What are Cryptocurrency Perpetuals?

Last Update: December 9th, 2024

Perpetual future contracts are types of derivatives agreements with no expiration date, enabling traders to hold positions indefinitely if margin requirements are met.

The contracts are similar to futures in that they let the user speculate on the price movements of an asset.

In the process, a user must incur funds kept as collateral to open a position. If the price of the asset moves in favor of the investor’s position, they get a profit when the position is closed. However, if it is unfavorable, the subscriber will receive fewer assets. Different from futures, an investor can hold their position indefinitely in perpetuals.

Introduction to Perpetual Futures

Perpetual futures are a type of derivative contract that enables traders to speculate on the future price of an underlying asset without an expiration date. Unlike traditional futures, which expire on a set date, perpetual futures allow positions to be held indefinitely, offering unmatched flexibility.

In the cryptocurrency world, perpetual futures are particularly popular. For instance, in 2024, the BTCUSDT perpetual market alone saw daily trading volumes exceed $50 billion, underscoring their dominance in crypto trading. Beyond cryptocurrencies like Bitcoin and Ethereum, these contracts are also available for other asset classes such as commodities and indices, adding to their appeal.

This combination of flexibility, high liquidity, and applicability across various markets makes perpetual futures a dynamic tool for traders seeking to navigate ever-changing market conditions.

How Do Perpetual Contracts Work with an Underlying Asset?

Perpetual contracts allow traders to speculate on the price of an asset without the constraints of an expiration date. These contracts rely on mechanisms like the funding rate to align the perpetual price with the spot price, ensuring fair market behavior.

For instance, suppose Bitcoin is trading at $37,000, and Investor A believes its price will rise to $47,000 within a year. Investor A can open a long position in a BTC perpetual futures contract to buy Bitcoin at $37,000. If the price rises as expected, the investor can profit by closing the position at $47,000, earning a $10,000 gain minus any fees. Conversely, if the price drops below $37,000, the investor would face proportional losses.

On the other hand, perpetual contracts also support short positions for traders expecting a price decline. If Investor B believes Bitcoin will fall below $37,000, they can open a short position. For example, if the price drops to $30,000, Investor B can profit from the difference, selling high and buying back low. However, if the price rises, the investor incurs losses.

Key Points:

- Funding Rate:

- A periodic payment mechanism ensures perpetual prices remain close to the spot market.

- Traders in long positions pay short traders if the perpetual price exceeds the spot price, and the reverse applies if the perpetual price falls below the spot price.

Perpetual contracts provide a flexible trading tool for both bullish and bearish investors, enabling them to capitalize on market movements without time constraints.

