Trading Course

Forex in Relation to Stocks and Commodities and Trading with MetaTrader

Forex in Relation to Stocks and Commodities and Trading with MetaTrader

In Chapter 11 – Forex in Relation to Stocks and Commodities and Trading with MetaTrader you will learn about the relationship between stocks, indices, and commodities to the forex market. In addition, you will learn how to master the MetaTrader platform.

- Stocks, Forex, and Commodities – Long relationship…

- Forex Signals – Following market alerts

- What not to do

- Master the world of Forex: “MetaTrader“

Stocks, Forex, and Commodities – Long Relationship

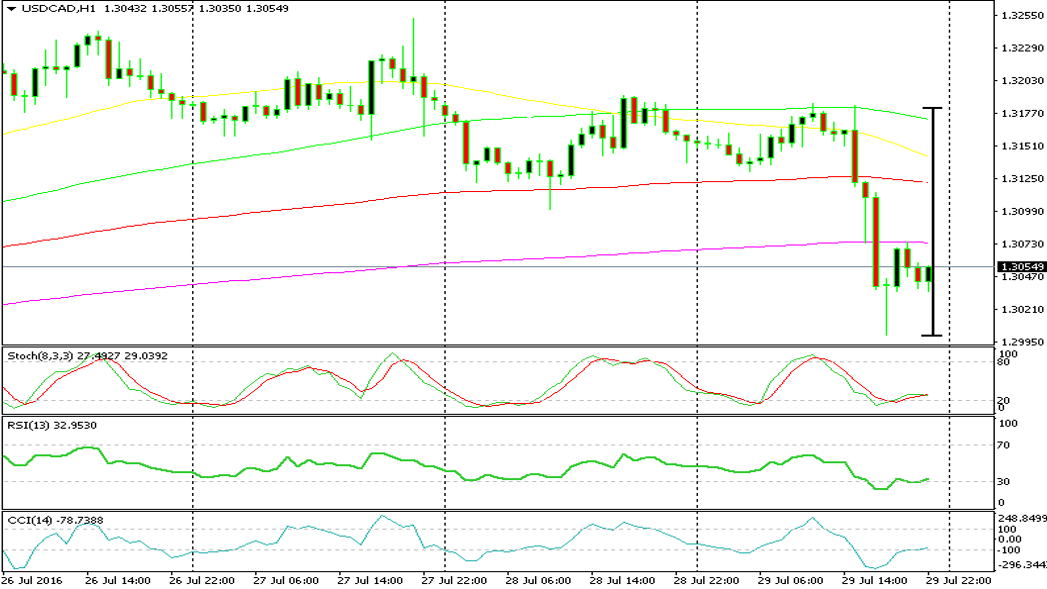

Be honest. You didn’t think that there was no relation between the Forex market, stocks, and commodities, right? Of course, they are related. There is a strong interaction between these three markets. The Canadian Dollar is highly correlated to oil prices since Canada contains the third largest oil reserves in the world. Look at the charts below… when oil goes up USD/CAD goes down during the end of the US trading session on Friday 29th of July 2016.

USD/CAD

While WTI (West Texas Intermediate) oil surged:

Let’s try to understand these relations: when a certain market exchange, in N.Y., London or any other market rallies, it used to mean that the economy in this particular market is growing. It has implications – more external investors from other countries want to enter this market and invest in a growing economy which opens up new potential horizons. It leads to more intense usage of the national currency, and to increased demand for the currency as a result. This is how Forex comes into the picture!

That used to be the story until the 2008 global financial crisis. Now, things have distorted a little. It just means that there is more monetary or fiscal stimulus coming up, such as a decline in the interest rates. That means that more cheap money will be around in the real economy, so obviously some of this money ends up in stocks, therefore the indices of the stock markets go up. That has been the story from these last eight years.

Another more recent example :

Here’s the candlestick chart for WTI crude oil prices from September to December 2023. The chart illustrates the price movements, with green bars indicating price increases (where the close is higher than the open) and red bars showing price decreases (where the close is lower than the open).

