 10

Pivot Point 17.50

R1 19.50

R2 21.56

R3 22.19

Crude oil’s May contract faced a massive dip as its prices fell into negative zone yesterday for the first time in history. However, the spot prices are trading at 17.20, supported above the level of 11. Violation of this level is likely to drive sharp selling in the market, and technically, this opens room for selling until 11 and 8 while resistance holds around 17.36 today.