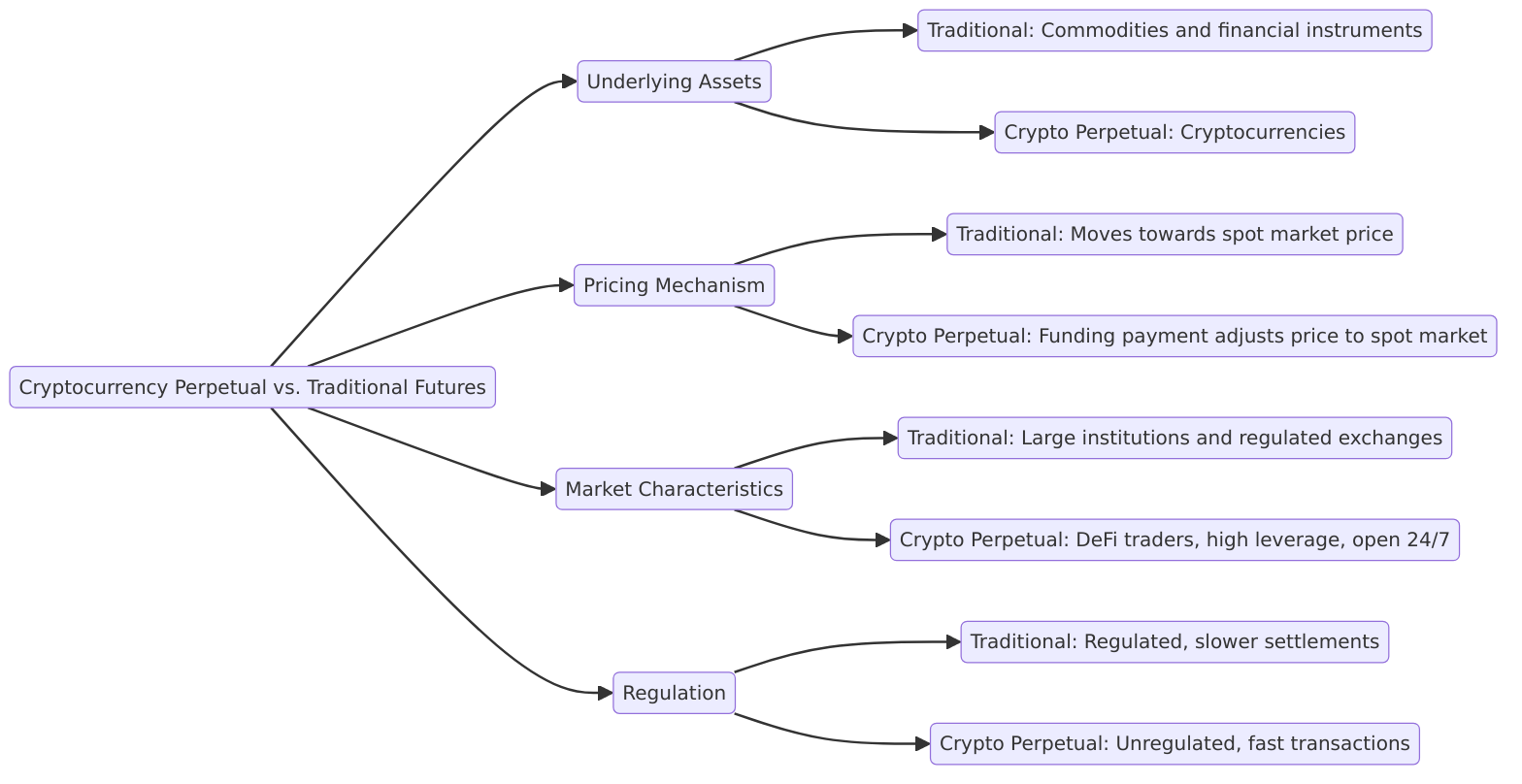

Cryptocurrency Perpetual vs. Traditional Futures

Cryptocurrency perpetual contracts and traditional futures contracts share similarities in their mechanics but differ significantly in their underlying assets, trading environments, and regulations.

Key Differences

- Underlying Assets

- Traditional futures contracts are based on commodities or financial instruments, such as oil, gold, or stock indices.

- Cryptocurrency perpetual contracts revolve around cryptocurrencies like Bitcoin, Ethereum, or other digital assets.

- Expiry

- Traditional futures have a fixed expiry date, after which the contract settles either in cash or through physical delivery of the asset.

- Perpetual contracts have no expiry date, enabling traders to hold positions indefinitely as long as margin requirements are met.

Price Mechanism and Funding

In traditional futures, contract prices gradually converge with the spot price of the underlying asset as the expiry date approaches. Perpetual contracts, on the other hand, use a funding rate mechanism to align prices with the spot market.

- When the perpetual contract’s price exceeds the spot price, traders holding long positions pay a funding rate to those holding short positions, ensuring price equilibrium.

- Conversely, if the contract price falls below the spot price, short position holders pay the funding rate to long position holders.

Trading Environments

- Traditional futures are traded on regulated exchanges like the Chicago Mercantile Exchange (CME), attracting institutional and retail investors.

- Cryptocurrency perpetual contracts are typically traded on cryptocurrency exchanges, catering to private players and a smaller pool of participants.

Similarities

Despite their differences, both instruments allow traders to:

- Speculate on price movements of an asset.

- Hedge against risks by taking long or short positions.

Regulation and Accessibility

- Traditional futures markets operate under strict regulatory oversight to prevent fraud and ensure legitimacy, often leading to slower settlement times.

- Cryptocurrency perpetual markets are largely unregulated, offering faster trade execution but exposing participants to higher risks.

Lastly, traditional markets have fixed trading hours, while cryptocurrency perpetual markets remain open 24/7, enabling traders to capitalize on random price movements around the clock.

