Morning Brief, Apr 3: How to Trade Gold on US Non-farm Payroll Figures

Good morning, fellas.

On Friday, the economic calendar is fully loaded with high impact events from Eurozone and the US. The services PMI figures are due from the Eurozone, the UK and the US. However; the US labor market figures will be the key highlight of the day. We may experience sharp price action during the US session in gold and other dollar related currency pairs.

Nonfarm Payroll & Unemployment Rate

The NFP (Nonfarm employment change) and the unemployment rate, both these economic figures, will be strictly observed at 12:30 GMT. Following the strong growth of 273K jobs, the US economy is anticipated to lose 100K jobs in March in the wake of the novel coronavirus. Whereas, the unemployment rate is anticipated to soar sharply from 3.5% to 3.8%. For sure, it’s something everyone’s already expecting, but still we may see bearish pressure on the dollar and support for the precious metal gold.

Average Hourly Earnings m/m – Additionally, we need to concentrate on the average hourly earnings. In February, the earnings remain steady at 0.3%, but March’s figure is expected to show a drop. Economists are expecting average hourly earnings to drop from 0.3% to 0.2%, but actually, we can expect worse as the prolonged lockdown around the globe is causing earnings to drop. We may see weaker trends in the dollar today.

GOLD – XAU/USD – Daily Outlook

A day prior, the precious metal gold prices soared over 1% to trade around 1,608 in the wake of record-high US jobless claims. The US unemployment claims rose for a second week in a series over intensified concerns of economic damage because of coronavirus, which eventually drove traders towards the safe-haven metal. The quantity of Americans registering jobless claims multiplied from the previous week to a record high of 6.65 million, as more areas of the US enforced stay-at-home steps to curb the coronavirus.

Global sentiment is getting worse with each passing day, despite the central banks’ and governments’ ongoing struggles to fight the economic fallout of COVID-19. As a result, investors seem to move towards gold as fears of a global recession stay in play, especially if noises start showing in the largest economy in the world.

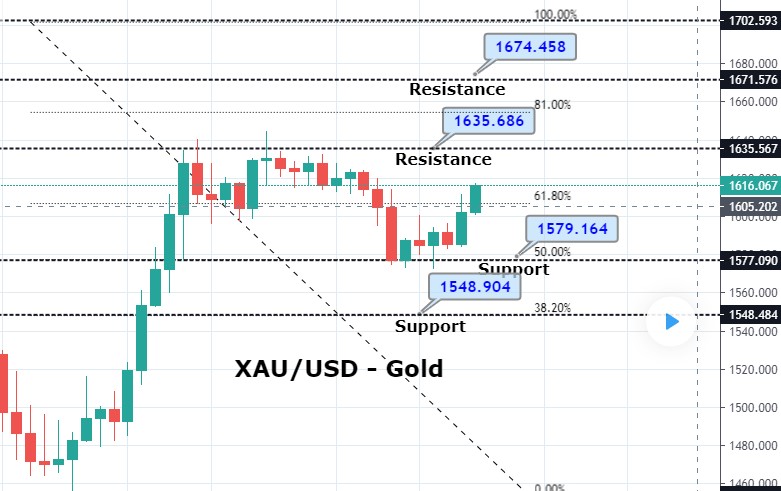

XAU/USD – Daily Technical Levels

Support Resistance

1574.53 1604.78

1557.62 1618.13

1527.36 1648.38

Pivot Point 1587.87

Gold is trading sideways in a tight trading range of 1,617 – 1,608, where an overall trading bias remains bullish. As we can see on the 4-hour chart, gold is facing immediate resistance at 1,617, which is extended by the double top and descending trendline pattern. Today, the major focus will stay on the Non-farm payroll figures, and the release of this data will help determine further trends in gold. Weaker NFP (which is highly expected) can trigger a bullish breakout and lead gold prices towards the next target level of 1,633 and 1,642. Alternatively, a bearish breakout can lead to gold prices lower to 1,594 areas. Let’s keep a closer eye on the US NFP today. Good luck!