This visual representation helps to highlight the significant fluctuations during this period, including the surge in prices due to geopolitical tensions and the subsequent reversal related to U.S. oil inventory changes.

The Biggest and most influential stock markets in the world

| 🔎 Stock Market | 📌 Description |

| DOW USA | One of the two premier stock indexes in the U.S.A., The Dow Jones Industrial Average measures the trading performances of the top 30 publicly traded companies. The DOW is highly influenced by market sentiment, economic and political events. Players: McDonald’s, Intel, AT&T, etc |

| NASDAQ USA | The largest electronic trading market in the U.S. with approximately 3,700 electronic listings. The NASDAQ has the largest trading volume among the stock markets of the world. Players: Apple, Microsoft, Amazon, etc |

| S&P500 USA | Its full name is the Standard & Poor 500. An index of the 500 largest American companies. Considered as a good barometer for the American economy. The S&P500 is the second most traded index in the U.S. after the Dow. |

| DAX Germany | Germany’s stock market index. Consists of the top 30 stocks traded on the Frankfurt Stock Exchange. The DAX is the most traded index in the Eurozone, being the most popular index in Europe. This is no surprise, given that Germany is the largest economy in the Eurozone. Key players: BMW, Deutsche Bank, etc |

| Nikkei Japan | Reflects the overall market conditions in Japan by tracking the top 225 companies in the Japanese market. Key players: Fuji, Toyota, etc |

| FTSE (“Footsie”) UK | The Footsie index tracks the performance of the most highly valued UK companies listed on the London Stock Exchange. As in other markets, there are a few versions, depending on the size of the index (FTSE 100 for example) |

| DJ EURO STOXX 50 Europe | The Eurozone’s leading index. Its full name is the Dow Jones Euro Stoxx 50 index. Tracks 50 top stocks from 12 euro member countries |

| Hang Seng Hong Kong | Hong Kong’s stock market index. Tracks the performance of the Hong Kong stock market by monitoring the price changes of the overall stocks included in this index. Organized by Hang Seng Bank’s HIS services. |

The information regarding the relationships between stock markets and currencies:

Correlation Between American and Japanese Markets:

It is still true that the American (e.g., S&P 500 and Dow Jones) and Japanese (e.g., Nikkei 225) stock markets can exhibit similar behaviors. This is due to global economic factors, such as interest rates, geopolitical events, and overall market sentiment. However, specific events and changes in economic policy can influence their correlations, so it’s important to monitor the current economic landscape.

DAX and Euro Performance:

The performance of the DAX and the Euro (EUR) is still closely linked, as the DAX represents Germany’s largest companies and Germany is the Eurozone’s largest economy. Therefore, trends in the DAX can often provide insights into movements in the EUR. However, external factors such as European Central Bank policies, inflation rates, and economic indicators from other Eurozone countries can also affect this relationship.

Correlation Between Indices and Currency Values:

The idea that an increase in money supply can lead to a decrease in currency value while boosting stock indices remains relevant. In general, if a country increases its money supply (e.g., through quantitative easing), it can lead to inflation, which often depreciates the currency value. However, the correlation is not always a perfect -1 (perfect negative correlation). Economic conditions, investor sentiment, and other factors can create fluctuations in this relationship. The situation can vary significantly from year to year and should be evaluated in the context of current market conditions.

In summary, the actual correlations can fluctuate based on economic developments, monetary policy changes, and global events. It’s always best to analyze current data and trends for the most accurate predictions.

Trading commodities on your Platforms

Many platforms allow you to also trade commodities like oil, gold, and silver. If you are interested in trading commodities there are several things you should keep in mind:

Goods and commodities are traded according to the stability of the local and global markets. To see this for yourself check out what happened to the price of Gas during the revolutions of the Arab Spring at the beginning of 2011 – prices rose to new historical records!

If you want to trade commodities it is really important to follow major events around the world and to do some fundamental analysis! Events can have a major impact on the prices of these goods.

