What is a Rebase Token?

Last Update: January 1st, 2025

A rebase token is a cryptocurrency designed to automatically adjust its circulating supply in response to price movements.

This adjustment is achieved by either minting additional tokens to increase supply or burning existing tokens to reduce it.

The goal is to maintain a stable price, making rebase tokens unique compared to traditional cryptocurrencies.

Understanding Rebase Tokens

Rebase tokens use algorithmic mechanisms powered by smart contracts to stabilize their price. These smart contracts automate the process of adjusting the token supply at regular intervals, such as every 24 hours. This makes rebase tokens, also referred to as elastic tokens, a cutting-edge innovation in the cryptocurrency space.

By dynamically increasing or decreasing the token supply, rebase tokens aim to maintain price stability and adapt to market conditions more effectively than traditional tokens. This feature makes them particularly appealing for investors seeking stability in volatile markets.

What is Elastic Supply and How Do Rebase Tokens Work?

An elastic supply is a mechanism that automatically adjusts the number of tokens in a liquidity pool, based on the price movements. Rebase works by automatically adjusting the supply of circulating tokens according to the token price movements.

Rebase tokens function by periodically adjusting their total supply to maintain price stability or target a specific value. Rebase tokens are similar to stablecoins in that there is a set price target.

The difference is that rebases have an elastic supply of tokens. Rebase mechanisms mitigate the effects of inflation, based on the balance of market demand and supply.

How Rebase Tokens Differ from Traditional Tokens

Rebase tokens stand out from traditional tokens due to their elastic supply mechanism, which adjusts the token supply in response to market demand. Unlike traditional tokens, which have a fixed supply, rebase tokens can increase or decrease their supply to maintain a stable price.

This flexibility allows rebase tokens to adapt to market conditions in ways that traditional tokens cannot.

Additionally, rebase tokens often exhibit higher liquidity compared to traditional cryptocurrencies, contributing to a more robust market and potentially increasing their market capitalization. This adaptability and liquidity make rebase tokens a compelling option for investors looking for innovative financial instruments.

What is a Positive/Negative Rebase?

A positive rebase occurs when the price of an elastic token rises above its target price. Conversely, a negative rebase happens when the token’s price falls below the target price.

For instance:

- Suppose you hold 50 tokens of Token A with a target price of $1.

- If the price increases by 20% to $1.20, a positive rebase would increase the number of tokens by 20%, giving you 60 tokens with a portfolio value of $72.

- Conversely, in a negative rebase, if the price falls below $1, the number of tokens in circulation would decrease to align with the target price.

Key Points:

- Positive Rebase:

- Triggered when the token price exceeds the target.

- Holders receive more tokens proportional to the rebase percentage.

- Compounds the token’s value, potentially increasing the portfolio’s total worth.

- Rewards both liquidity providers and token holders with additional tokens or governance participation.

- Negative Rebase:

- Occurs when the token price drops below the target price.

- Reduces the total token supply, aligning with the price target.

- Ensures price stabilization but can reduce the number of tokens held.

How Do Projects Determine the Target Price?

Projects set a target price for rebase tokens by establishing a nominal price that the token adjusts toward over time. The rebase mechanism transforms elastic price tokens into synthetic commodities, with fluctuating supply designed to achieve price stability. Supply adjustments are based on market demand and supply dynamics, effectively preventing price manipulation.

The target price is typically determined by evaluating the token’s fair market value, ensuring it aligns with current market conditions. For example, Ampleforth (AMPL) pegs its target price to the U.S. dollar adjusted for 2019 CPI, ensuring stability and predictability.

Benefits for Token Holders

Rebase tokens present several key advantages for holders:

- Price Stability: The elastic supply mechanism ensures predictable prices, making these tokens reliable for transactions and investments.

- Enhanced Liquidity: Rebase tokens often have higher liquidity compared to traditional cryptocurrencies, simplifying token trading.

- Participation in Tokenomics: Holders can benefit from staking, governance participation, and other tokenomics, earning rewards for active involvement.

For example, Olympus DAO rewards OHM holders through staking, which compounds returns and stabilizes the token price over time.

