Top Crypto Market Predictions for 2025: Hottest Sectors to Invest in

As the cryptocurrency landscape continues to expand at a breakneck pace, investors and enthusiasts are keenly eyeing the developments that will shape the market in the coming year. Building on the momentum from 2024, where Bitcoin (BTC) surged past $100,000 and Ethereum (ETH) crossed the $4,000 mark, latest analysis by VanEck, BlackRock, CoinShares, and Bitwise offers a comprehensive outlook for 2025.

With a mix of bullish forecasts and strategic insights, here are the top crypto market predictions and the hottest sectors to watch and invest in for 2025.

1. Crypto Bull Market to Peak and See New Highs

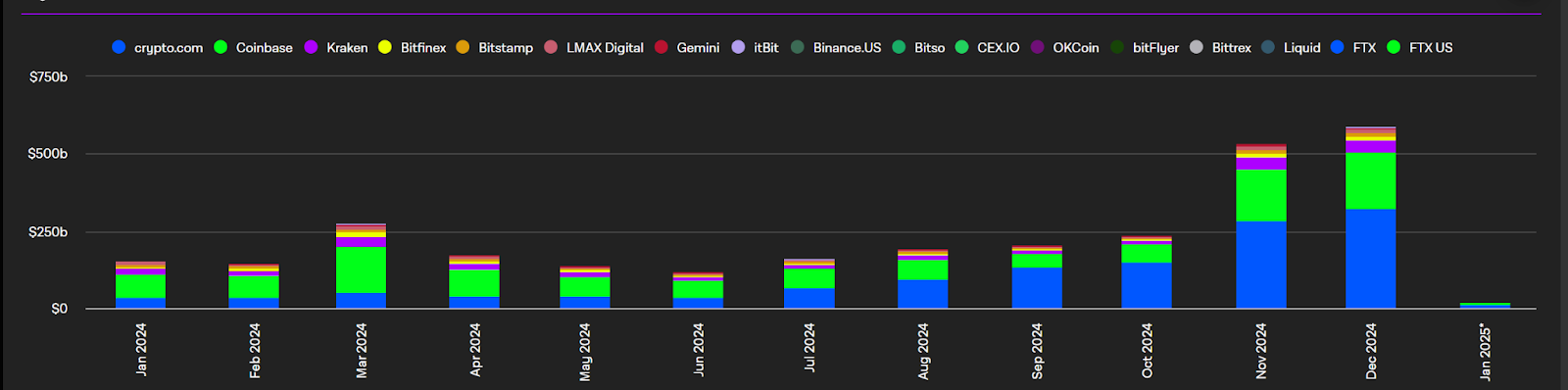

USD support exchange volume, Source: The Block

VanEck predicts that the crypto bull market will maintain its upward trajectory through 2025, reaching a medium-term peak in the first quarter before setting new all-time highs in the fourth quarter. Bitcoin is forecasted to soar to approximately $180,000, while Ethereum could climb above $6,000. Prominent altcoins like Solana (SOL) and Sui (SUI) are expected to exceed $500 and $10, respectively.

The sustained bull market suggests robust growth opportunities across major cryptocurrencies. Investors should consider diversifying their portfolios to include not only Bitcoin and Ethereum but also promising altcoins that could experience significant appreciation.

2. U.S. Could Embrace Bitcoin with Strategic Reserves and Increased Adoption

The political landscape in the United States is poised to become more favorable towards cryptocurrencies, particularly Bitcoin. With pro-crypto leaders appointed to key governmental positions, VanEck anticipates the establishment of Bitcoin reserves at federal or state levels. Additionally, the approval of multiple spot Bitcoin Exchange-Traded Products (ETPs) is expected to integrate Bitcoin further into traditional financial systems.

The U.S. embracing Bitcoin could lead to increased institutional adoption and stability in the market. Investors might find opportunities in Bitcoin-related financial products and services, as well as companies involved in Bitcoin mining and custody solutions.

