How to Start Forex Trading

How to Start Forex Trading revealed. We have researched various ways to start forex trading to provide traders with a comprehensive guide with the necessary steps.

In this in-depth guide, you’ll learn:

- How to Start Forex Trading for Beginners from Scratch

- How to Start Forex Trading on a Phone – Is it Possible?

- Popular Forex Trading Apps and Platforms

- What is Forex Trading and How Does it Work?

- How to Trade Forex on MT4/MT5

- Can I teach myself Forex? – Answered

- How Much Money do I need to Start Forex Trading

and much, MUCH more!

🏆 10 Best Forex Brokers

| Broker | Review | Leverage | Min Deposit | Website | |

| 🥇 |  | Read Review | 1:400 | Minimum Deposit $100 |  |

| 🥈 |  | Read Review | 1:30 | Minimum Deposit $100 |  |

| 🥉 |  | Read Review | 1:1000 | Minimum Deposit $25 |  |

| 4 |  | Read Review | 1:500 | Minimum Deposit $200 |  |

| 5 |  | Read Review | 1:100 | Minimum Deposit $100 |  |

| 6 |  | Read Review | 1:2000 | Minimum Deposit $200 |  |

| 7 |  | Read Review | 1:1000 | Minimum Deposit $10 |  |

| 8 |  | Read Review | 1:Unlimited* | Minimum Deposit $10 |  |

| 9 |  | Read Review | 1:500 | Minimum Deposit $100 |  |

| 10 |  | Read Review | 1:3000 | Minimum Deposit $1 |  |

How to Start Forex Trading – a Key Point Quick Overview

- ☑️ The 5 Best Forex Brokers for Beginners

- ☑️ What is Forex Trading?

- ☑️ How Does The Forex Trading Market Work

- ☑️ How to Set up For Forex Trading

- ☑️ Understanding Fundamental Analysis in Forex Trading

- ☑️ Understanding Technical Analysis in Forex Trading

- ☑️ How to Develop a Forex Trading Strategy

- ☑️ Understanding The Psychological Side of Forex Trading

- ☑️ How to Start Your Forex Trading Journey

- ☑️ In Conclusion

- ☑️ Frequently Asked Questions

The 5 Best Forex Brokers for Beginners – a Comparison

| 🔎 Broker | ☑️ Suited for Beginners | 💶 Min. Deposit | 🚀 Open an Account |

| 🥇 AvaTrade | ✅Yes | 100 USD | 👉 Click Here |

| 🥈 Exness | ✅Yes | 10 USD | 👉 Click Here |

| 🥉 HF Markets | ✅Yes | None | 👉 Click Here |

| 🏅 FXGT.com | ✅Yes | 5 USD | 👉 Click Here |

| 🎖️ XM | ✅Yes | 5 USD | 👉 Click Here |

The 5 Best Forex Brokers for Beginners (2024)

- ☑️ AvaTrade – Overall, the Best Forex Broker for Beginners

- ☑️ Exness – Excellent Educational Resources

- ☑️ HF Markets – No Minimum Deposit Forex Broker

- ☑️ FXGT.com – Best Web Trading Platform

- ☑️ XM – Great deposit and withdrawal options

AvaTrade

AvaTrade is a globally renowned broker that offers access to world-class educational tools and resources. Beginners can navigate the Forex Markets with the help of Tutorials, Articles, and Blog posts.

| 🔎 Broker | 🥇 AvaTrade |

| 💴 Minimum Deposit | 100 USD |

| 🖱️ Account Types | Retail, Islamic, Professional |

| 🪙 Base Currencies | ZAR, USD, GBP, AUD |

| 5️⃣ Ease of Use Rating | 4/5 |

| 🎁 Bonuses | ✅ Yes, referral bonus |

| ⏰ Support Hours | 24/5 |

| 💵 Currency Pairs | 51; Major, Minor, Exotic Pairs |

| 🤝 Affiliate Program | ✅ Yes |

| 🚀 Open an Account | 👉 Click Here |

AvaTrade Pros and Cons

| ✅ Pros | ❌ Cons |

| Over 1,260 instruments | Inactivity fees on dormant accounts |

| Fixed spreads from 0.6 pips on the Pro Account | The demo account is available for 21 days |

| Islamic Account | Deposit and withdrawal options are limited |

| There is a free demo account available | Leverage is capped at 1:30 for retail accounts |