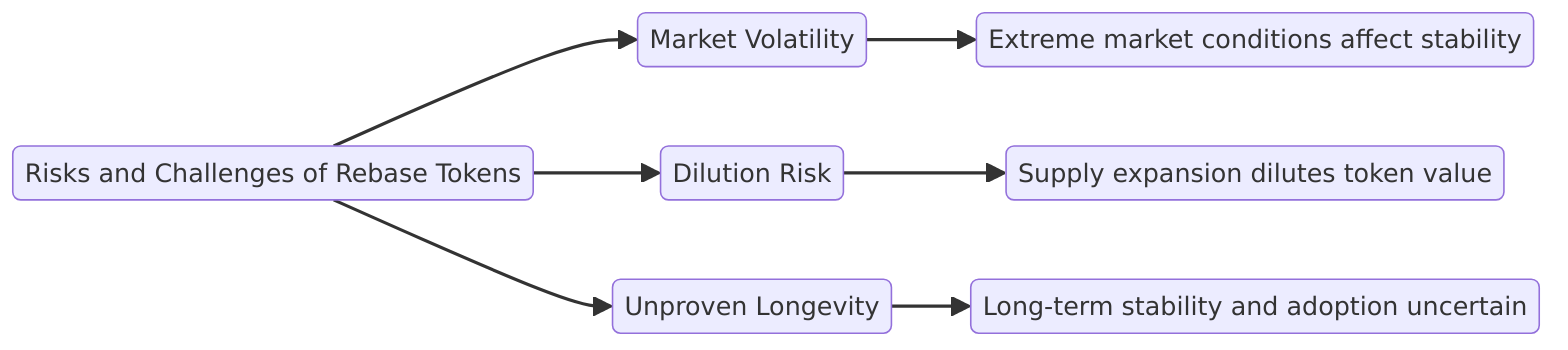

Risks and Challenges

While rebase tokens introduce innovative mechanisms, they come with inherent risks:

- Market Volatility: Price stability is not guaranteed, as extreme market conditions can still impact rebase tokens.

- Dilution Risk: When token supply expands, the value of individual holdings may be diluted, affecting overall portfolio value.

- Unproven Longevity: As a relatively new cryptocurrency type, the long-term stability and adoption of rebase tokens remain uncertain.

Investors should monitor performance metrics, such as supply adjustments and market demand, to mitigate risks associated with rebase tokens.

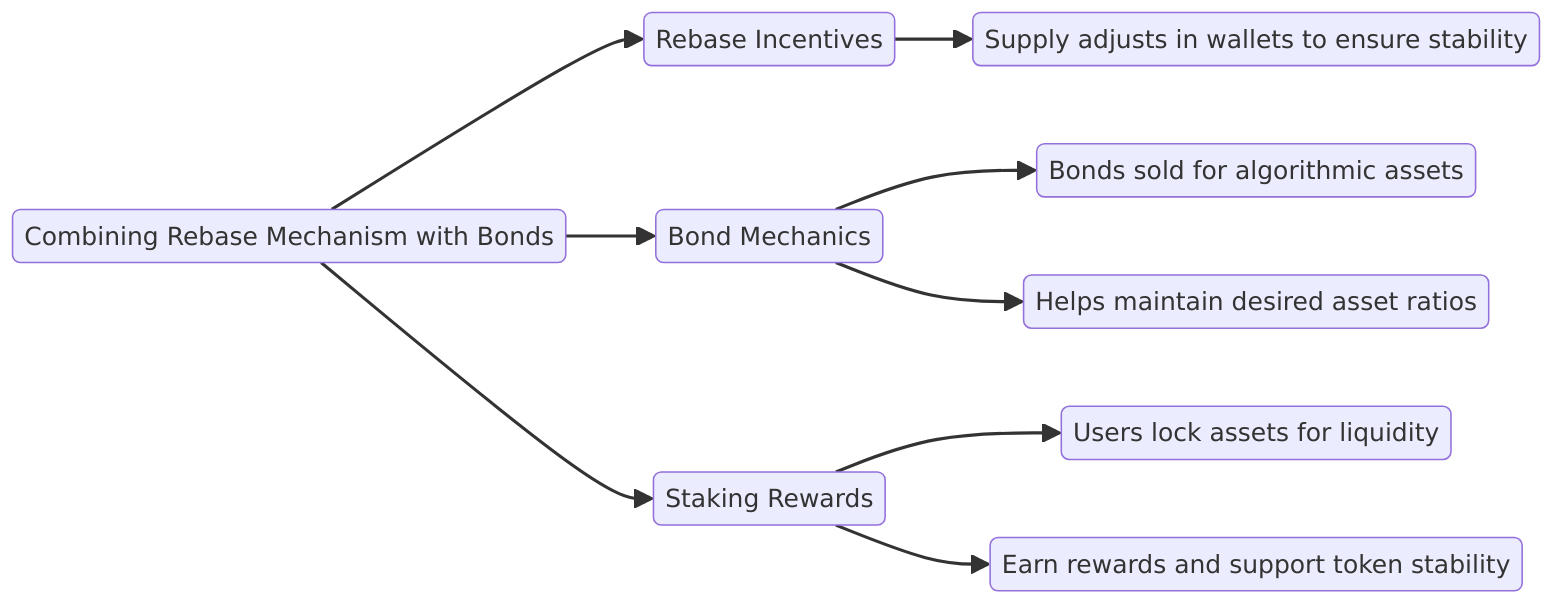

Combining the Rebase Mechanism with Bonds

Rebase mechanisms often pair with bonds and staking to create a sustainable ecosystem:

