Trading in the financial markets is a tough job. Sure, there are times when trading becomes straightforward, particularly during solid trends, but we know that most of the time it is a jungle out there. Everyone tries to make a killing profit with what they have available and most of the time they fail to do so, which results in them turning into victims.

There are many unknowns in forex, lots of technical indicators and many more technical strategies, plenty of fundamental events such as economic news, data releases, central banks etc. Nowadays, we even have politics messing with the financial markets quite often. Donald Trump and Brexit have damaged the USD and the GBP many times over the past two years.

But, we are our own biggest enemy without a doubt. We try to make things easier when they are difficult, and they are pretty often quite difficult in forex. We also complicate things and make them much more difficult when they are easy. As we mentioned before, sometimes things are pretty easy; during strong trends, clear ranges etc.

How do we make things difficult for ourselves, you might ask. Well, actually, let’s start with how we make things easier when they aren’t.

Making it Easy When It’s Difficult

We put too much trust in ourselves

At first, when we start trading forex, it is almost certain that we will fail. Almost everyone fails the first time, whether it is with a small or a large account at stake, but in 99% of the cases, it is small funds that we invest in our first live account. Almost all retail traders lose their first account when they go live, I know I did with a $500 account.

Then we get down to business, putting in hard work trying to understand the market and how it behaves. We learn all sorts of strategies and techniques and then we go for the kill on the second try. Now we are more experienced, we understand the markets and know trading up to some degree.

It starts paying off and we start winning trades one after the other whilst losing some along the way. Our account starts growing and we become more confident as the days go by. I grew my account from $500 to around $4000 in around three weeks. That’s when we get overconfident and start trading like we are pros. Some traders do stick to their money management techniques when they get better at trading but sooner or later, most of us of us give into greed and start trading above our means. After all, that’s why we got into this business, right? Well, no. We’re here to make it in the long run.

A big portion of forex traders who are new to this game lose on their second try and give up after that. I went in for the third time and finally made it, but many give up after the second failure. That’s because they lost when they thought they had mastered the market. We know that even the most successful traders lose, hedge fund managers too, so why do you think you won’t ever lose a trade, or even an account?

We put too much trust in our strategy

Of course, out of thousands of forex trading strategies out there, most of which don’t work, there are a few which work. We have a section with the best forex trading strategies but it is hard for new traders to pick one that works without guidance. I have seen forex traders post all sort of silly strategies in forex forums, putting high hopes on them, as if they have found the Holy Grail. Then, obviously, they fail after a few wins.

I mean, even the most experienced forex trader loses, especially nowadays that politics have made the forex market move around and change direction like a lunatic. How many times have we seen hedge funds close the year in loss? We do see that from time to time, if not often. So, why would you trust a forex strategy to work 100% of the time? I would say that trading strategies get you only to a certain point, then it has to come from your own understanding of the market.

How can you trust this trading strategy?

If you understand the market well and employ a good strategy along with some stable money management technique, then you shouldn’t have too many problems, but even then, there will surely be losers. So, don’t trust your strategy too much.

Making it Difficult When It’s Easy

We choose strange indicators/strategies

If you take a quick look at the most famous forex blogs where traders post their trading ideas and analysis, you will find all sorts of indicators and strategies that will leave you baffled. Often, new traders get bemused by fancy names and end up using trading strategies and indicators which are so complex that it is impossible for two traders alone to draw them out in the same way.

When you use a complex trading strategy that is difficult to put into practice and interpret, you end up using it all by yourself. If you are not a central banker or head of a major hedge fund, which I’m sure you aren’t, then the market won’t go your way or according to your strategy, because markets follow the majority, usually.