Exness

Exness is a popular broker choice for both Novis and Professional traders. Beginners Traders will have access to features such as a Demo Account, Analytical Tools, and, a Help Centre that covers frequently asked questions on topics such as Trading, Instruments, and Security. Furthermore, Exness makes a Our Guides section available.

| 🔎 Broker | 🥇 Exness |

| 💴 Minimum Deposit | 10 USD |

| 📈 Spreads | From 0.0 pips EUR |

| 📉 Leverage | Unlimited |

| 🪙 Currency Pairs | 100+ |

| 🤝 Affiliate Program | ✅Yes |

| 🚀 Open an Account | 👉 Click Here |

Exness Pros and Cons

| ✅ Pros | ❌ Cons |

| Flexible trading accounts | Demo account is only valid for 21 days |

| Well-regulated + Comprehensive fund protection | Limited product portfolio |

| Powerful trading platforms | Country Restrictions |

HF Markets

HFM is a Forex Broker best known for its high level of Regulation and focus on Trader Safety. HFM offers access to a comprehensive list of Tools, Educational Resources, News, and, Analysis. Educational Resources include Trading Courses, Videos, Webinars, and, Events.

| 🔎 Broker | 🥇 HFM |

| 💴 Minimum Deposit | $0 |

| 📌 Regulation and Licenses | FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA |

| 5️⃣ Ease of Use Rating | 5/5 |

| 🎁 Bonuses | ✅Yes |

| ⏰ Support Hours | 24/5 |

| ⚙️ Trading Platforms | MT4, MT5, HFM Trading App |

| 🚀 Open an Account | 👉 Click Here |

HF Markets Pros and Cons

| ✅ Pros | ❌ Cons |

| Top-tier Regulation | Regional constraints |

| Segregated Accounts for Client Funds | Inactivity fees |

FXGT.com

FXGT.com is a popular broker amongst beginners as it not only offers access to educational resources but additionally a small minimum deposit plus a Sign-Up Bonus on offer. Educational resources include eBooks and a Blog.

| 🔎 Broker | 🥇 FXGT |

| 💴 Minimum Deposit | 5 USD |

| 💵 Inactivity Fee | ✅Yes |

| 📈 Spreads | From 0.0 pips |

| 📉 Leverage | 1:1000 |

| 🪙 Currency Pairs | 41; major, minor, exotic pairs |

| 📌 Scalping | ✅Yes |

| 📍 Hedging | ✅Yes |

| 🎁 Bonuses | ✅Yes |

| ⏰ Support Hours | 24/7 |

| 🚀 Open an Account | 👉 Click Here |

FXGT.com Pros and Cons

| ✔️ Pros | ❌ Cons |

| FXGT is regulated by numerous financial regulators, including FSCA, CySEC, VFSC, and FSA, ensuring traders' security and confidence | Although FXGT offers a diverse choice of instruments, it may lack comprehensive instructional materials compared to competitors |

| The price structure is reasonable and includes no deposit or withdrawal fees, making trading more affordable | FXGT charges inactivity fees on dormant accounts |

| FXGT provides access to a wide selection of trading assets such as forex, cryptocurrencies, precious metals, energy, indices, and stocks | While the dynamic leverage approach is useful for risk management, traders may need to evaluate their holdings and margin requirements continually |