- Rebase Incentives: Currency supply is adjusted directly into users’ wallets, incentivizing demand and ensuring stability.

- Bond Mechanics: Bonds are sold and redeemed for algorithmic assets, helping maintain the desired asset ratio. This gives protocols control over liquidity rather than renting it.

- Staking Rewards: Users lock assets to provide liquidity and earn rebase rewards, further supporting token stability.

For instance, Olympus DAO combines rebasing with bond issuance, allowing the protocol to own its liquidity while rewarding participants.

Market Performance

The market performance of rebase tokens varies widely, depending on market dynamics and adoption:

- Promising Examples: Tokens like Ampleforth (AMPL) have demonstrated resilience in achieving price stability and maintaining value.

- Challenges: Some projects struggle to maintain equilibrium, facing difficulties due to market volatility or lack of adoption.

Despite these challenges, the adoption of rebase tokens is growing. However, their market capitalization remains relatively small compared to traditional cryptocurrencies. Investors should carefully evaluate performance trends, adoption rates, and protocol mechanisms to make informed decisions.

Popular Rebase Projects in DeFi

Rebase tokens, also known as elastic supply tokens, are cryptocurrencies that automatically adjust their circulating supply to maintain a target price. This mechanism involves increasing (positive rebase) or decreasing (negative rebase) the token supply based on market price deviations from the target.

Unlike traditional tokens with fixed supplies, rebase tokens aim to achieve price stability through these supply adjustments.

Ampleforth (AMPL)

- Overview: Ampleforth is an uncollateralized synthetic asset offering uncorrelated returns in DeFi.

- Mechanism: AMPL rebases daily at 02:00 UTC using Chainlink Oracles, targeting a price of $1.009 (adjusted for the 2019 USD CPI).

- Highlights: Introduced the Geyser liquidity mining program, designed to distribute rewards over a decade.

- Note: Holders must consider capital gains tax when trading or converting AMPL tokens.

Base Protocol (BASE)

- Overview: BASE is pegged to the total cryptocurrency market capitalization, offering investors broad exposure to market trends.

- Mechanism: The token’s target price represents a fractional value of the overall decentralized crypto market cap, ensuring reliability for investors.

- Key Advantage: Tracks and mirrors the trends of the entire cryptocurrency industry.

RMPL

- Overview: RMPL is a fork of AMPL featuring randomized rebasing with a $1 price target.

- Mechanism: Rebases occur when the price exceeds $1.05 or falls below $0.95, with a rebase period capped at two days.

- Unique Approach: Unlike AMPL, RMPL uses random rebasing to counteract price-fixing opportunities.

Yam Finance (YAM)

- Overview: Yam combines staking, rebasing, and governance protocols to create a dynamic DeFi ecosystem.

- Mechanism: Rebases occur twice daily (8 AM and 8 PM UTC). Positive rebases purchase yCRV tokens for the governance treasury.

- Development: Following an early bug affecting deflation measures, the project transitioned from YAM to YAMv2 and later to YAMv3 via audited smart contracts.

REB

- Overview: A rebase project with a $1 target price that rebases every 12 hours.

- Key Stats: Launched in 2020 with an initial supply of 2.5 million tokens; 2 million are currently circulating.

- Claim: The protocol positions itself as both inflation-resistant and immutable.

BASED

- Overview: BASED is an elastic supply protocol targeting a rebase price pegged to Synthetix’s dollar-pegged stablecoin ($1).

- Mechanism: Rebases occur daily when the price shifts by 5% or more.

- Token Distribution: Early token rewards were distributed through Pool 0 (daily halving) and Pool 1 (72-hour halving).

- Goal: To achieve full autonomy by burning private keys.

Olympus DAO (OHM)

- Overview: Olympus DAO creates decentralized reserve assets backed by cryptocurrencies.

- Mechanism: Uses staking and bonding to encourage deposits or collateral exchange for discounted OHM tokens.

- Unique Model: OHM tokens are backed by cryptocurrency reserves rather than fiat, making it independent of USD-pegged stablecoins.