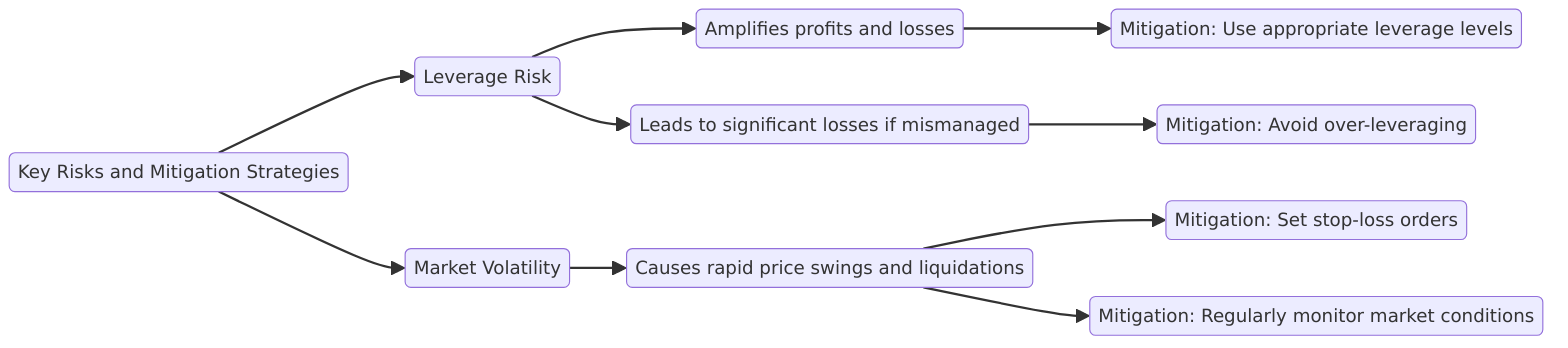

Managing Risk in Perpetual Futures Trading

Trading perpetual futures offers opportunities for significant profits but also involves substantial risks, particularly due to the use of leverage. Effective risk management is essential to navigate this complex trading environment.

Key Risks and Mitigation Strategies

- Leverage Risk

- Leverage amplifies both profits and losses. While it allows traders to control larger positions with a smaller margin, it increases the potential for significant losses.

Risk Mitigation:

- Use appropriate leverage levels based on your risk tolerance.

- Avoid over-leveraging to protect your capital.

- Market Volatility

- The highly volatile nature of cryptocurrency markets can lead to rapid price swings, increasing the likelihood of liquidation.

Risk Mitigation:

- Set stop-loss orders to limit potential losses.

- Regularly monitor market conditions to stay updated on potential risks.

Understanding the Funding Rate

The funding rate is a periodic payment exchanged between long and short traders to align the perpetual futures price with the spot price.

- If you hold a position for an extended period, the funding rate can affect profitability.

- Traders must factor in these payments when planning their positions to avoid unexpected losses.

Best Practices for Risk Management

- Research: Always conduct thorough research on the derivatives instrument you plan to trade.

- Risk Assessment: Understand the risks of perpetual futures, including market volatility and leverage.

- Education: Stay informed about trading mechanics, including how funding rates and margin requirements work.

By employing sound strategies and maintaining caution, traders can mitigate risks and better manage the challenges of perpetual futures trading.

Benefits and Drawbacks of Perpetual Futures

Perpetual futures offer several benefits, including the ability to speculate on the future price of an underlying asset without an expiration date, high leverage, and efficient price discovery. They also offer continuous trading opportunities, allowing traders to capitalize on market trends and volatility.

However, perpetual futures also come with some drawbacks, including the risk of significant losses due to leverage, funding rate fluctuations, and market volatility.

Additionally, perpetual futures are not suitable for all traders, particularly those who are new to trading or risk-averse. Overall, perpetual futures can be a powerful tool for traders who understand the risks and benefits associated with them. By weighing the pros and cons, traders can make informed decisions and potentially enhance their trading strategies.

BTC Perpetual Futures

BTC perpetual futures are contracts that allow traders to buy or sell Bitcoin (BTC) without a set expiry date. These contracts are widely used to hedge market risks or speculate on price movements.

Key Features

- Hedging Example: Suppose Bitcoin is trading at 75,000, and an investor believes it will drop to 70,000. They can open a short position with a leverage of 10x using $1,000 as collateral.