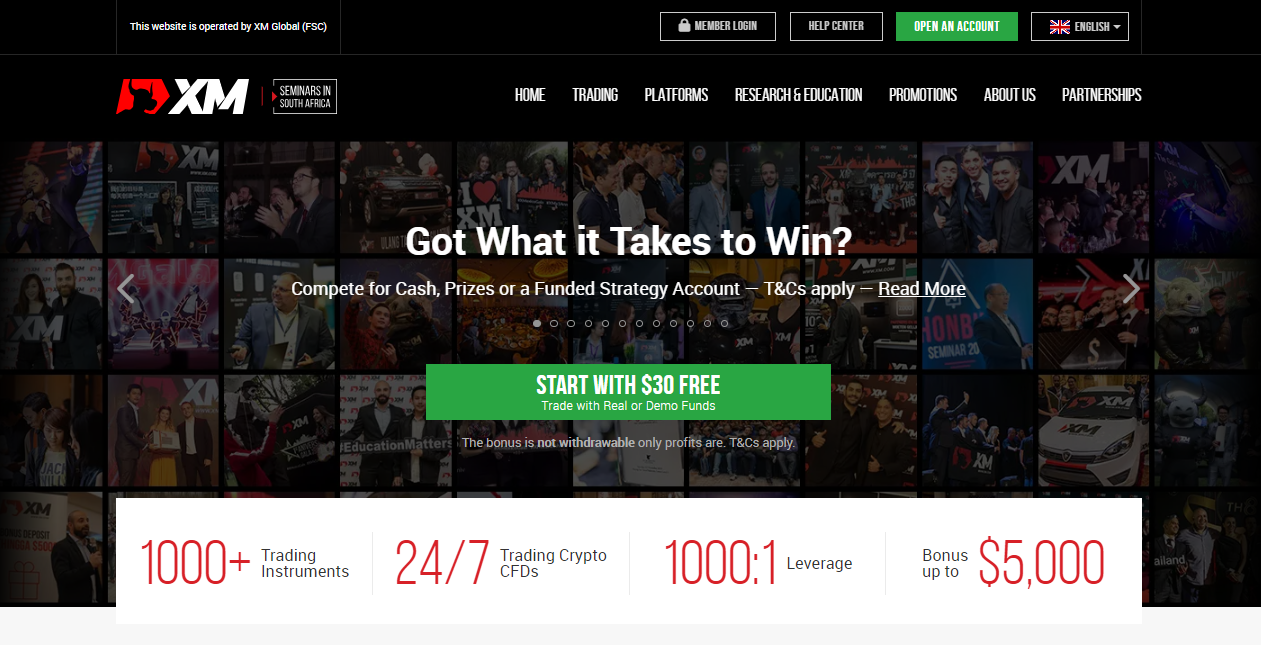

XM

XM is a renowned online brokerage firm that specializes in forex and CFD trading. Traders will have access to Research, Trade Ideas, Live Education and, Webinars.

| 🔎 Broker | 🥇 XM |

| 💴 Minimum Deposit | $5 USD |

| 🎁 Bonus Offers | ✅Yes |

| 📈 Account Types | Micro Account, Standard Account, XM Ultra-Low Account, Shares Account |

| ⏰ Support Hours | 24/7 |

| 🆓 Demo Account | ✅Yes |

| 🚀 Open an Account | 👉 Click Here |

XM Pros and Cons

| ✔️ Pros | ❌ Cons |

| XM provides both MetaTrader 4 and MetaTrader 5, which are known for their cutting-edge technology and user-friendly interfaces | The forex fees are average compared to other brokers, which may be a disadvantage for forex traders |

| XM offers trading in over 1,000 financial instruments across many asset classes | XM's product portfolio is less competitive than other major brokers |

| XM employs variable spreads to provide traders with tighter and more accurate quotes | XM charges an inactivity fee |

| XM offers 24/7 customer care in 30 languages, allowing for secure connection with a dedicated team | XM services are unavailable in Iran, Somalia, Afghanistan, North Korea, Canada, and the United States |

| XM provides a few account types, including Ultra-Low, Micro, Standard, and Zero accounts, to fulfill the needs of different traders | FCA regulations prevent UK clients from trading cryptocurrency CFDs |

| XM provides instant deposit and withdrawal options, including bank transfers, credit cards, and e-payments like Skrill and Neteller, with no fees | XM's maximum leverage varies per client jurisdiction, potentially limiting trading methods for certain traders |

What is Forex Trading?

Forex trading is at the core of global finance, involving the dynamic exchange of currencies and exceeding even the busiest stock markets in daily turnover.

