Markets on Thursday: The USD Falls on Deal Talk

The trade war saga through us a bit of an unexpected curveball on Wednesday. The USD was slightly lower on the day on some soft data, while the potential for some trade talks grabbed headlines.

A story hit the wires suggesting that the US and China would meet again for another round of trade talks. We recently had Chinese officials in Washington, but clearly thost early discussions amounted to little. These next talks might do the same, but it did help boost markets.

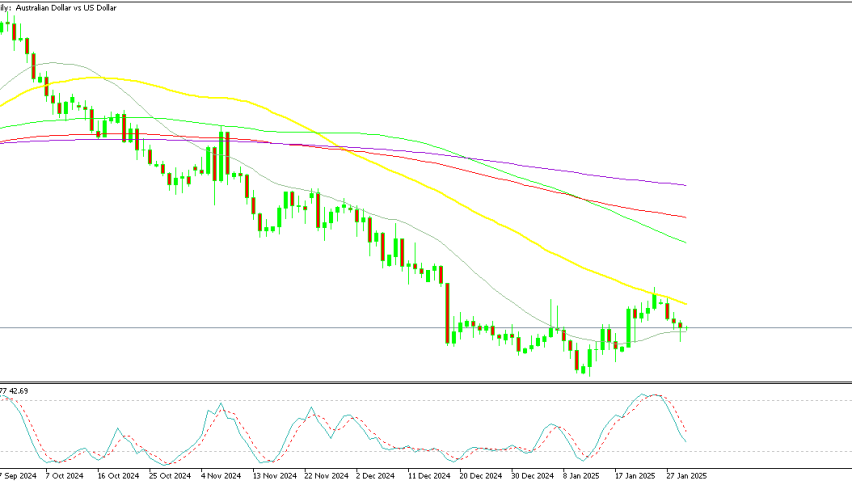

The AUD/USD in particular liked the news. Both it and the Kiwi have been beaten down a fair bit recently and they managed to rebound on the news. The Aussie will again be in focus today as we get data on Aussie employment.

US PPI was also soft yesterday, which didn’t help things get going. However, there is more top-tier data ahead with the ECB and BOE to meet on interest rates.

The USD is Outlook

The DXY has failed at the support turned resistance level at 95.50. We are now seeing price grind back down to the 94.5.0 level, where we have seen buying in the past.

We are very much range bound at the moment and waiting on news on trade for the most part.

We have been trading sideways since mind-June and clearly, this is a bit of a holding pattern for the time being.