- If BTC falls to 70,000, the trader’s position would gain $5,000 minus fees.

- Leverage Impact:

- Traders can use leverage to amplify their positions.

- For instance, with 5x leverage, $2,000 allows a trader to control a $10,000 position in Bitcoin.

- Funding Rates:

- Funding rates align perpetual prices with the spot market.

- Example: If the funding rate is 0.01% and the position is $10,000, the cost is $1 for holding the position during the funding period.

BTC perpetual futures combine leverage and market dynamics, making them a popular choice for risk hedging or speculative trading.

ETH Perpetual Futures

ETH perpetual futures are contracts based on the price of Ether (ETH), enabling traders to take long or short positions with no expiry. These contracts are linked to the index price, calculated as the volume-weighted average price (VWAP) of ETH across major exchanges.

Key Features

- Example of Price Movement: If ETH trades at 5,000 and a trader opens a long position with 20x leverage using $500 as collateral:

- If ETH rises to 5,500, the trader’s profit is ($500 × 20 × 10%) = $1,000.

- If ETH drops to 4,800, the trader risks losing their $500 margin if they don’t have stop-loss protection.

- Margin Requirements:

- Initial Margin: The upfront capital required to open a position.

- Example: To trade $10,000 in ETH with 10x leverage, the trader needs $1,000.

- Maintenance Margin: The minimum balance needed to keep a position open.

- If the account balance falls below this level, the position is at risk of liquidation.

- Initial Margin: The upfront capital required to open a position.

- Leverage and Liquidity:

- ETH perpetual futures are highly liquid, enabling quick entry and exit.

- Retail investors often use them to capitalize on ETH’s volatility, whether for speculation or risk management.

With transparent margin requirements and the ability to hold positions indefinitely, ETH perpetual futures offer flexibility and utility for both novice and experienced traders.

Conclusion

Perpetual futures contracts offer traders the unique ability to speculate on asset price movements without the constraints of an expiration date. They provide flexibility, high leverage, and liquidity, making them a powerful tool for managing risks and capitalizing on market trends.

However, the absence of expiry, combined with market volatility and leverage, demands cautious risk management. Understanding funding rates, margin requirements, and the mechanisms driving perpetual futures can help traders navigate this complex yet rewarding trading instrument effectively. For experienced traders, perpetual futures can enhance trading strategies, while new traders should proceed with a thorough understanding of associated risks.

FAQ Section

- What are perpetual futures contracts?

Perpetual futures are derivative contracts that allow traders to buy or sell an underlying asset, such as cryptocurrencies, without an expiration date. Traders can hold positions indefinitely as long as margin requirements are maintained.

2. How does the funding rate work in perpetual futures?

The funding rate is a periodic payment exchanged between long and short traders to keep the contract price aligned with the spot price. For example, if the funding rate is 0.01% on a $10,000 position, the payment will be $1 for the funding period.

3. What is the difference between perpetual futures and traditional futures?

- Expiry: Traditional futures have a set expiration date; perpetual futures do not.

- Market Hours: Perpetual markets operate 24/7, while traditional futures follow exchange-specific hours.

- Regulation: Traditional futures are heavily regulated, whereas perpetual futures are often unregulated.

4. How is leverage used in perpetual futures trading?

Leverage allows traders to control larger positions with a smaller margin. For instance, with 10x leverage, a $1,000 margin can control a $10,000 position. However, leverage amplifies both profits and losses, requiring careful risk management.

5. What are the risks of trading perpetual futures?

Risks include significant losses due to leverage, funding rate fluctuations, and market volatility. Traders should use stop-loss orders, appropriate leverage, and conduct thorough research to mitigate these risks.

Sidebar rates

HFM

wgt-lc-defi

- DeFi Lending

- DeFi Yield Farming

- AMM (Automated Market Maker)

- DEX

- Cross Chain Bridges

- Crypto Options

- Tokenized Bonds

- Crypto Derivatives

- On-chain synthetic Assets

- Cryptocurrency Perpetuals

- Cryptocurrency Staking

- Cryptocurrency Total Locked Value (TVL)

- Impermanent loss

- Rebase Token

- Decentralized Autonomous Organization

- Decentralized Application

- Gas Fees

- Liquidity Pools

- Cryptocurrency Tokenomics

- Pegged Stablecoins