While traders engage in this decentralized marketplace to speculate on currency movements for profit, they also use it as a hedge against potential currency risk. Key pairings such as EUR/USD, USD/JPY, and GBP/USD drive this market due to their liquidity and small spreads.

These pairs serve as economic indicators and denote geopolitical stability worldwide.

Moreover, forex trading goes beyond mere transactional activities; instead representing larger socio-economic forces that shape investor sentiment towards financial opportunities across an ever-evolving 24-hour market structure.

How Does The Forex Trading Market Work

The foreign exchange market, or Forex, is the biggest financial marketplace on earth. With a daily trading volume exceeding $6 trillion and availability 24 hours per day for five days weekly, it comprises various currency exchangers globally such as banks, hedge funds or individuals.

Unlike stock markets that work during specific business times in physical locations, this decentralized system operates across computer networks or over-the-counter platforms (OTC).

Forex trading involves the acquisition of a currency while simultaneously disposing of another, commonly for speculation, hedging, or trade finance objectives.

The currencies are transacted in pairs, and the exchange rate determines their relative value. For example, the EUR/USD pair uses the Euro as that base currency, whereas the US dollar plays the quotation role.

The exchange rate assigned to this duo shows how much quote money one requires to purchase a single unit based on denominations awarded per transactional cycle within selected timelines.

The Forex market fluctuates due to several factors in the global economic environment, such as inflation, political stability, and economic performance. Interest rates also significantly impact currency value, which central banks largely influence.

The policies adopted by these financial institutions regarding monetary supply and interest rates are crucial determinants of exchange rate values. An increase in interest rates leads to gains for that country’s currency due to better returns from assets denominated using its denomination.

The high trading volume and global participation are responsible for the Forex market’s exceptional liquidity, another distinct attribute. This liquidity minimizes price slippage during significant transactions, allowing traders to execute or exit positions relatively easily.

At any given time, changes in the market’s liquidity can be tracked as various global financial centers open and close; however, one should expect increased volatility and higher trade frequency when both London and New York trading sessions overlap.

The participants in the market range from multinational corporations who hedge currency risks to small traders who wager on changes in exchange rates.

There are diverse forex trading strategies, such as analyzing charts and patterns through technical means or assessing economic indicators and news events via fundamental analysis approaches.

How to Set up For Forex Trading

A cautious and strategic entry into Forex trading starts with selecting the right broker, which is paramount to ensuring a positive trading experience, gaining market access, and maintaining financial security. Therefore, careful planning is necessary.

To ensure a secure, productive, and cost-efficient trading experience in Forex, it is crucial to examine three critical factors when selecting your broker – adherence to regulatory requirements, the caliber of tools and platforms offered for trading purposes, and fee structures linked with spreads.

These essential criteria must be considered before deciding on a Forex broker:

Regulatory Compliance

Traders can enhance their security by using a broker authorized by reputable agencies like the FCA in the UK, CySEC in Cyprus, or ASIC in Australia.

These authorities enforce strict rules on financial reporting, client fund segregation, and operational conduct, reducing fraudulent activity and safeguarding against brokerage insolvency.

Trading Platforms and Tools

To navigate the Forex market, it is important to make a wise selection when it comes to trading platforms and tools. MetaTrader 4 and 5 are among the top systems that offer robust analysis features, automatable trading operators, and simple-to-operate interfaces.

Opting for a broker who provides access to these renowned platforms and other analytical resources, such as real-time news feeds and instructional materials, could boost your competence in decision-making while you trade more efficiently overall.

Fees and Spreads

It is crucial to comprehend a broker’s fee arrangement. In the Forex market, brokers earn profits through spreads (price differential between buy and sell orders) and trading fees in specific situations.

For traders who deal with large volumes of transactions, low transaction costs coupled with competitive spreads can greatly impact profitability rates.

Additionally, being transparent about pricing mechanisms while abstaining from concealed expenses are equally significant requisites when consulting a forex brokerage service provider.

Opening a Trading Account

To start trading, individuals must provide personal details, complete an authentication process, and often choose from a variety of account options – standard, mini, or micro depending on their level of proficiency and financial capabilities.