3. Tokenized Securities Could Cross $50 Billion in Value

Tokenized securities are set to revolutionize traditional financial markets by offering improved efficiency, decentralization, and transparency. VanEck forecasts that the value of tokenized securities will surpass $50 billion in 2025, driven by both public and private blockchain platforms.

Tokenized securities present a new frontier for investment, allowing for fractional ownership and enhanced liquidity of traditionally illiquid assets. Investors should explore platforms and projects facilitating the tokenization of real-world assets, such as private credit and equity securities.

4. Stablecoins’ Daily Settlement Volume to Touch $300 Billion

Stablecoins’ TVL, Source: DefiLlama

Stablecoins are transitioning from niche trading instruments to core components of global commerce. By the end of 2025, daily settlement volumes for stablecoins are projected to hit $300 billion, up from approximately $100 billion in late 2024. This surge will be fueled by adoption from major tech companies and payment networks.

The growing reliance on stablecoins for daily transactions and remittances highlights their potential as a stable investment asset within the volatile crypto market. Investors should monitor stablecoin projects and their integrations with traditional financial systems for lucrative opportunities.

5. AI Agents’ On-Chain Activity to Surpass 1 Million Agents

AI and memecoins were the most active sectors in December 2024, Source: X

Artificial Intelligence (AI) agents are set to become a significant force in the blockchain ecosystem, with onchain activity expected to exceed 1 million agents in 2025. These specialized AI bots will perform a variety of tasks, from maximizing yield in DeFi protocols to acting as social media influencers.

AI-driven blockchain applications represent a cutting-edge investment opportunity. Investors might consider backing projects that develop or utilize AI agents for decentralized applications (dApps), as these technologies are likely to drive substantial innovation and adoption.

6. Bitcoin Layer-2s Could Reach 100,000 BTC in TVL

Layer-2 (L2) solutions for Bitcoin are anticipated to lock in a total value of 100,000 BTC by 2025, enhancing Bitcoin’s scalability and functionality. These L2s will facilitate lower latency and higher transaction throughput, enabling more robust decentralized finance (DeFi) ecosystems on Bitcoin.

Bitcoin L2s offer enhanced utility and scalability, making them attractive for investment. Projects developing L2 solutions or those building DeFi applications on Bitcoin’s L2s could see significant growth, presenting lucrative investment opportunities.

7. Ethereum Blob Space to Generate $1 Billion in Fees

Ethereum’s Blob Space, a specialized data layer for Layer-2 transactions, is projected to generate $1 billion in fees by 2025. This growth will be driven by the explosive adoption of L2s, advancements in rollup technology, and the introduction of high-fee use cases such as enterprise-grade applications and tokenized real-world assets.

Ethereum’s Blob Space is set to become a critical revenue stream, reinforcing Ethereum’s position as the premier settlement layer for decentralized applications. Investors should keep an eye on developments in Ethereum’s scaling solutions and related projects that leverage Blob Space for their operations.

8. DeFi Could Touch New ATHs with $4 Trillion DEX Volumes and $200 Billion TVL

DeFi TVL, Source: DefiLlama

Decentralized Finance (DeFi) is expected to reach unprecedented heights in 2025, with decentralized exchange (DEX) trading volumes projected to surpass $4 trillion and total value locked (TVL) in DeFi protocols reaching $200 billion. This growth will be driven by the influx of tokenized securities, high-value assets, and the proliferation of AI-related tokens.

DeFi continues to offer substantial growth potential as it becomes a cornerstone of the decentralized economy. Investors should explore leading DEX platforms, DeFi protocols, and projects that are integrating AI and tokenized assets to capitalize on this booming sector.

