Fibonacci Support In View For EUR/USD

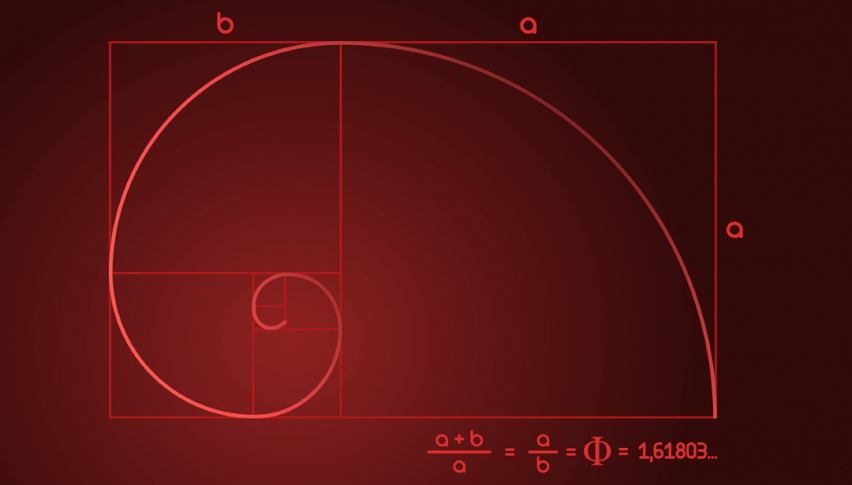

The proximity of the 62% Fibonacci Retracement of October’s range to the 1.1000 psyche level may bring a EUR/USD buying opportunity.

Bearish sentiment is once again ruling the day, threatening to extend the EUR/USD’s losing streak to four ― can anything stop the bumrush south?

The Greenback’s early-November strength has several key EUR/USD Fibonacci support levels in line for a test. At press time (about 2:15 PM EST), rates in the EUR/USD are well beneath October’s 38% retracement at 1.1062. This is a key price point; if we see a weekly close beneath 1.1062, a correction of the daily uptrend may be headed our way in the near future.

EUR/USD Approaches Macro Fibonacci Support

The proximity of the 62% Retracement of October’s range to the 1.1000 psyche level is a unique support area. Should the EUR/USD continue trending south, a buying opportunity from this area is likely to come into play.

+2019_11_07.png)

Here are the key downside support levels to watch ahead of Friday’s closing bell:

- Support(1): Psyche Level, 1.1000

- Support(2): 62% Fibonacci Retracement Of October’s Range, 1.0993

Bottom Line: No doubt, early October has been a big month for the Greenback. Given the wide-open Friday economic calendar, there are few reasons to believe it is going to stop ahead of the weekend break. Aside from the Michigan Consumer Sentiment Index (Nov.), there are no primary market movers scheduled during tomorrow’s U.S. session.

Until elected, I will have buy orders for the EUR/USD queued up from 1.1004. With an initial stop at 1.0974, this trade produces 25 pips on a bounce from macro Fibonacci support.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account