Most brokers facilitate the registration process by utilizing online verification techniques, granting efficient access to Forex markets.

Demo Accounts

Demo accounts are essential educational tools for novice traders, providing a platform to practice trading techniques without risking capital. They enhance confidence and understanding of market phenomena through simulations, benefiting both beginners and professionals alike.

Understanding Fundamental Analysis in Forex Trading

The Importance of Economic Indicators

Fundamental analysis is essential for Forex trading, assessing economic indicators, financial metrics, and factors to predict currency value. It provides traders with long-term trends knowledge and helps them make informed decisions based on fundamental aspects influencing a nation’s economic growth potential.

Political Events and Their Impact on Forex Markets

Forex traders use economic indicators like GDP expansion, employment rates, inflation, and industrial output to gauge a country’s financial health.

An above-average GDP increase can boost currency appreciation, while high inflation can decrease it. Consistent monitoring helps make accurate market predictions and allows strategic adjustments.

Understanding Market Sentiment

The forex market is highly influenced by political events, including elections, geopolitical tensions, government policy changes, and international relations.

These events can cause sudden fluctuations and increased volatility in exchange rates, leading to currency instability and investors tending towards safe-haven currencies like USD or JPY. Understanding these occurrences is crucial for traders making wise trading decisions.

Understanding Technical Analysis in Forex Trading

Forex traders rely heavily on technical analysis, a key instrument that forecasts future currency price movements by analyzing trading volumes and pricing trends.

This approach contrasts with fundamental analysis, which considers economic metrics and political developments; instead, technical analysts identify patterns in historical data along with chart readings to anticipate market behavior down the line.

Reading Forex Charts

Forex charts act as a medium for illustrating market psychology and participant actions by displaying the price fluctuations of a currency pair over time. Traders use chart formats like line, bar, and candlestick graphs to evaluate market changes.

Among these choices, candlestick charts are widely used because they provide detailed information regarding open, high, low, and closing prices during specific periods.

Candlestick Patterns

Using candlestick patterns for technical analysis is crucial as they reveal valuable information on the market outlook and potential price changes. These patterns, such as bullish engulfing or bearish harami, can indicate a reversal, whereas Dojis are an indicator of hesitation in the market.

Proficiency in interpreting these patterns empowers traders to predict short-term fluctuations and make sound decisions considering the psychological state of the marketplace.

Support and Resistance Levels

Chart analysis is crucial in financial trading, highlighting support and resistance levels. Support levels indicate a potential halt in downward currency movement, while resistance levels hinder upward movement due to increased supply.

Recognizing these patterns helps traders establish trade positions, use stop losses, and gain insights into future pricing trends through historical data analysis.

Technical Indicators and Their Uses

Mathematical calculations based on the price and volume of a currency pair, known as technical indicators, yield valuable insights into market conditions. These tools are commonly used to assess trends, momentum shifts, and potential reversal points that can effectively guide trading decisions.

Moving Averages

The use of moving averages results in a streamlined representation of price data that facilitates the identification of trend direction. The Simple Moving Average (SMA) and Exponential Moving Average (EMA) are two widely employed types.

Opportunities for entering or exiting trades can be inferred from instances wherein there is an intersection between two distinct moving averages, also called crossovers, and cases where prices traverse over a predetermined threshold represented by the same indicator.

Relative Strength Index (RSI)

Quantifying the pace and alteration of price movements on a scale from 0 to 100, the Relative Strength Index (RSI) serves as a momentum oscillator.

According to historic observations, an RSI surpassing 70 implicates overbought currency with potential for reversal or correction, whereas an RSI less than 30 indicates oversold circumstances.

MACD (Moving Average Convergence Divergence)

A momentum indicator known as the MACD tracks trends by comparing two moving averages of currency prices. The 26-period and 12-period EMAs are subtracted to compute the MACD, which is visualized alongside a signal line (the MACD’s 9-period EMA) on a chart.

This display lets traders identify potential buy or sell opportunities based on crossovers between these lines.

How to Develop a Forex Trading Strategy

To achieve long-term success in the ever-changing currency markets, creating a robust Forex trading strategy is imperative. A meticulously planned approach ensures that you trade with discipline and consistency despite market complexities.