9. NFT Market Recovery, Trading Volumes to Reach $30 Billion

NFT trading volumes by blockchain in Q4 2024, Source: The Block

After a challenging period during the 2022–2023 bear market, the NFT (Non-Fungible Token) sector is poised for a strong recovery in 2025. Trading volumes are expected to rebound to $30 billion, driven by increased cultural relevance and the entry of newly affluent users diversifying their investments into NFTs as assets with enduring value.

The resurgence of the NFT market presents opportunities for investors in high-quality, culturally significant NFT projects. Additionally, platforms facilitating NFT trading and the integration of NFTs into broader digital ecosystems are worth considering for investment.

10. DApp Tokens to Narrow the Performance Gap with L1 Tokens

In 2025, decentralized application (DApp) tokens are expected to catch up with Layer-1 (L1) blockchain tokens in performance. This shift will be fueled by a wave of innovative DApp launches, particularly in artificial intelligence (AI) and Decentralized Physical Infrastructure Networks (DePIN), which will enhance the utility and product-market fit of DApp tokens.

As DApp tokens gain traction, they offer diversified investment opportunities beyond the foundational L1 tokens. Investors should look for DApps that provide unique utilities and address specific market needs, particularly those leveraging AI and DePIN technologies.

Additional Market Insights for 2025

Institutional Adoption and Corporate Holdings

Corporate adoption of Bitcoin is set to surge, with public companies expected to increase their Bitcoin holdings by 43% in 2025. Companies like MicroStrategy and Coinbase are leading the charge, positioning Bitcoin as a strategic asset within their balance sheets. This trend underscores the growing confidence in Bitcoin as a store of value and a hedge against fiscal uncertainty.

Institutional and corporate adoption provides a strong foundation for Bitcoin’s long-term value. Investors might consider exposure to Bitcoin through institutional-grade financial products and companies with significant Bitcoin holdings.

Regulatory Landscape and Policy Shifts

The regulatory environment in the U.S. is becoming increasingly crypto-friendly, with potential legislative support for Bitcoin and other digital assets. Pro-crypto policies are expected to foster a conducive environment for blockchain innovation and financial integration, further driving market growth.

Favorable regulatory developments can significantly impact crypto valuations. Staying informed about policy changes and investing in projects compliant with new regulations can mitigate risks and enhance investment returns.

Technological Advancements and Blockchain Scaling

Advancements in blockchain technology, particularly in scalability solutions like Ethereum’s Dencun Upgrade and Solana’s Firedancer, are set to improve transaction efficiencies and support mass adoption. These technological improvements will enhance the usability and performance of blockchain networks, making them more attractive for both developers and users.

Technological advancements are key drivers of blockchain adoption. Investing in projects and platforms that are at the forefront of scaling innovations can provide early access to growth opportunities as these technologies gain widespread adoption.

AI Integration and Innovation

The integration of AI with blockchain is expected to drive significant innovation in 2025. AI agents will not only optimize financial strategies but also enhance user interactions across various dApps. This synergy between AI and blockchain will unlock new use cases and efficiencies, further embedding cryptocurrencies into everyday applications.

The convergence of AI and blockchain opens up new investment avenues in AI-powered blockchain projects. These projects are likely to lead the next wave of innovation, offering substantial returns as they develop and scale their technologies.

Conclusion: Navigating the Crypto Landscape in 2025

As we look ahead to 2025, the cryptocurrency market presents a landscape rich with opportunities and dynamic growth sectors. From the continued ascent of Bitcoin and Ethereum to the burgeoning fields of DeFi, AI agents, and tokenized securities, the potential for substantial returns is immense. However, as with any investment, it is crucial to conduct thorough research, stay informed about regulatory developments, and maintain a diversified portfolio to mitigate risks.

The predictions outlined by VanEck, Bitwise, BlackRock, and other leading analysts offer a roadmap for what could be a transformative year for crypto. Investors poised to capitalize on these trends will likely find themselves at the forefront of the next “Golden Age of Crypto,” navigating a market that blends technological innovation with strategic financial growth.