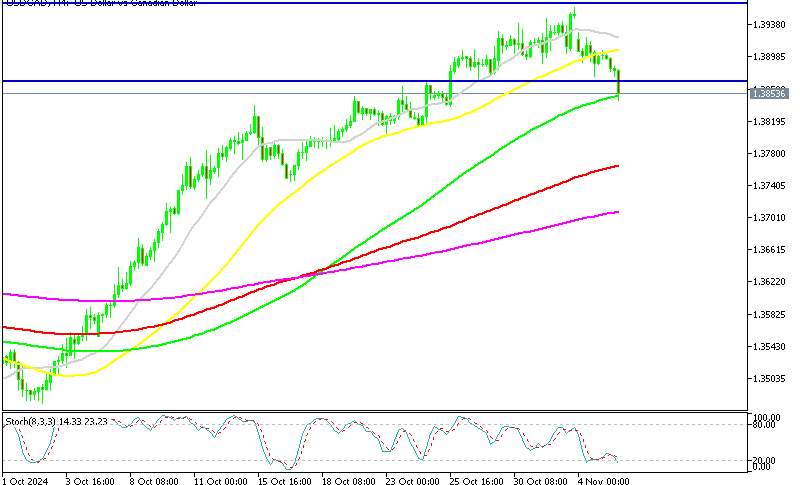

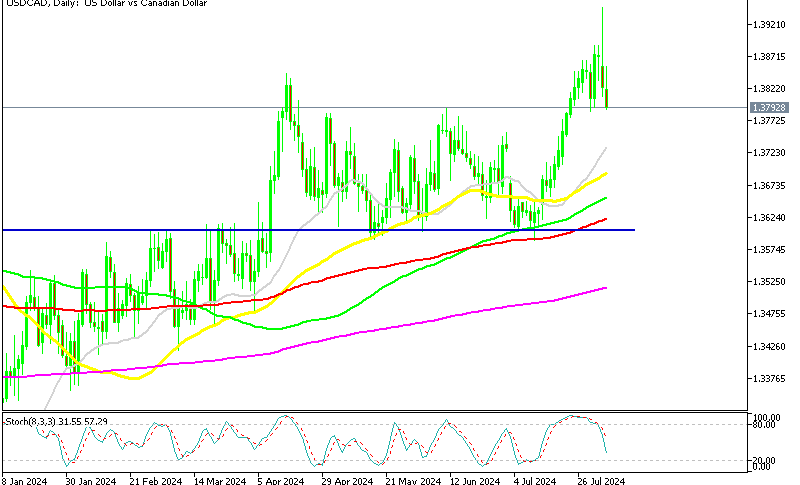

The strangest thing with new forex traders is that even when the market is quite easy to trade on, with periods of strong uptrends and clear ranges, they go and make a mess of charts with all sorts of indicators, making their charts look like a fantastic map. All you need in an uptrend is a trend line or a moving average, while in ranges, you only need two horizontal lines. Obviously, you end up making your trading and your life difficult, which results in losing another account. So, the best advice is to keep it as simple as possible, which will make your trading much easier.

We didn’t need anything more than the 50 SMA (yellow) to make a killing in GBP/USD last week

We try to overtrade even when there’s nothing to trade or when things are not clear

Ah, overtrading. Personally, I have never suffered from overtrading, it’s been quite the opposite for me, to be honest and I’m sure this has saved me one or two accounts. I would have probably given up after losing a third account, but I never overtraded, not even when I was new to this business and still not when I mastered the market on the second and third account.

I have seen many forex traders who trade like they are in a competition, trying to get every pip in the market. We’re not here to trade every move and get every pip. We are here to be profitable and therefore make money and be successful in the long run. Overtrading messes with your head and your feelings, making you obnoxious and often paranoid. That will surely affect your trading even if you are the most experienced trader and have the best trading strategies at your disposal.

In Conclusion

There’s no golden rule to finding the right balance in trading. It is a personal goal which we should achieve as traders and which no one can give to us as a gift since it is, well, personal for everyone since everyone of us is unique. One thing is for sure, we shouldn’t make things too difficult with strange strategies and overtrading. Neither should we make it too easy by putting too much trust in a forex strategy or even in ourselves. We should always question ourselves. So, finding the “Golden Average” in trading is a must in this game and it is only you who can find it.