It involves selecting a suitable trading technique based on your unique aims, risk tolerance level, and time availability while implementing adequate measures to mitigate possible losses through effective risk management practices.

Types of Trading Strategies

A trader’s trading strategy is influenced by their market view and preferred approach to managing deals within different time frames. Every strategy has unique guidelines concerning risk management, entry/exit points, and trade duration.

Day Trading

Day trading involves buying and selling currency pairs within the same day. Traders take advantage of short-term fluctuations in the market by completing transactions before their closure. This approach demands significant time and quick decision-making skills based on up-to-the-minute market data.

It is best suited for traders who can devote their entire day to keeping track of investments and changes in the marketplace, promising substantial earning potential with an emphasis on risk management monitoring.

Swing Trading

Swing trading involves accumulating profits from a currency pair over several days or weeks using technical analysis to anticipate likely price changes and make trades that capitalize on market momentum swings.

This approach demands both patience and sound knowledge of market trends, enabling traders to gain from significant fluctuations in value beyond what day traders typically aim for.

Position Trading

The strategy involved with position trading entails retaining positions for extended periods, from weeks to months or even years. Position traders rely on fundamental analysis that factors in macroeconomic trends over the long term and their impact on currency values.

Given market fluctuations, a profitable outcome demands an expert understanding of global economies and constant patience.

Risk Management Techniques

Every profitable Forex trading strategy relies on strong risk management practices, ensuring traders can sustainably withstand the market’s volatility.

Setting Stop-Loss and Take-Profit Orders

Utilizing stop-loss and take-profit orders is imperative to manage risk and protect profits. To decrease potential losses, a stop-loss order will cancel a trade at an established price point, while a take-profit order ends the transaction once it has reached targeted profit margins.

By enforcing these measures, traders can remain steadfast in their trading strategy without compromising sound judgment based on emotions.

Understanding Leverage and Margin

Traders can use leverage to handle a sizable position with minimal funds, increasing gains and losses. Margin pertains to the security deposit required for commencing and continuing an amplified stance. While leveraging has potential benefits in earning substantial profits, it also heightens susceptibility towards significant losses, especially when market trends reverse unfavorably against traders’ standing.

Managing risks effectively during Forex trading ventures requires mastering the skillful application of leverage techniques alongside sound margin handling practices as crucial aspects of risk management.

Understanding The Psychological Side of Forex Trading

In the forex markets, one’s psychological state often determines whether they will succeed or fail. To successfully navigate the unpredictable currency market, traders must conquer emotional and mental obstacles.

This requires developing trade discipline, managing losses effectively, and dedicating oneself to constant learning and adaptation.

The Importance of Trading Discipline

Effective trading relies heavily on trading discipline. This discipline entails adhering strictly to a comprehensive plan that covers entry and exit points, risk management strategies, and trade selection criteria.

By enhancing focus and minimizing emotional decision-making tendencies, frequently leading to impulsive trades, traders without self-control often find themselves in unfavorable situations.

Disciplined traders demonstrate patience, waiting for optimal conditions before entering or exiting transactions without succumbing to the negative influence of fear of missing out (FOMO) on their decisions.

This systematic approach emphasizes the importance of consistency in accurately assessing performance levels and making necessary adjustments to evolving trade circumstances.

Dealing with Losses

Dealing with losses is an integral part of trading, and it can significantly impact a trader’s emotional well-being and overall performance. Embracing the inevitability of losses is crucial in handling them intelligently.

Rather than seeing loss as a failure, adept traders consider these experiences opportunities for growth to enhance their skills further.

Cultivating resilience requires detaching one’s ego from specific deals and recognizing that financial setbacks do not reflect personal worth.

Approaching loss sensibly while focusing on long-term goals instead of assessing immediate outcomes allows traders to safeguard psychological balance while preserving motivation.

Continuous Learning and Adaptation

Due to various factors, such as global economic conditions, political events, and market sentiment, the forex market is in a state of constant flux. This makes it particularly important for traders to regularly upskill themselves and be adaptable if they aspire towards long-term success.