Another event? Oil prices hit rock bottom for several months at the beginning of 2016. The reason? The global economy has been slowing down since 2014. In early 2016, two more events added fuel to the fire; the US economy had led the recovery but having difficulties due to the winter season (amongst other reasons), and the Chinese stock market was rapidly losing value. The consequence? The market felt that the oil demand would decrease and everyone accelerated selling the oil. It reached below $30/barrel in early 2016.

Example: Gold is protected from inflation. Therefore, when concern about rising inflation in a specific market occurs, gold often gets stronger! Likewise, gold and silver are highly influenced by political instability. If South Africa is having political problems, gold’s price would probably rise dramatically (South Africa is a major gold exporter). But fundamental analysis isn’t enough. That is why we also use technical indicators. The use of such indicators for the goods and commodities markets is identical to their use in the Forex market. You should know that strategies like Swing, Breakouts, Day Trading, etc apply to these markets also.

The value of certain commodities, such as precious metals, occasionally rises when other large markets lose value. For example, in the past decade, while both the global economy and most major currencies have weakened, more and more traders have turned to commodities investments, which means a negative correlation between the commodities and the indexes is formed.

But not for long. That lasted until the US economy, and the rest of the global economy began the second downturn in a decade. The demand for commodities fell so the correlation between the global economy and commodities turned positive again. As soon as you hear negative news from a large global economy, the commodities would drop like stone, apart from gold which is a haven commodity.

Important: The average length of trends in commodities markets is usually much longer than in Forex markets. As a result, trading these goods can offer a great long-term investment. Rallies are often long and massive. Therefore, when a trend breaks, it probably indicates a long-term change is coming our way. You can use technical indicators like Fibonacci, RSI, and the rest to help spot these trends.

The high liquidity of the gold chart makes it an attractive investment alternative, even for intraday trades.

Many traders from all over the world have discovered the commodities markets through their trading platforms. These markets have become ever more popular during the last few years, for several reasons: massive volume and high volatility thanks to a range of events that have had a huge impact on these markets; simplicity and convenience of the brokers’ platforms; more educated traders; and the numerous headlines that these have grabbed in the media.

These recommended brokers offer full-service commodities trading with excellent terms.

🏆 10 Best Forex Brokers

| Broker | Review | Leverage | Min Deposit | Website | |

| 🥇 |  | Read Review | 1:400 | Minimum Deposit $100 |  |

| 🥈 |  | Read Review | 1:30 | Minimum Deposit $100 |  |

| 🥉 |  | Read Review | 1:1000 | Minimum Deposit $25 |  |

| 4 |  | Read Review | 1:500 | Minimum Deposit $200 |  |

| 5 |  | Read Review | 1:100 | Minimum Deposit $100 |  |

| 6 |  | Read Review | 1:2000 | Minimum Deposit $200 |  |

| 7 |  | Read Review | 1:1000 | Minimum Deposit $10 |  |

| 8 |  | Read Review | 1:Unlimited* | Minimum Deposit $10 |  |

| 9 |  | Read Review | 1:500 | Minimum Deposit $100 |  |

| 10 |  | Read Review | 1:3000 | Minimum Deposit $1 |  |

Forex Signals

A Forex signal is an online trading alert on the currency pairs, indicating fresh trading opportunities.

Signals services allow you to follow and copy trading actions and executions from experienced and successful traders. The providers of these alert services spot opportunities by using technical tools as well as fundamentals. Alerts are provided either by analysts who perform their moves in real-time, or by automated systems, like robots, which analyze the market by using sophisticated algorithms. A signal’s quality depends on its success percentage, simplicity of performance, system efficiency, and speed. Forex signals can be provided via websites, Email, SMS, or by Tweet.

Using Forex signals can be a great trading strategy if you:

- Don’t Have Much Time: If you find it hard to trade and manage your positions on your own, the following alerts can help.

- Want to Earn Extra Money Easily: If you’re looking for a way to make additional income with minimal effort, this can be a good option.

If you want to open more than one or two trades at the same time, following market alerts can help you manage several positions alongside your trades.

