Risk-off sentiment drives bulls in Gold – Is it going after $1,232?

Gold is holding above a strong support level of $1,219 and it's pretty much likely to violate the $1,223 resistance level. The bullish....

What’s up, traders.

The precious metal GOLD trades bullish due to anxieties about a potential decline in China’s economic growth amid an ongoing trade war and crashing equities. Investors seem to trade the risk-off sentiment, therefore, we are also supposed to follow them to catch a swing trade. Buckle up for it…

Risk-off Sentiment

The global stock markets continue to trade bearish as investors focus on the US-China trade war, Italy debt crises and the uncertainties over Brexit. Thus, funds are moving from the stock markets to safe-haven assets such as bullion (gold and silver) and the Japanese Yen.

GOLD – Technical Outlook

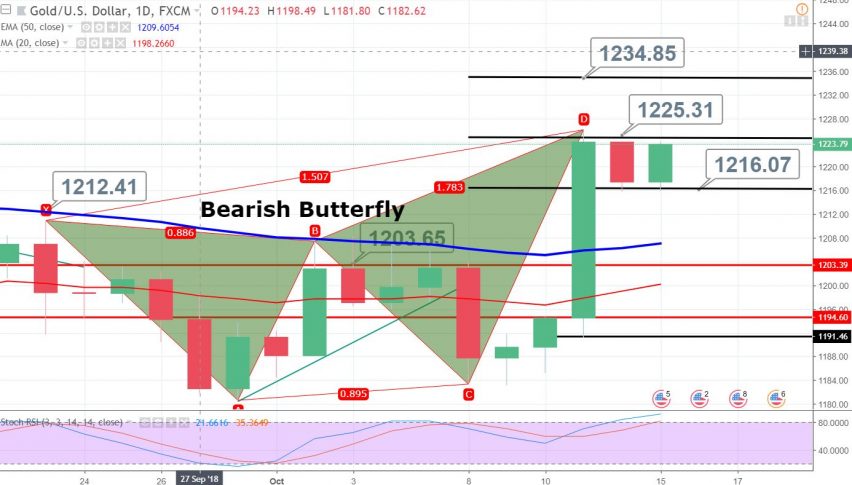

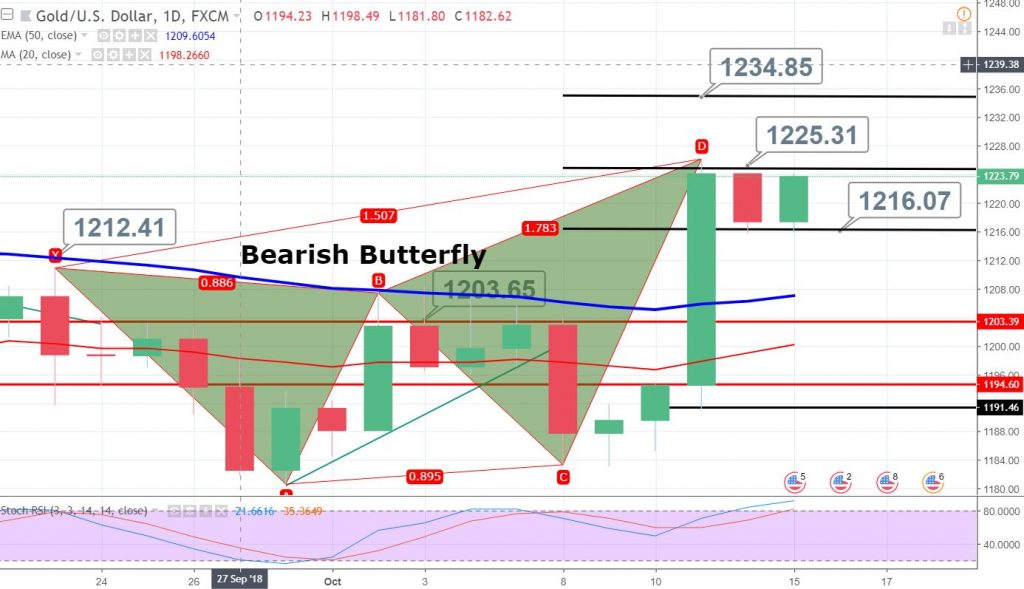

On the daily chart, gold formed a bearish butterfly pattern which gave us an opportunity to capture a quick sell on Friday. But the scenario has changed a bit now. Gold is holding above a strong support level of $1,219 and it’s pretty much likely to violate the $1,223 resistance level. The bullish breakout may lead gold prices towards $1,224 (First Target) and even towards $1,232 (Second Target).

Gold – Trade Plan

Based on the above fundamental and technical outlook, we just shared a long-term forex trading signal to buy at $1,221 to target $1,224. Investors are advised to stay tuned to FX Leaders for more updates on gold. Good luck!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account