It involves keeping oneself abreast of current trends prevalent within the market and being attuned to geopolitical influences that could potentially impact currency fluctuations.

Traders must constantly tweak their strategies based on information from reliable sources while proactively incorporating fresh insights into decision-making processes.

A mindset inclined toward continuous growth ensures adaptability, enabling these individuals to stay proactive amidst changes in this dynamic industry’s landscape at any given time.

How to Start Your Forex Trading Journey

Starting a Forex trading career requires careful planning, strategic thinking, and continuous learning. Traders must navigate market instability with poise and capitalize on potential gains.

This involves formulating a comprehensive trading plan, staying updated on market trends, and forming connections within the trading community for valuable advice.

Creating a Trading Plan

A trader’s trading plan outlines their approach, objectives, risk tolerance, and trade criteria. It promotes discipline, reduces emotional biases, and ensures consistency in trading activities.

An effective strategy includes detailed objectives, systematically executed methodologies, suitable financial instruments, timeframes, and analytical tools for identifying trade opportunities. Consistent adherence enhances the probability of success in Forex markets.

Staying Informed and Updated

Geopolitical events, economic data, and central bank policies influence the forex market. To make informed decisions, traders must stay updated on these factors through the financial news, economic calendars, and global market impact.

Understanding economic drivers helps predict market changes and adjust strategies. Real-time notifications from trade platforms speed up reactions to fluctuating prices.

Joining Trading Communities

Forex trading groups provide traders access to a wealth of information, experiences, and tactics shared by fellow traders. These communities create a nurturing environment for learning, exchanging ideas, and discussing market trends.

They offer psychological support, fresh perspectives, and learning from successes and failures. Being affiliated with seasoned traders motivates persistence during tough times, enhancing personal trade strategies and overcoming challenges in the marketplace.

In Conclusion

In our experience, Forex trading offers both financial benefits and challenges. It offers liquidity, 24-hour trading, and the potential to increase gains, making it an attractive option for diversifying financial portfolios.

Beginners have access to resources like instructional materials and trading platforms. However, the unpredictable nature of currency markets can lead to substantial losses, especially without a good plan.

The psychological stress of trading, including dealing with losses, discipline, and decision-making, can be overwhelming.

According to our research, one must balance financial intelligence, emotional endurance, and a commitment to lifelong learning to succeed in Forex trading. A balanced approach is essential for success in this industry.

Addendum/Disclosure: No matter how diligently we strive to maintain accuracy, the forex market is volatile and may change anytime, even if the information supplied is correct when going live.

Investor Warning: Foreign currency trading on margin is associated with an elevated risk and may not be appropriate for all investors. Before engaging in foreign currency or Contract for Difference (CFD) trading, you must evaluate your investing goals, expertise, appetite for risk, and willingness to be exposed to risk. In addition, you should not start investing capital you cannot afford to lose because you could lose part of your original investment.

Frequently Asked Questions

Can I start forex trading with a small amount?

Yes, many brokers have micro or mini accounts, allowing you to begin trading forex with minimal investments.

What are the risks of forex trading?

Forex trading involves high risks, including the possibility of losing more than your initial investment. Market volatility, leverage, and a lack of experience can all lead to losses.

Is forex trading a way to get rich quickly?

No, although some traders make substantial gains, FX trading is risky. Success necessitates persistence, education, and a realistic strategy centered on sustained gains rather than sudden wealth.

Do I need a forex trading strategy?

Yes. A strategy defines your trading approach, including entry and exit points, risk management, and currency pairings to trade.

Is forex trading a viable career path?

Yes, Forex trading is a viable career option, but it involves substantial time, effort, and skill development. Most successful professional traders have developed their methods over time.

What are the best forex brokers for beginners?

Look for brokers with a solid reputation, robust regulation, educational materials, cheap fees, and easy-to-use platforms. Popular options include AvaTrade, HFM, Exness, OANDA, IG, and Tickmill.

What should I learn before forex trading?

Learn about forex basics, currency pairings, technical analysis, risk management, and trading psychology. Several online resources, classes, and demo accounts are available to assist you in learning.