- Key Innovation: Olympus owns its liquidity, which provides stability and mitigates reliance on third parties.

Wonderland (TIME)

- Overview: Forked from Olympus DAO, Wonderland backs its native token TIME with multiple reserve assets.

- Mechanism: Treasury repurchases and burns TIME tokens when its value drops below the backed amount.

- Options for Users:

- Bonding: Users buy discounted tokens from the treasury.

- Staking: Participants earn compounding returns by holding TIME.

- Focus: Ensures intrinsic value stability while offering flexible earning models.

Conclusion

Rebase tokens offer a unique approach to achieving price stability through elastic supply mechanisms. While they present opportunities for stable pricing, staking rewards, and liquidity control, they also introduce risks related to market volatility and dilution. Understanding these dynamics is crucial for navigating this evolving space in decentralized finance.

FAQ: Rebase Tokens

A rebase token is a type of cryptocurrency that automatically adjusts its circulating supply in response to price changes. This adjustment aims to stabilize the token’s price by minting new tokens (positive rebase) or burning existing ones (negative rebase).

2. How Do Rebase Tokens Work?

Rebase tokens use smart contracts to periodically adjust the total supply based on price movements.

- If the price exceeds the target, the supply increases (positive rebase).

- If the price falls below the target, the supply decreases (negative rebase).

For instance, Ampleforth (AMPL) uses this mechanism, rebasing daily to align with a target price pegged to the U.S. dollar adjusted for 2019 CPI.

3. What is Elastic Supply?

Elastic supply refers to the ability of a token to adjust its circulating supply automatically based on market conditions. This dynamic supply adjustment ensures the token maintains its price stability.

4. What is a Positive/Negative Rebase?

- Positive Rebase: Occurs when the token price exceeds the target, increasing the token supply. Holders receive additional tokens proportional to the rebase percentage.

- Negative Rebase: Happens when the price falls below the target, reducing the token supply. This stabilizes the price but decreases the number of tokens held.

Example:

If you own 50 tokens with a target price of $1:

- Positive Rebase: Price rises to $1.20; you now hold 60 tokens, with a portfolio value of $72.

- Negative Rebase: Price drops to $0.80; the supply contracts, reducing the tokens in circulation.

5. What Are the Benefits of Rebase Tokens?

- Price Stability: Achieved through elastic supply, making them suitable for transactions and investments.

- Enhanced Liquidity: Easier to trade compared to traditional tokens.

- Participation Opportunities: Tokenomics mechanisms like staking and governance allow holders to earn rewards.

6. What Are the Risks of Rebase Tokens?

- Market Volatility: Prices may still fluctuate significantly in extreme conditions.

- Dilution Risk: Expanded supply may dilute individual holdings’ value.

- Uncertain Longevity: As a relatively new concept, their long-term stability and adoption remain unproven.

7. How Do Projects Determine the Target Price?

Projects set a target price by evaluating the token’s fair market value.

For example: AMPL targets $1.009, adjusted for 2019 CPI, ensuring alignment with current economic conditions.

8. What Are Some Popular Rebase Projects?

- Ampleforth (AMPL): Daily rebasing using Chainlink Oracles to maintain a $1.009 target price.

- Olympus DAO (OHM): Decentralized reserve asset backed by cryptocurrency reserves.

- Wonderland (TIME): Forked from Olympus DAO, offering staking and bonding options for TIME tokens.

9. Can Rebase Tokens Avoid Volatility Completely?

No, while rebase tokens aim to stabilize prices, they cannot eliminate all market volatility. External factors, such as market demand and sentiment, still play a role in price fluctuations.

10. How Can I Participate in Rebase Token Projects?

- Hold Tokens: Benefit from rebases and potential price stability.

- Stake Tokens: Earn compounding rewards through staking protocols.

- Buy Bonds: Acquire discounted tokens from treasuries in some rebase ecosystems, such as Olympus DAO and Wonderland.

Sidebar rates

HFM

wgt-lc-defi

- DeFi Lending

- DeFi Yield Farming

- AMM (Automated Market Maker)

- DEX

- Cross Chain Bridges

- Crypto Options

- Tokenized Bonds

- Crypto Derivatives

- On-chain synthetic Assets

- Cryptocurrency Perpetuals

- Cryptocurrency Staking

- Cryptocurrency Total Locked Value (TVL)

- Impermanent loss

- Rebase Token

- Decentralized Autonomous Organization

- Decentralized Application

- Gas Fees

- Liquidity Pools

- Cryptocurrency Tokenomics

- Pegged Stablecoins