How do market alerts work?

To learn what a good live Forex signal includes take a look at how FXMarketLeaders’ FREE signals are provided:

How Do Market Alerts Work?

To understand what constitutes a good live Forex signal, let’s examine how FXMarketLeaders provides its free signals in 2024:

- Pair: The relevant currency pair to trade.

- Action: A clear trading signal indicating whether to buy or sell the pair.

- Stop Loss and Take Profit: While optional, using Stop Loss orders is highly recommended when opening positions. All FXMarketLeaders’ alerts come with suggested Stop Loss and Take Profit levels to help manage risk.

- Status: Indicates the alert’s current status—active means the signal is open, and traders should follow it.

- Comments: Updates regarding the signal status or market conditions are provided as needed.

- Trade Now: A prompt to access the trading platform and open a position based on the alert.

By following these signals, traders can enhance their decision-making process and capitalize on potential market movements effectively. Follow the experts for free!

FXMarketLeaders alerts are completely FREE! On our trading alerts page, you can find daily live market updates, suggesting trading strategies across the major currency pairs!

What not to do!

We’ve prepared for you a list of “7 Forex commandments“. Follow them carefully to trade like the pros:

Here’s a simplified version of the “What Not to Do” section for teaching purposes:

- Think for Yourself: Don’t just follow what other traders say. Make sure you understand their reasons and agree with them. Trust your judgment!

- Stick to Your Plan: Don’t change your trading strategy while you’re in a trade. Avoid resetting your Stop Loss points. Keep your emotions in check and don’t let fear make your decisions for you.

- Treat It Like a Business: Be serious about trading. Don’t get overconfident or careless. Always act responsibly.

- Have a Good Reason to Trade: Only enter a trade if you have strong reasons for doing so. Don’t trade just to pass the time—Forex is not a game! If you’re feeling too emotional, you might need to step back.

- Don’t Rush to Exit: Take your time when closing a trade, whether you’re winning or losing. Follow your plan and only close a trade if the market goes against your expectations.

- Use Low Leverage: Don’t use too much leverage, as it can increase your risk. Remember, where you place your Stop Loss matters. If it’s too close to your entry point, you might lose your position quickly.

Trading has risks, but it’s not like a casino. Practice first, learn your trading platform, and avoid opening too many positions at once. Don’t risk all your money on one trade!

MetaTrader trading platforms

Metatrader4 and MetaTrader5 (MT4 and MT5) are the most popular trading platforms in the world of Forex. They are very simple and convenient platforms to use. Many brokers (in fact most of them) offer Metatrader platforms alongside their own branded platform. However, there are a few world-class brokers who have developed their unique trading platforms, like the extremely popular eToro.com.

While MT5 is the newest version, MT4 is still widely used and loved by many traders.

Key Features of MetaTrader Platforms:

- Multiple Charts: You can view one chart or several charts at the same time, allowing you to analyze different currency pairs easily.

- Easy Account Management: If you have multiple trades open, MT4/5 helps you switch between accounts and positions quickly and smoothly.

- Technical Indicators: The platform comes with many technical indicators that help you analyze the market. We’ll focus only on our favorite indicators in this course.

- Quick Orders: Placing buy and sell orders is straightforward, and the platform responds quickly to your commands.

- Market Analysis Tools: There’s a dedicated section for market analysis, including a calendar and price quotes for all currency pairs, helping you stay informed.

- Quick Installation: Downloading the MT4 or MT5 software takes just 10-20 minutes, and it serves as a helpful tool for practicing your trading skills.

That is what it looks like:

Congratulations! You completed the FXLeaders Trading Course. Now you are ready to turn trading opportunities into big profits!

Join thousands of FX Leaders around the world, who began their forex trading career with the FXLeaders Forex Trading Course.

It’s time to implement all you learned and start taking your first steps in the market. You are welcome to join the tens of thousands of members in our popular online Forex portal- FXLeaders.com. You will find all kinds of trading tips and help, including free forex signals.