Lack of Fundamentals Keeps Gold Steady – Sentiment Analysis in Action

The trading volume on Monday remains pretty thin as investors await high impact economic events from global economies. In particular, the monetary policy decisions from the Bank of Japan, Bank of England and Federal Reserve Bank stay in the limelight.

However, gold prices made a slight gain earlier today amid a weaker dollar and dovish policy decision from the Federal Reserve. Gold trades at 1,419 facing a solid resistance level around 1,422. Traders await the US central bank’s July 30-31 monetary policy meeting, where it is expected to trim its interest rate by at least 25 basis points.

In my opinion, the interest rate cuts are fully priced in and we may see a reversed movement in gold prices on the rate cut.

Gold is also supported as the US economic growth stalled less than anticipated in the second quarter, making the Fed less inclined to cut rates by 50 basis points given the economic improvement.

Lastly, the US and Chinese trade discussions are moving to Shanghai this week, as mediators from both countries come face to face for their first conversations since a truce at G20 last month. Expectations are low for a breakthrough.

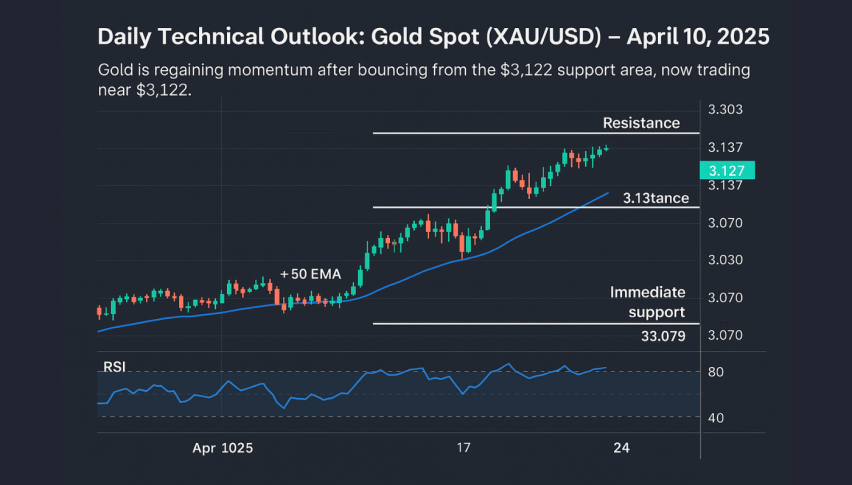

GOLD is trading bullish after gaining the support of around 1,411. Last week, the precious metal gold violated the descending triangle pattern at 1,420 and now the same level is likely to extend resistance to gold.

Stochastics holds over 50, suggesting bullish bias. While the 50 and 100 periods EMA are pushing gold prices lower below 1,422. For the moment, support prevails at 1,416 and a bearish breakout could extend bearish rally until 1,412 again.

Support Resistance

1419.58 1430.79

1413.38 1435.81

1402.17 1447.02

Key Trading Level: 1424.6

Gold – XAU/USD – Trade Idea

I will be looking to add a sell position below $1,422 with a stop loss above $1,425 and take profit of $1,410 and $1,405 upon the release of positive GDP data.

Good luck!